Good morning. Happy Thursday.

The Asian/Pacific markets closed mostly down – there were several 1% losers, but China gained 1.6%. Europe is currently down across the board. Futures here in the States point towards a sizeable gap down open for the cash market.

CSCO had earnings after the bell yesterday and is getting clobbered once again…not as bad as 3 months ago but still down more than 10% – a huge move for a boring, slow-moving stock.

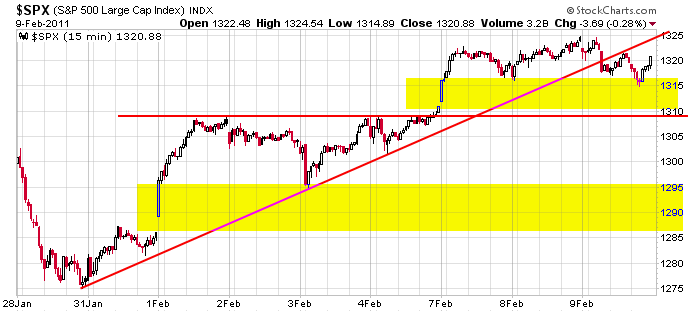

Here’s an update of the 15-min SPX chart I posted yesterday. A meaningless support line was broken, but then it gathered more significance when it turned around and became resistance during the mid day bounce. The late day bounce was exactly what I wanted (see my comment on the message board) to paint the charts neutral or positive, but I was hoping for a gap up this morning, not a gap down. Oh well. My short term target is still 1310.

The overall trend remains up, but I’m still not looking to initiate new positions. I’m content to manage what I have and let the market do its thing in the near term. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Feb 10)”

Leave a Reply

You must be logged in to post a comment.

The PIGGS are having fainting spells again. ECB bought its way out last time there were credit scares, but now the bond gouls are taking an interest in Portigal as a default risk, why is that? Will, maybe they know that the ECB and Germany really don’t want to do bail- outs anymore. The DAX goes nuts everytime they say bailout.

We never know what tips the boat over, often it seems small. But a tipping point arrives without fan fair.

Watch, Brazil, Shanghai, HSI, and India: all markets in decline. It is time to watch whether a coreallation of markets can be fatal to the US equities. For some reason inflation is being mentioned everywhere these days. Of course, Bernanke just told us that can not be a problem. So skip that one. Trade close to the chest, they may sell today.

Living at home is how I learned to hedge.

We do live longer. What are you on?

Hey Neal ! what about a Dow 15000 T-Shirt ?

And the only heat I pack is my surfboard as I stroll across the road to the Beach : }