Good morning. Happy Monday. Hope you had a nice weekend.

The Asian/Pacific markets closed up across the board. China gained 2.5%; Austrailia, Hong Kong, Japan and Korea gained more than 1%. Europe is currently mostly up, but gains aren’t big. Futures here in the States point toward a flat open for the cash market.

The market was somewhat held hostage last week to the events in Egypt, but once the President stepped down, new across-the-board highs were registered.

Nothing has been able to slow the market down. Indicators, divergences, extended winning streaks, over bought situations…the market keeps chugging along with its own agenda, so I see no reason to fight it. We could argue day and night as to whether the market should be going up, but that doesn’t matter because our job is trade what is happening, not what should be happening.

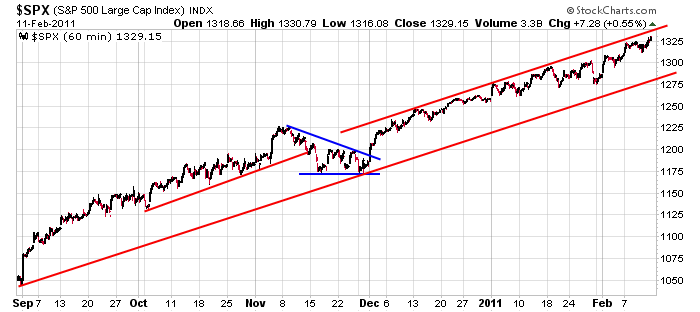

Here’s the 60-min SPX chart. The last 23 days have been 17 up and 6 down. If a pullback does materialize, 50 points (similar to Nov is realistic). Make sure you know what time frame you’re trading.

Otherwise the call is the same…don’t over-analyze.

Also options expire this week, so I’ll be doing my monthly OE report today after the close.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Feb 14)”

Leave a Reply

You must be logged in to post a comment.

Trade the charts! Considering all of the newsletters that I subscribe to

and listening to the gossip heads on CNBC all day long, it all boils down

to one thing: Trade the charts! They are the roadmap to profits whether

it’s going up, sideways, or any direction. And watch out for light trading

volume, especially around mid-day. That’s when I usually walk my

dog, Max. HW

Great Analysis. Thank you.

http://balancetrading.blogspot.com/