Options expire this Friday, so let’s take a look at the open-interest on SPY, DIA, QQQQ and IWM to see if they hint at movement the rest of the week. Here’s the theory: the market conspires to cause the most pain, to cause the most number of people to lose the most amount of money. If the market is to accomplish this, what does it need to do this week?

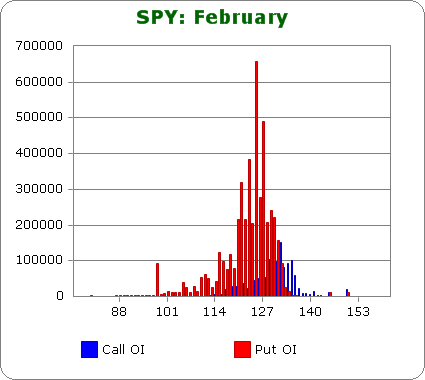

SPY (closed 133.43)

Puts out-number calls 3.1-to-1.0 – much more bearish than last month.

Call OI is highest between 129 & 135.

Put OI is huge between 118 & 132 with the biggest spikes coming at 123, 125 and 127.

There’s some overlap betwen 129 and 132, but since puts dominate calls, a close in the upper part of the overlap would cause the most pain. With today’s close at 133.43 there’s room to move down while still causing most puts to expire worthless. So flat-to-slightly down trading will do the trick.

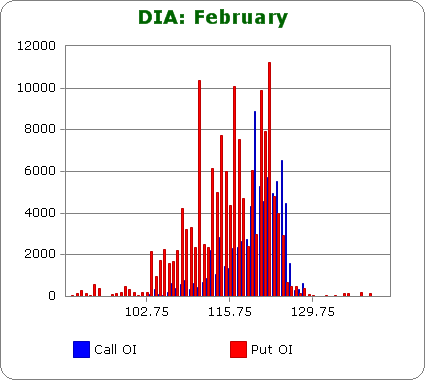

DIA (closed 122.61)

Puts outnumber calls 1.9-to-1.0 – same as last month.

Call OI is highest between 119 & 123.

Put OI is highest between 112 & 122 with spikes at 112, 116, 119 and 120.

There’s some overlap between 119 and 122, but again, since puts out-number calls, we need to focus on the puts to determine max pain. A close high enough to cause the puts to expire worthless but low enough to not enable the calls to make money is needed. The level around 122/123 would accomplish the mission. With today’s close at 122.61, flat trading the rest of the week is needed.

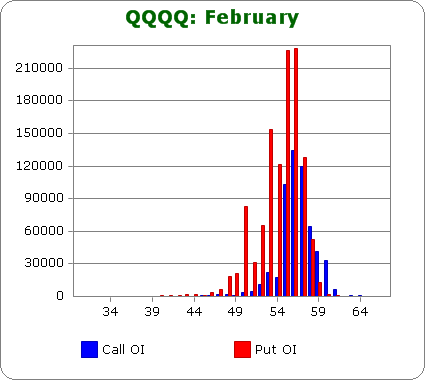

QQQQ (closed 58.58)

Puts out-number calls by 2.6-to-1.0 – slightly more bearish than last month.

Call OI is highest at 55, 56 and 57.

Put OI is between 53 & 57.

Calls and puts are very concentrated with QQQQ and the OI zones overlap (between 55 & 57) for about half the area. Since puts far out-number calls, a close near the top of the zone is needed to cause max pain. With today’s close at 58.58, a slight move down is needed.

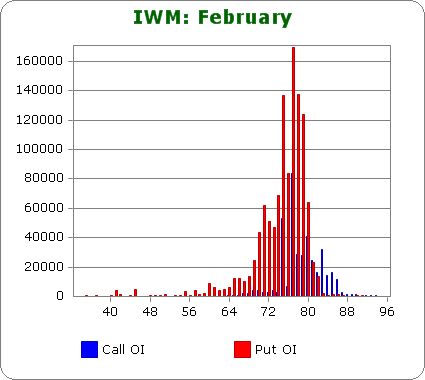

IWM (closed 82.49)

Puts out-number calls by 3.3-to-1 – slightly less bearish than last month.

Call OI is highest between 75 & 80 with spikes at 75 and 77.

Put OI is highest between 75 and 79 and is moderately high down to 70 and up to 82.

Put and call OI overlaps between 75 and 79, but since puts dominate calls, let’s focus on those. Plain and simple IWM needs to close near 79 to expire most puts worthless. With today’s close at 82.49, the market can move down and still accomplish the mission. Flat trading is fine, but a move down is more desireable.

Overall Conclusion: Once again puts buyers bet big, and again they are very likely to get crushed. The market is already priced to expire most puts worthless, and because the market has been on a such a steady rise, it has a cushion. It can move down and still cause lots of pain. Flat trading is fine, but a slight move down the rest of the week would be ideal.

0 thoughts on “Using Put/Call Open-Interest to Predict the Rest of the Week”

Leave a Reply

You must be logged in to post a comment.

i didn’t understand. open interest points that puts writers most benefit from this situation. And the opposite for call writers that sold options and not buyed them?

Am I wrong?

Pini,

Max pain refers to put and call buyers. These are the sheep that the Market Makers like to fleece. They’ve gotten me many times. Sometimes to the penny. I don’t play anymore.