Good morning. Happy Thursday.

The Asian/Pacific markets closed mixed and with a bullish slant. Europe is currently trading mixed and with a bearish slant. Futures here in the States are flat.

I am beyond the point of having anything interesting to talk about because the market has a one track mind…it just keeps going up and nothing puts in its path or thrown its way matters. For my own personal trading it’s been great because I’ve been able to hold positions much longer than usual. In fact from a trading standpoint, making money has been fairly easy. If I wasn’t running the day to day operations of Leavitt Brothers, I wouldn’t be spending much time in front of my computer during the day – there’s been no reason to. But from a commentary standpoint, I’ve been tested because I don’t think there’s much to talk about yet I’m supposed to talk about stuff every day. 🙂

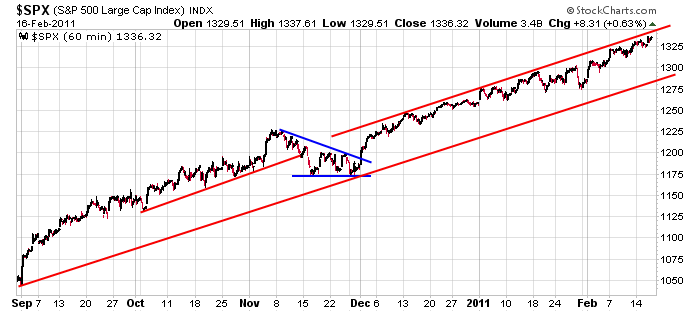

Here’s the 60-min SPX chart. Other than the brief pullback in November, the market has only moved in one direction. Perhaps my complete bordome with the movement and lack of interesting things to talk about is a sign a top is not far off.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Feb 17)”

Leave a Reply

You must be logged in to post a comment.

My Umdd has gone up 100 pts since Sept k10 It has doubled my position which is the prime position during the “off months” in my seasonality trade plan. I have a stop and I am following it closely put I am mesmerized, god works in strange ways.

Today the President meets with the Techies to get some advice. I have not been holding my breath. After all AAPL is down, what do they know? Zuckerberg did even finish college. slugs.

Oh Yes, Bradley turn date today: No clue what it means, I am ready for a change in direction.

Ditto: Today, 2/17/2011 is a Bradley model turn cycle date. HW

Greek mythology is interesting. Perhaps you should talk about the siren’s song and putting wax in your ears. Don’t be lulled.

hardly any movement on the indexes,currencies ny tick ind ect at the moment–not even a fraction of a move to show the charts are alive

how can the market makers do it so effortlessly–get it to the strike price they want –everytime for opts ex

who are the market makers –not the fed i hope—they are loousy gamblers

ndx’s turn yesterday–today spx 1340–dji 12300

Somebody help me out on this one. Does the market generally go up ‘into’

options expiration and then it goes down the following week. Or does the

market tend to go down ‘into’ options expiration week and go up the

following week. Please advise. HW

as u know the big boys start closing out their opts about a week early into opts ex ,whilst the retailers always leave it to the last day minute

for the last year the instos take it to a high just before opts ex and work their way down for ex day–opts ex day can be either so boring flat or a high to low day

next week if there is any insto buying left they will rotate

well thats the way it has been in the past–but i take nothing for granted