Good morning. Happy Wednesday.

The Asian/Pacific markets closed mixed and without much continuity – closing numbers were all over the board. Europe is currently mostly up, but there are no 1% winners. Futures here in the States point towards a moderate gap up open for the cash market.

Monday the market traded quietly in a small range and finished with small gains. Yesterday the market traded quietly in a small range and finished with small losses. Overall the market is unchanged for the week and virtually unchanged since Monday’s open. Considering last Friday’s big move up to new highs, it’s not a bad thing to simply hold the gains for a couple days.

Day to day I’m running out of things to talk about because nothing seems to matter. The charts don’t matter. The indicators don’t matter. Divergences don’t matter. News doesn’t matter. The market has a mind of its own, and no matter what is thrown it’s way, it moves up. If it likes the news, it moves up. If it doesn’t like the news, it moves up. It truly has a mind of its own. It does what it wants, and what it wants is to move up.

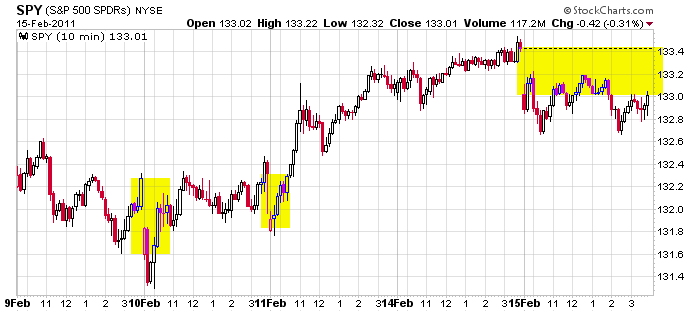

Yesterday’s gap down remains unfilled – a change from the previous gap downs which filled quickly. If the futures hold, the gap will be filled at today’s open (can a gap be filled with a gap). Here’s the 10-min SPY chart. Shorter term traders can look for a push to a new high followed by a gap fill. Longer term traders should sit back and enjoy the overall uptrend.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers