Good morning. Happy Tuesday. Hope you enjoyed your long weekend.

The Asian/Pacific markets closed down across the board. China and Hong Kong each dropped more than 2%, and there were several 1% losers. Europe is currently down across the board; losses are moderate. Futures here in the States point towards a huge gap down for the cash market. Relative to Friday’s close, S&P futures are down ~ 16 points.

The big news comes out of Libya where protesters are following in Egypt’s path. Oil has surged 9% because the the country is responsible for ~ 2% of the world’s daily output, and it’s feared the unrest could led to shortages in supply.

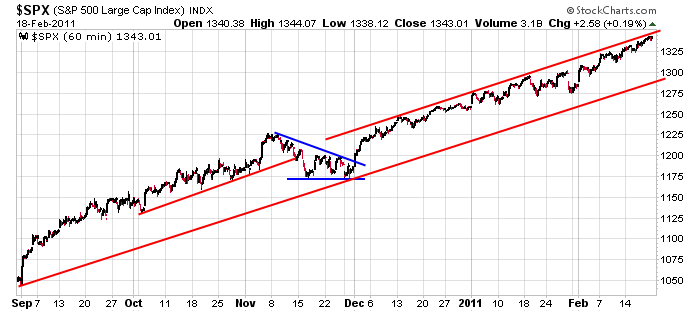

All the indexes registered new highs on Friday, so the trend remains solidly up. Every other “crisis” from overseas has been absorbed by the market; will this be any different? I suspect the market will again make new highs this time around, but I can’t say when it’ll happen. Other than some weakness in November, the market has been steadily climbing since the end of August. It needs a rest; perhaps news from Libya will be the excuse the market needs to take time off.

Here’s the 60-min SPX chart. The index could drop 50 points and still be considered in a solid up trend.

News trumps the charts. Play good defense with current positions and see how things settle out today.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Feb 22)”

Leave a Reply

You must be logged in to post a comment.

Not a long trip down. Buy the dip.

You’re all too complacent. The market is going to sell-off at least 12% from last week’s highs.

Time to fill those 12/01/2010 index gaps.

Everyone keep supporting the fraud and perpetuating the Ponzi scheme…. buy buy buy….

Bateman may be right, but I live with “the system”. My morals and ethics are comforting but they do not provide income.

ponsi was a egytian and created pyrimid selling–yes that is a banker and the chief is the central banks

the trend is down and has been since 2008,but im not a possition trader

From a couple of weeks ago…the Dow went down 166 points on

a Thursday and then recovered the next day. However, now we’ve

got a whole bunch of these so called ‘turn cycle’ dates to

contend with which may or may not turn out to be true. HW