Good morning. Happy Wednesday.

The Asian/Pacific markets closed mixed and with a bearish slant. Only the Taiwan market moved more than 1% (it dropped 1.7%). Europe is currently mixed. There are no significant upside or downside movers. Futures here in the States point towards a gap up open for the cash market.

Yesterday was either the worst down day or second worst down day in 3 months. It’s really been amazing how strong the market has been. The last time the market fell so hard was the end of Jan when fears out of Egypt caused everyone to sell first and ask questions later. Those losses were recovered in two days. Yesterday’s selling was no doubt caused by the unrest in Libya – partly due to the conflict there and partly due to the prospect of having the oil supply from the country disrupted. Once the selling started, it was pretty much a 1-way ticket down until the closing bell. Was the selling over done? Will the losses be quickly recovered again? Or will the situation be used as an excuse for the market to finally correct? We shall see. Nobody knows what’s going to happen, and when you consider the wild card (the Fed) and have no idea if they’ll continue to support the market, it’s best to stay out of the prediction business and stay in the “position management” business. On the long side I’m content to sit and watch and let things settle out for a few days. On the short side, as I said yesterday, I’d rather buy a reverse ETF than short an individual stock.

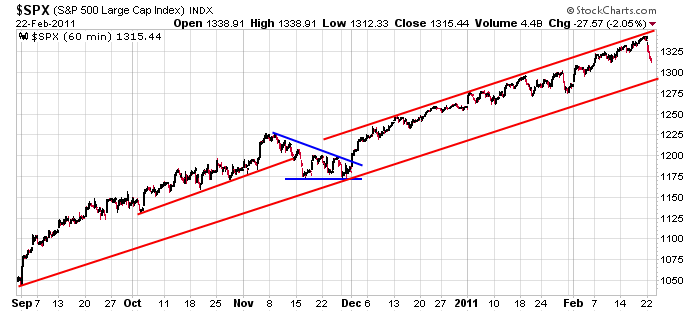

Here’s the SPX 60-min chart. A 50-point move off the high is very doable, and that would take the index to just below 1300. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Feb 23)”

Leave a Reply

You must be logged in to post a comment.

the fed–pomo trades the es futures or the spx futures as well as other futures

perhaps it needs to make some money to balance the budget and will sell the futures to buy back later–ie short

or maybe it will use a reverse etf as well

or maybe its london office will use a spreed betting cfd to short the market –its tax free

How do u ignore the 20 day ma that we keep on bouncing off of im not a buy the dipper but look how were holding the 20 day ma

Otherthan when I look at the Bollinger Bands, I pay no attention to the 20-day. If you use it and it works for you, great. There are lots of ways to analyze the market. Most of them work some of the time, none of them work all the time. I happen to not use the 20-day.

We know the Fed is in the market, but they must play strategically to have any effect. Currently the pressure is global for a correction; watch the correlation of national markets. No sure POMO has the juice to do much in the short run. IF the market moves up today, it will be something they will hitch a ride on.

Maybe 1230 sp is possible in this move, but the point is QE2 is not over until June, and maybe not then. Until that time, the bias is up on equities. at about 1300 I am planning on going long.

In the meanwhile, we must be troubled by the moves in commodities. It means deflationary forces are still there for whatever reasons. Oil prices are threatening, what will Ben do with that??

See Dave Rosenberg’s financial calender in the Gluskin Shiff market letter . Interesting.

If QE2 is over in June, won’t traders take profits ahead of time in anticipation of the mad rush to the door?

the markets dont have enough short interest to have any LEGS to the UP side,thanks to the fed and world central banks ect,

but complacent bulls may not sell either

a break of dji y/day low which its just done would be rather bearish

U guys R 2 cryptic 4 me. I haven’t a clue what u just said.

I was out this morning running a few errands and I just got back

into the saddle a few minutes ago. The first question I asked

myself is how come the market aint down another 200 points today?

Quite simply, because the average Joe is saying to himself that

these events over in the middle east are just temporary and that

the market will soon turn positive once again. I heard Kramer

on CNBC a couple of weeks ago saying something to the effect

that unless the entire middle east is sinking rapidly all at

one time then that would have a major impact on the U.S. markets. HW

this is insto selling–joe six pack doesnt have a chance

ask Jason to show u how the instos are hedged