Good morning. Happy Thursday.

The Asian/Pacific markets closed mostly down – there were several 1% losers. Europe is currently mostly down – the German and Swiss markets are down more than 1%. Futures here in the States point towards a gap down which will open the indexes near yesterday’s lows.

Due to the situation in Libya, oil output has been cut, and oil prices have surged. A high oil price based on increased demand isn’t a bad thing (although it eventually chokes off the economy that is supporting it), but a high oil price based on a lack of supply is nothing more than an unwanted tax on businesses and consumers around the world.

There’s no question the last two days have been the worst since last August and have pulled some indicators to their lowest level since August. The number of S&P 1500 stocks trading above their 10-day MA is at its lowest level since Aug 24. The number above their 20-day is at its lowest since Aug 31. The number making 10-day highs and 10-day lows is at their lowest and highest readings (respectively) since Aug too. The last two days has been the first time since Sept 22nd and 23rd there has been back-to-back days of more than 1000 decliners (at the S&P 1500)

Generally speaking the longer term charts still look great – it takes more than 2 days of selling to completely destroy a rock solid trend. But short term things are pretty bad.

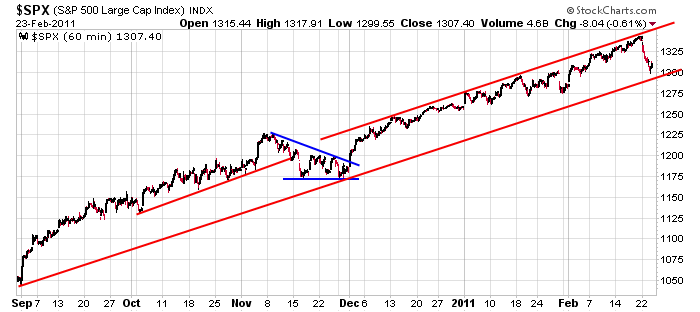

Here’s the 60-min S&P chart. Two days have wiped out two weeks worth of gains. In my opinion, breaking the support trendline doesn’t automatically mean the uptrend is over and a new downtrend underway. The market isn’t that exact; it’s not that precise. Technical damage has been done, and I don’t want to hold long unless a stock is obviously benefiting from the situation overseas. For my personal trading, I’m content to stick with the inverse ETFs (TZA and BGZ) and let things settle out. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Feb 24)”

Leave a Reply

You must be logged in to post a comment.

The news runs the markets but long range trends are always there and that is UP.

Good employment trend today, poor lEI, and Oil has them scared.

Yesterday the selling backed off at 1299 my suggestion of closing the gap at 1287 maybe reachable, but probably not today.

What do you believe about oil prices? I think that they have nearly peaked and when the excitement subsides the markets will resume reacting to QE2 and go UP again.

Today is a nowhere day. Watch silver for a clue as to the pulse of the marketplace.

Best

I think you’re right that once the situation in Libya blows over the market will go back to moving in the direction of the Fed…but the question is how long will that take.

i disagree Jason and all—but thats what makes a market

imo its 11800 dji for a failed retest of 12000 and the start of a bit of a prolonged correction

libia and other funtamentals is just a smoke screan letting the instos do a planed sell off

look at my ny tick indicator —-today allmost all below zero and many tick extreams below minus 1000–this is a live indicator on 2 min chart showing no of stocks selling on down tick ect

many other things also suggesting a prolonged correction

im not saying short everything–well maybe i am–but dont be complacent and hope for a return of the bernanke put,that has only 3 months to go and bernanke has told parliment just last week he would stop if could,but will let run out

oh well everyone has a right to a opinion

Silver: after $40.00 what % trailing stop would you recommend?