Good morning. Happy Monday. Hope you had a nice weekend.

The Asian/Pacific markets closed mixed and with an upward bias. Hong Kong gain 1.4%; South Korea lost 1.2%. Europe is currently mostly up. Futures here in the States point towards a moderate gap up open for the cash market.

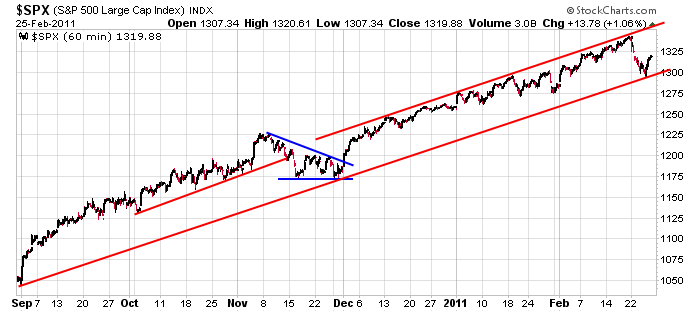

After grinding higher day after day for a long time, the market finally woke up last week. Volatility increased and so did the intraday ranges. The overall trends remain solidly up, but the short term is questionable. Here’s the 60-min SPX. It’s the same chart I posted all last week – trendlines remain identical. For what it’s worth the index has held its uptrend line.

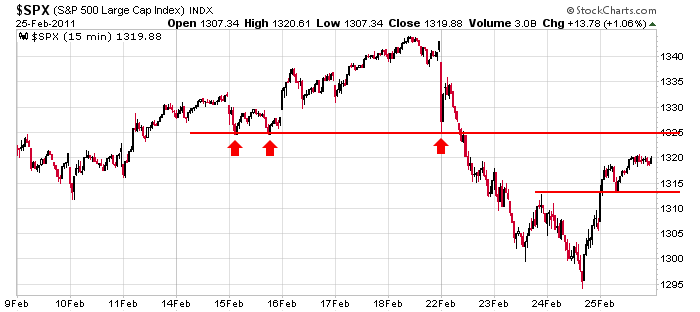

And here’s the 15-min chart. The horizontal lines are what I consider to be short term support and resistance, but as of now (about 75 min before the open), the S&P is set to open slightly above 1325.

News will dictate what happens next. If Wall St. doesn’t think Libya is a big deal, it could be onward and upward for the indexes. But if protests spread in that area of the world, last Tuesday’s selling could be just the tip of the iceberg. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Feb 28)”

Leave a Reply

You must be logged in to post a comment.

“If Wall St. doesn’t think Libya is a big deal…”

If that isn’t the statement that really sums it all up. This is the same brain trust that thought the events preceeding the 2008 collapse were not a big deal either. Wall Street is a collection of psychologically defective egotistical morons and that won’t know a “big deal” until it is far too late…

I didn’t say Wall St. would be right to think Libya isn’t a bid deal. I simply stated the market could go up of this were true. Said another way, if the egotistical morons on Wall St. keep buying, guess what, the market is going up.

Most likely we will try to fill the gap from the 2/18 high of S&P 1344. HW

GM looks odd -weak- no strength. Rumors the dollar will sink again taday.

Google shows their cloud is not infalible – lost many email accounts. Price likely stronge.

What is going on in Ireland? the new government threatened to jump ship and the Euro rises. Pardon me, but does bad fiscal behavior merit currency appreciation? Yes in EU, No in the US.

Top in June, live it up til then.

Charlie Sheen is going through the classic signs of detoxification.

And I’m not talking about a Colon cleanout. HW

did anyone short todays LH ,tinny weeny sub wave ,counter trend high

good fiscal behavior is for ireland to dump the bond holders–germany /london bankers,giving them a justifyable crew cut causing a great financial melt down that was based on lies

at this stage of the charts a gap up open that fails is a sign of relative weakness

Hey AUSSIE JS: What happened in your last post? All of your spelling was A+

I guess you turned on that little button that says ‘Spell Check’ HW

no –i dont trust computers to spell correctly

Because you do SUCH a fine job yourself,don’t you Aussie Joe ?

Dear friends look at this Nasdaq BP Renko chart:

http://stockcharts.com/h-sc/ui?s=$BPCOMPQ&p=D&yr=1&mn=0&dy=0&id=p44398494535

“Don´t fight with the coming Trend”