Good morning. Happy Tuesday.

The Asian/Pacific markets closed mostly up. India gained more than 3%; Indonesia, Japan, Singapore and Taiwan rallied more than 1%. Europe is currently mostly up; there are no standout winners or losers. Futures here in the States point towards a small gap up open for the cash market.

Yesterday was the third day out of the last four the market trended down early and then trended up during the afternoon session. I’m not going to read too much into it other than to note if a top is indeed in place, the bulls are not going to go down without a fight.

Bernanke speaks to a House of Representatives committee today.

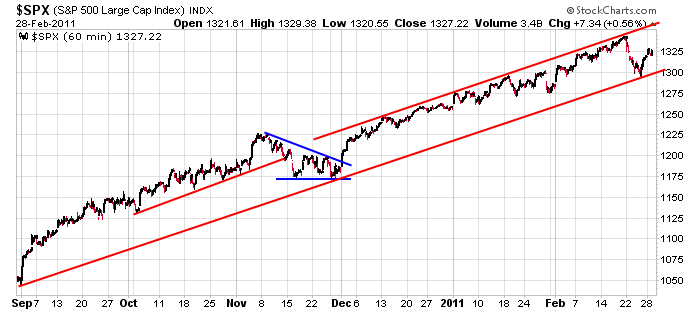

Things have certainly calmed down since last Tuesday’s sell-off. The S&P lost about 50 points off its high, and as of today’s open, about 35 of those will have been recovered. I’m also sensing traders aren’t too worried about Libya or protests spreading elsewhere in the region. Whether they should be worried is another story. The overall trend remains up, but given how the market has reacted to Egypt and Libya, we need to be on our toes. News trumps the charts, and given the odds for a surprise event overseas, I don’t think this is a time to go all in. Be selective and manage your positions well.

There’s been a fair amount of press regarding the market’s tendency to move up the first day of the month, so most players are expecting an up day today. Here’s the 60-min SPX chart. Charts don’t get much better than this.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Mar 1)”

Leave a Reply

You must be logged in to post a comment.

Well it’s Weds 1 am here and I feel as important as a pimple….But it’s better than being a follicle on Bush….or is that Two in the Hand ?

Hey if Aussie Joe comes in ask where he’s from in the land of oz ?

also one day will get that Photo for u Neal…and whatb about a Dow 1300 T-shirt ?

Helps if you are sober when you post.

This the Bernanke Day for gods sake: anything can happen!

townsville ,queensland,Jay

if spx went down 900 points in the first leg then 900 points from now would be about 444

therefore we should breeze through 666 on way to 444

hey Neal

queensland is about 1/5 -one fifth the size of usa

the cyclone was 500 miles wide,-we were on the outskirts of it and only got force 2 winds,which was exhilerating and thrilling

what was not good was the cleaning up after and 4 days without power

im still repairing some rental properties i own

—-price has broken my targets confirming a down turn

1313 spx –12095 dji

saw on t.v even jimmy rogers is short the ndx

im short ftse-dax-ndx-spx=dji-xjo-n225 and ill stay in them overnite and see how they go