Good morning. Happy Thursday.

The Asian/Pacific markets almost closed up across the board. Only China lost ground, and South Korea and Taiwan rallied over 2%. Europe is currently up across the board. France, Germany, Norway and London are up more than 1%. Futures here in the States point towards a very big gap up open for the cash market.

So the single most bearish day since August (Tues) was followed by an fluctuating range bound day (yesterday), and now we’re going to get a big gap up which will be above yesterday’s high and will recapture half of Tuesday’s losses. The bulls won’t go down easy, if they go down at all.

Here’s the 60-min SPX chart I’ve been posting the last two weeks. The long term trend remains up…and even if support gets taken out, we need to be open to the formation of a falling wedge.

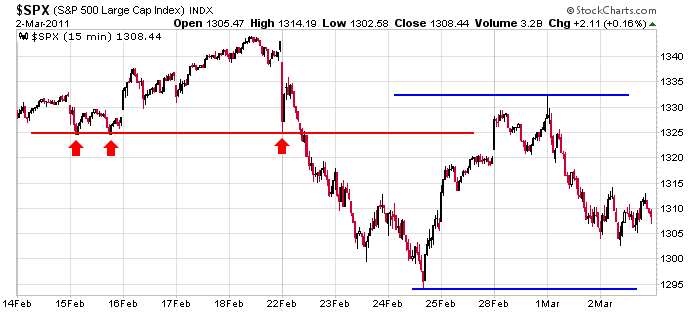

And here’s the 15-min chart…not much clarity. We’ve gotten some ups, some downs, much more volatility and an expansion of the intraday ranges, and after three weeks we have a market that will open today in the middle of its range between 1345 and 1295.

I’ve been in conservative mode lately and not taking any big chances.

Tomorrow, 60 min before the open the Labor Dept. releases the latest employment figures. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Mar 3)”

Leave a Reply

You must be logged in to post a comment.

Employment on Friday may hold the key for a while to come. Mr. Bernanke’s stimulus is still effective but only for a couple of months.

The futures are up 13SP this AM and I suspect that is just a preamble to the return of the bull. But not so healthy a bull, gold and silver down, but $ down too. And… interest rates are steady to down. Divergences Divergences Watch out.

Does the dollar fall further, or do we see higher interest rates?: ECB says EU rates up in April.

Back to a pile of cash for a while. Nothing here this morning.

Neal is going to stop posting on this website and Charlie Sheen

is going to stop blow up his nose. Hey, what day is it today?

Is it….uuuh…April fools day or something? Oh no, not quite yet.

Bernanke is just waiting for the right moment to pull the rug

out from under the floor. Any day now when nobody is expecting

it. Isn’t that what happens when you become too complacent? HW

no–im not on todays exhuaustive move up

wish i could draw u a chart but a classic top would be a lower double top at spx 1334 or a marginal above that,but it shouldnt go above 1344

unless u were a daytrader u would need confirmation below 1294

for us orphans that dont have a possition ,these things are good to know

yes,Jason–trying to pick tops is bad for the mind set –well sometimes

Hey Neal—u can always come and stay at the great barrier reef—alright free if u do the house work

ndx wants to fill the gap before going to zero and ftse seems happy with 6000

of course the deutcherbank is controling things now –no longer goldmans