Good morning. Happy Wednesday.

The Asian/Pacific markets closed down across the board. Hong Kong, Japan, Singapore and Taiwan lost more than 1%. Europe is currently down across the board. Only Belgium has lost more than 1%. Futures here in the States point towards a flat open for the cash market.

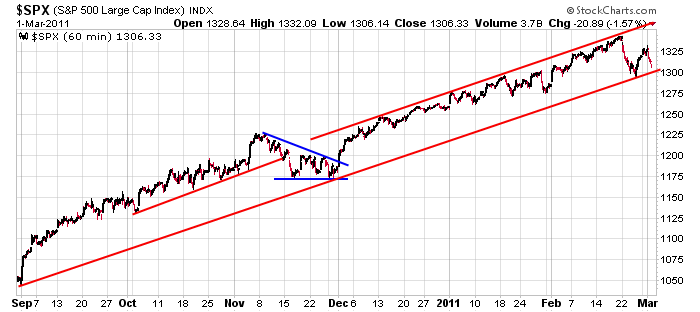

Judged individually yesterday was the single worst day since the end of August. Only 6 S&P 1500 stocks closed in the upper 10% of their intraday range. On the flip side, 1031 closed in the bottom 20% of their range and 1231 closed in the bottom 30%. These are the most extreme readings since August 30. By itself yesterday should be taken in stride, but taken with last week’s big down day and the sell-off at the end of January, we need to take note. At the very least the market is telling us upside progress will be put on hold for the time being.

The longer term trend is still up (see below), but the short term is definitely in question. This is not a time to take big chances. I’m a firm believer that you take the easy and obvious trades, the ones that jump off the computer screen at you. If you have to squint your eyes to see the trade, pass. Right now I don’t see much that is jumping off the screen at me. I’m also a big fan of group strength. Stocks that do well tend to come from groups that are doing well. Right now, only gold, silver and oil are doing very well, but most of the stocks in those groups are too far gone to chase. Be patient. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers