Good morning. Happy Monday. Hope you enjoyed your weekend.

The Asian/Pacific markets closed mixed. China rallied almost 2% while Australia, India, Japan and S. Korea dropped over 1%. Europe is currently mostly up; only Stockholm (up 1%) has moved more than 1%. Futures here in the States are flat.

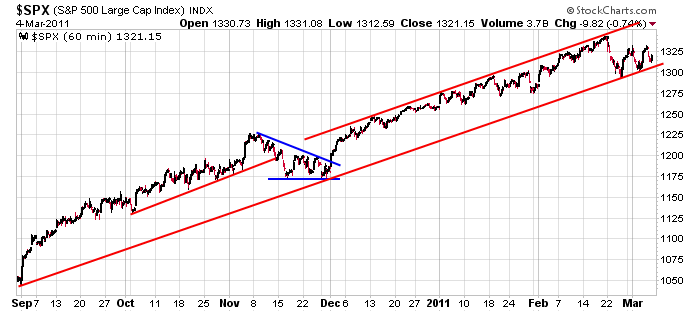

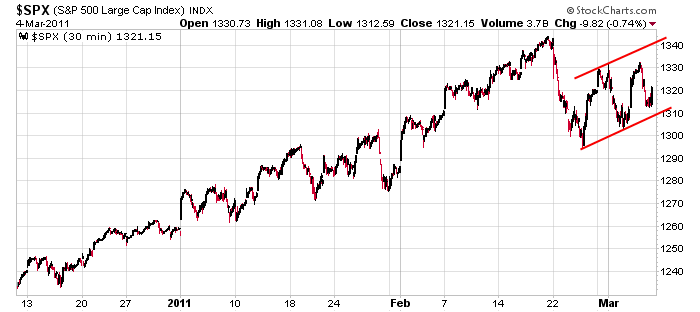

I don’t have much to add to the comments I made over the weekend. The overall trend remains up (see first chart below) while near term, the market is in consolidation mode…and it could be argued the indexes are forming bearish rising patterns (see second chart below).

Until things clear up, this is not a time to take big risks. If you only allow yourself to take the easy and obvious trades, you’ve been doing more sitting and watching and less trading lately because things are less clear, the near term trend is nonexistent and there are much fewer good opportunities. If you’re a day trader, eat your heart out. Last week was heaven. If you’re a swing trader, there’s no shame in laying low. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Mar 7)”

Leave a Reply

You must be logged in to post a comment.

Yes,Jason a daytrader loves the volitility,but without the trend it just becomes choppy and deceptive–thats why i love ur common sence approach and read ur articles

a triangle could be forming from the highes as well and the central banks wont let this or the euro , die easy–eventually they will have too

sure feels like a topping market—hope we can get a drop below 12000dji for a retest that fails—but my reallity is the 1 min chart–longer than that im hopeless

My macro picture says up into June, with some volitaltiy of course, then, a strong correction. My picture is timed by cycles, and maybe the cession of the QE2. Who knows?

My IPad 2 is very hard to put down, it makes my life different, the laptop now seems confining. I have a flash memory on the pad that lets me go to 100Gs. Will it change the home/office computer suite? I am considering another 100 for our firm.

Disruptive technology is required if we are to grow again. Apple marketing is part of the story. Wish I had the brains to own the stock back a couple of years.

Consolidation today is my bet, but I will build longs in ETF leverages for the run to 1400 or so.

1400 on the S & P Neal…NOT Dow 14000….Are you using the wrong glasses again Neal or are the effects of the ’87 Reisling kicking in ?