Good morning. Happy Friday.

The Asian/Pacific markets closed down across-the-board. Almost every index dropped at least 1%. Europe is current down across-the-board. There are several 1% losers there too. Futures here in the States point towards a down open for the cash market but not nearly as down as one might expect considering the losses overseas.

Looking at a bunch of charts last night, noting how many of them are broken, I’m going to go out on a limb and say it would take some very good news out of the Middle East to trump the extremely poor technicals. A few broken charts is fine because money rotates around the market, but when many charts in many groups are broken, there isn’t enough money at any given time fix them all at the same time. That means best case scenario is for some to get fixed while others lag and then the next group gets fixed and so on. This takes time which is why I’m thinking absent good news, the best case scenario going forward is flat trading. Worst case is obviously much worse.

The bulls have their backs against the wall right now. They either dig in and defend their turf or the game is over in the near term. There are too many broken charts for the market to reverse without great news trumping everything.

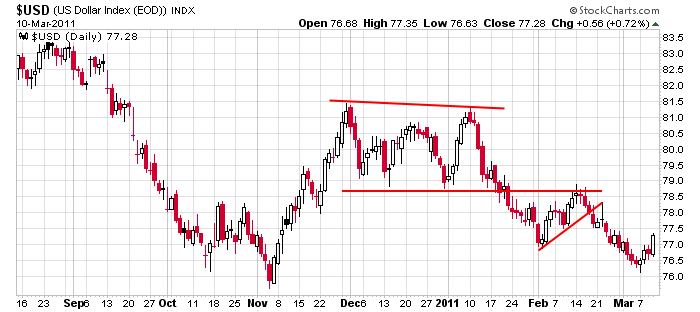

Aside from the many broken charts and indicators such as the Average True Range (ATR) moving up, the US dollar is bouncing too. It has mostly moved opposite the market over the last year (or has the market moved opposite the dollar?), so a move up adds more downside pressure to equities.

I’ve been in conservative mode for a couple weeks. As a swing trader who typically holds for a couple days or a several weeks, my goal is to take good set ups under favorable conditions and then let the charts play out. But the conditions haven’t been favorable, so I haven’t been very active. This could change now as my charts tell me even if the market bounces, the upside will be limited. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Mar 11)”

Leave a Reply

You must be logged in to post a comment.

My spread puts were good and profitable yesterday, but today I am lightening up.

I am taking on more bond calls and playing the dollar to make a run back into the 80s.

The bond auction yesterday was 3:1 bid-offer, highest in history. Someone wants to hold US Tresuries, long end of the curve.

Yen up on dollar, I am long expecting more appreciation after the quake.

Whidbey: what is a good bond ETF

I can use to play the move? TLT? HW

HW

Look at BIV,BLV, LQD as possibles which can be stopped and which low costs. The first two are Treasuries mostly, and LQD is corporate bonds. Today Friday is a reaction day and ymight make a good entry possible. Use 5-8% to avoid the volitality stop outs.

i havnt seen a opts ex or quad played this way

small flash crash and work way up to start then down ect almost as if the market makers were taking out all the calls or bulls

normally its take the market to highes on short squeezes and work way down

but its good volitility

today looks like small range–prob the 12000dji-1300 spx has a lot to work through

mon long range hopefully

AussieJS: are you still there my boy?

How are you going into the weekend?

What positions. Trader talk here in

NYC is that mostly people want to

stay flat until Monday. HW

wise idea Howard

im not a position or swing trader

these days i only collect bull scalps as a futures trader

the only position i may leave open is short the japan markets n225 and oz -xjo

usa futures open when sydney does so i can get the mood from there

with opts ex next fri i think by the way the markets are trading the market makers are hedged short

my best guess for mon is a flash crash to spx 1275 or lower

i may has a small short on the ndx as japan has a lot of tech’s and with the quake and sunarmi

japan and asia could see a lot of selling

Jasons opts report -open interest is good—i follow the $CPCI and $CPCE charts

even oz ,indonessia and new zealand are on sunarmi alert

we jast had a cyclone that im still cleaning up from