Good morning. Happy Thursday.

The Asian/Pacific markets closed down across the board. Australia, China, Japan and Taiwan each lost more than 1%. Europe is currently mostly down. Losses are less than ia Asia. Futures here in the States point towards a down open for the cash market.

You see what I see. The market is working on a second consecutive inside week, and we’ve already gotten two consecutive inside days. Needless to say, pressure is building, and a quick move in either direction should play out soon. A solid up day today would put the indexes back at their highs. A solid down day would put them near 5-week lows. The overall trend remains up, but near term, anything goes.

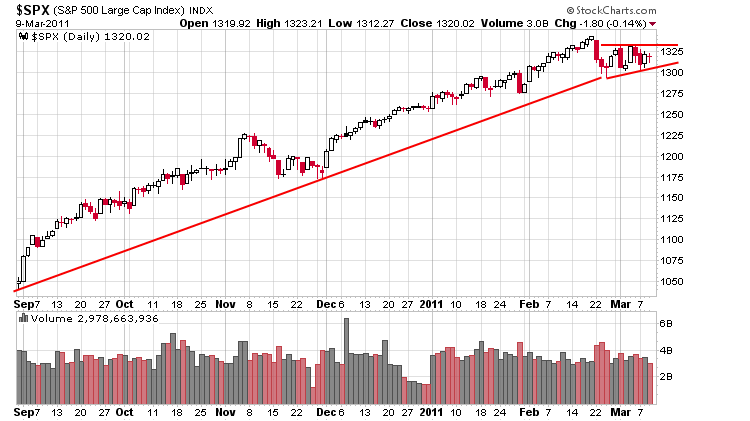

Here’s the daily S&P chart. If all you knew was this chart, you couldn’t be anything but bullish. Yeah the volume has been heavier on down days than up days, so a little caution would be warranted, but otherwise, based on this chart alone, it would be hard to be anything but bullish.

The wild card right now is Saudi Arabia. There are planned protests in the country tomorrow which will be middle of the night here in the States. Absent a big move today that seems to start the market’s next leg, it wouldn’t be a bad idea to scale back today.

For those of you who trade the eminis, today is rollover day.

More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Mar 10)”

Leave a Reply

You must be logged in to post a comment.

Flat and staying that way for a while. Bonds up. Why?

Stay flat. Too much whipsaw action going on

in the market right now. Take Max, my dog

out for a long walk on days like these. HW

weak longs gotta leave.

see how the charts warned you>

see how the big traders knoew everything.

see how you and your Trade Station predicted this

And thank cnbc…they had a special bithday on the Dow ..two year high.

was there not a Doji star?

Or Weinstein cross.

You want Dow 12000…you got it.

Now you gotta expect the road to get bumpy…

But we told you so.

Except we did not charge you.

a change of behaviour–

prev opts ex–instos have pushed it to highes –thurs fri mon tues before and worked their way down into opts ex

nows its down at start then push up with whipsaw then down to close intraday–just love it

so it may be 7 days down to quad witch

todays a bit of a grind but im waiting to reload

my ny tick ind keeps me on the right side of the zero line