Good morning. Happy Monday. Hope you had a nice weekend.

The Asian/Pacific markets closed mixed, but Japan understandably lost over 6%. Europe is currently mostly down – only Germany has dropped more than 1%. Futures here in the States point towards a sizeable gap down for the cash market that will erase Friday’s gains.

I don’t have much to add to my weekend report. The market is in touble unless it can right itself quickly, and today’s open won’t help the matter. The confluence of higher volatility, weaker breadth readings and news from overseas (Libya, Japan) seems to be too much to swallow all at once. The market has needed to correct for a while, and this is a great time because the blame can be passed to something other than the US economy.

There’s a Fed meeting tomorrow. It could stall or delay things for a day, but overall the Fed rarely changes the sentiment.

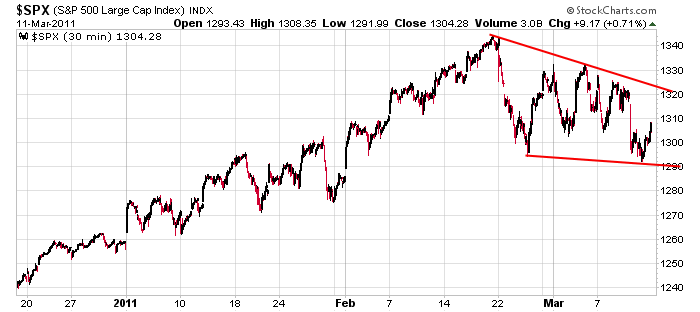

Here’s the 30-min SPX chart. The bulls will argue a falling wedge within an uptrend is forming. They’re right, but if the index fails to move to resistance and instead falls below the lower trendline, the pattern will be mostly invalidated. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Mar 14)”

Leave a Reply

You must be logged in to post a comment.

(1) Aussie JS: Get back into bed with your vegamite sandwich

and start bull scalping. I owe you thanks for going (partially)

short at the bell on Friday. Look for a Fed ‘pop’ tomorrow

and then resume the downward trend into Quad witching. HW

Look at Apple running in the pre-market. No doubt everybody

is bailing out of their Japanese positions and rotating

into Apple. HW

Down thru Wednesday, Fed speak, then up to June high. I will go long for the ride up using leveraged index funds and few of Jason’s ideas.

the dax is getting killed on japan news–dont buy any chip stocks –chip prices through the roof–or insuance stocks–all japan related

had 2 rides to s5 piviopt on dax all ready

PLUS THE BIGBOYS ARE HEDGED TO THE SHORT SIDE FOR OPTS EX FRI—retailers still long

still shoert japan –its in trouble

ndx is only thing trying to push up but that wont last the day out

i dare the fed to stand in the way of the big boy instos that want it down

ive put my glasses on so i can see what key im hitting–its midnite here

just love the way the big boys are playing it –the drop the market hard to take out stops

then work their way back up to take out the opts and calls–intraday i mean–then down again–im getting tired of reloading

love volitility

Wall Street usually breaks for the lunch hour.

So let’s see what happens in the afternoon

session today. Don’t forget….Aussie JS

Europe will then be closed,so watch your

short position with tight stops. HW

europe closes in 1 hour –they may want to push it up into close–thats usual but this aint usual

short uranium stocks –bhp -rio -paladin –thats 3 of our oz stocks

just had a tick extream–so im flat

sorry Jason –i know this is not a daytrading forum

yes…this is! a day trading forum.

watch out for Fed speak tomorrow. HW

Today, these are the hot ETF’s for day trading:

short: TZA and FAZ

long: TNA and FAS

Howard Weinstein

NYC

u have changed ur hours of trading–time change–so i dont get my midday nap

longer term imo we are at the start of a elliott wave 3,that should take all world markets down to zero–but good for the swing trader

of course it needs to confirm the downtrend first