Options expire this Friday, so let’s take a look at the open-interest on SPY, DIA, QQQQ and IWM to see if they hint at movement the rest of the week. Here’s the theory: the market conspires to cause the most pain, to cause the most number of people to lose the most amount of money. If the market is to accomplish this, what does it need to do this week?

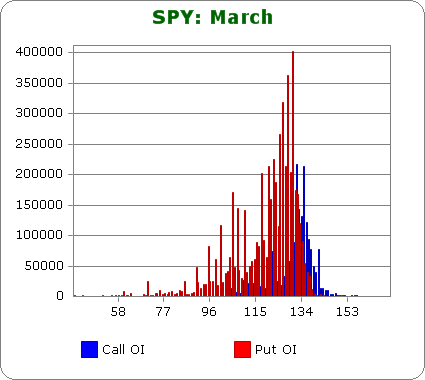

SPY (closed 130.05)

Puts out-number calls 2.6-to-1.0 – less bearish than last month.

Call OI is highest between 130 & 137.

Put OI is highest between 117 & 133 with a few additional spikes below 115 which don’t matter much.

Even though puts heavily out-number calls and the market has been weak recently, SPY option traders are not sitting on much profit. At today’s close, most calls will expire worthless and only the puts bought at the highest strikes are in-the-money. A close right here would cause a lot of pain, but a move a 2-point move up would cause even more pain.

DIA (closed 119.85)

Puts outnumber calls 1.9-to-1.0 – same as last month.

Call OI is highest between 122 & 124 and tapers off in both directions.

Put OI is highest between 118 & 123, and there’s a huge spike down at 70.

It’s worth noting high open-interest for DIA is 10K while high open-interest for SPY 200K. Hence I’m don’t think the DIA numbers matter. In any case, most calls are out-of-the-money and therefore will expire worthless absent a big move up the next couple days, and DIA closed today in the lower half of its high open-interest range noted above. Hence a couple point rally is needed to cause the most pain.

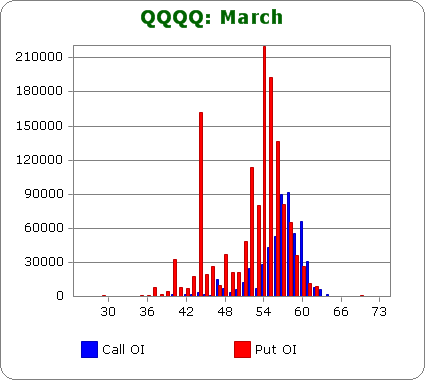

QQQQ (closed 56.29)

Puts out-number calls 2.2-to-1.0 – less bearish than last month.

Call OI is highest at 57 & 58 and still moderately high a couple strikes above and below these two levels.

Put OI is highest between 52 & 57, and there’s a big spike down at 44.

The call and put high OI zones meet at 57, so a close there would cause lots of pain, but since puts far out-number calls, a close slightly higher would cause even more pain. With today’s close at 56.29, a small move up is needed.

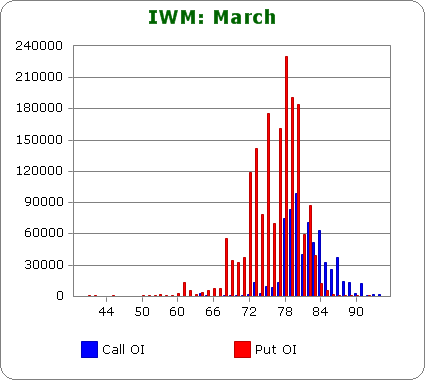

IWM (closed 79.75)

Puts out-number calls 2.9-to-1.0 – less bearish than last month.

Call OI is highest between 78 & 80, and there are a couple moderate spikes at 82, 83 and 84.

Put OI is highest between 77 & 80 with lower spikes at 72, 73 & 75.

There’s some overlap between 77 & 78, so if calls and puts were equal, a close there would cause the most pain. But puts out-number calls, so a higher close is needed. Today’s close was 79.75 – not bad. Flat or slightly up trading the rest of the week would to the trick.

Overall Conclusion: Once again the bears bet on a decent move down, and while the market is well off its high, it’s not enough off its high to give them big profits. If the market trades flat the rest of the week, a lot of pain will be felt by option buyers. But a small move up would cause even more pain.

0 thoughts on “Using Put/Call Open-Interest to Predict the Rest of the Week”

Leave a Reply

You must be logged in to post a comment.

as its the big instos that move the market and thus its their opts that count most not the retailers

Jason can you at sometime in the future or as way of reply ,please explain how you read the following charts and what you find the important points

these chart codes may vary as to what platform you use so ill just list them

— $CPCI, $CPEC, $CPC,$CPU–ON ESIGNAL ITS $PC-ST,$PCCI-ST–investor tools its$cpc

basicly what im looking for is to know when the big boys are hedged long or short

and when the retailers are on the opposite side

thanks in advance and your open interest info is great

Outstanding. Thank you.

is there a mistake at the comment of SPY? it is written:move a 2 point move up-did you mean a 2%?thank you.

No I meant to say 2 points…if it can move from 130 to 132…doesn’t matter now, the market is getting crushed.

Interesting.

Anyway the assumption is that the “market movers” are SPY,DIA,IWM.

What about SPX,YM,RUT?

And don’ t you think a cumulative (index+ETF) analysis cuold be more interesting?

Thanks

Paolo