Good morning. Happy Monday. Hope you had a nice weekend.

The Asian/Pacific markets closed mostly up; China, Hong Kong and India gained more than 1%. Europe is currently mostly up; there are no big winners. Futures here in the States point towards a positive open for the cash market.

I don’t have anything to add to the report I posted over the weekend or the video I posted on the blog. The trend is up; every little dip is getting bought. The market feels like it’s intent on moving up regardless of what’s put in it’s path.

There are very few econ numbers released this week, and earnings season doesn’t begin for a couple more weeks. I’m not sure if a lack of news is good or bad, but it is what it is. The market will have to do its own heavy lifting this week because it won’t get help from elsewhere.

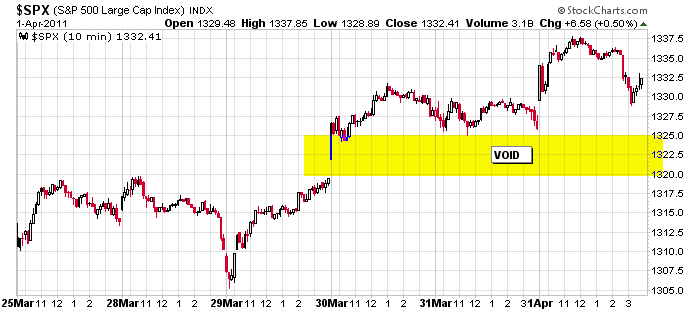

Here’s the 10-min SPX. The overall trend is up, but a void space remains unfilled. It may pull on the market. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Apr 4)”

Leave a Reply

You must be logged in to post a comment.

Bernanke speaks tonight at 7:30pm eastern.

Looking for a small pullback in the final

hour of trading today. HW

Futures are up a little over FV. Weinstein may be correct, its a Bernanke day? Two gaps on the SP, both will be filled this spring probably.

My Vanguard hold portfolio is up 6% ytd. This portfolio has averaged 8-12%/yr for last five years, except one. It doubles every 6-12 years. At my age its is comforting to know

Larry Swedlow is right, buy and hold is not dead because it works. Note to the over 40 crowd.

My trading does better but lots of work. I am expecting a top in May or early June ’11 based on cycles.

Our firm trades Jason’s setups; he does better than anything else we see including me.

Hi Sir,

where (web link) is the report you posted over the weekend? Thanks.

Hi Connie…

The report is posted in the member’s section of the website. Sorry it’s not accessible out here on the blog.

Jason

i just love it when i disagree with everyone

the reality is the trend is down till /if we break the feb highs

(#1) Aussie JS : don’t be so anticipatory. You remember my post from last week?

The next turn cycle date is on or about April 8th. Don’t be a hero. Most Aussie

guys, are anyway. But while we are still at the end of month/begining of month

bullish cycle, I think I’ll take my dog Max out for a long walk. Still looking

for some kind of a mild sell off maybe later on in the day. Target: S&P 1325.

ur right,Howard

sometimes i have a bad mind set—impatients–thats why im a daytrader

but cant help but think the apples may have japanesse worms and ibm may catch some

1. Apple is stalling out around here for a multitude of reasons.

Speak to Professor Neal Weinstraub, he specializes in the Apple stock.

2. IBM was all the rage a couple of weeks ago. They were having

some sort of annual meeting, and all the spin doctors were pumping

up the stock. But then they dropped it like a hot potato for some

reason. Today I was reading where some analyst jut gave it a $200

dollar price target, but the stock is somewhat inactive right now.

3. The new buzz word on CNBC Pisani is ‘margin compressions’ Notice how

they don’t say earning suck. They always come up with these fancy words

like ‘consolidate’ margin compressions’ etc.