Good morning. Happy Tuesday.

The Asian/Pacific market closed mixed – China and Hong Kong gained more than 1%. Europe is currently mostly down – there are no big losers. Futures here in the States point towards a gap down open for the cash market.

The Nas 100 is being rebalaced. AAPL will see its weighting reduced from around 20% to 12%, so any funds out there that track the NDX will be selling some AAPL shares to reflect the weighting. If you’ve been wondering why AAPL has been weak the last month, this is why. Somebody knew this was going to happen, so they loaded up on short side waiting for this day (AAPL is down 4 premarket). It reminds me of the story told in Ugly Americans. They should just make trading off insider info legal – nobody goes to jail anyways.

Moody’s cut Portugals sovereign debt today saying financial support from the EU was a matter of urgency.

China raised key interest rates today (4th time since October) in an attempt to dampen inflation.

Meanwhile things continue to progress nicely here in the States. The Russell small caps are at a new high. The Dow is at it’s high. The S&P and Nas are lagging but still in good shape. There are many reasons to not believe the price movement, but hopefully I’ve drilled it into your head you should trade what is happening, not what you think should be happening.

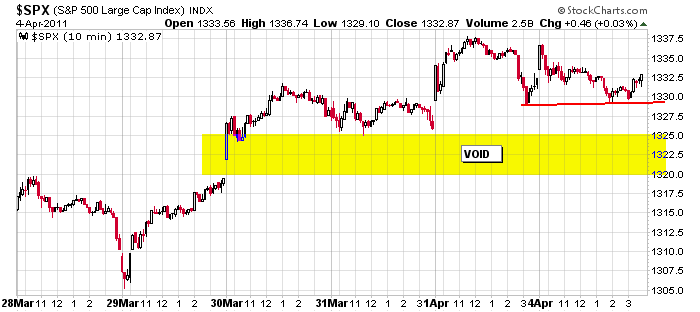

Here’s an update of the 10-min SPX chart. As of now, today’s open will be near yesterday’s low. There’ll be some support between that level and last Friday’s low. After then there’s a void space between 1320 and 1325. If today is weak, filling that void is a no brainer.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Apr 5)”

Leave a Reply

You must be logged in to post a comment.

The ETF’s that I am using for day trading are as follows:

Long: UPRO, TNA and FAS Short: SPXU, TZA and FAZ

Try to stay away from them pre-market because there

is some kind of balloon effect. That is to say there

is too much premium built into these guys pre-market.

Ben says HE is “right” and They are” wrong”. The speech was” damn the inflation full speed ahead with easing. No statement on QE3. What QE3? As usual a model of clarity and guts.

Stagflation is likely in 2011. GDP likely < 2.5% Q1. Then? Likely a correction since the market is levitated, not in PE but expectations.~ May 24 sometime a correction seems cycled in.

AAPL revalued in SP index. Down.Threatens NDX today. TXU makes big buy for 6 billion$ searching for a monoply power ??

Cautious the bears are hungry. Remember Sigfried and Roy? Turn on you in a flash.

Yogi the Bear is going to throw Boo-Boo to the wolves. HW

New York State Governor Elliot Spitzer gave me his

little black book not too long ago. HW

just bought some puts on (TOL) Toll

they were talking about it today on CNBC

Howard said dont go short till fri ,but i got bored

the ndx looks like its starting its 2nd lower high

Thanks Jay for that little bit of clarity on aapl, “so they loaded up on short side waiting for this day “. It could have been next year and I wouldn’t have known.