Good morning. Happy Thursday.

The Asian/Pacific markets closed mixed; there was little overall movement. Europe is currently mixed; little movement there too. After trading below yesterday’s lows overnight, futures here in the States suggest a positive open for the cash market.

The European Central Bank is raising its main interest rate 1/4 point to fight inflation despite dept problems with Protugal, Greece and Ireland.

DISH Network is buying Blockbuster – I have no idea why they’d buy an old-school movie rental business that has high costs and low margins.

The last two days the market has made a higher high and higher low on a day-to-day basis, but the bulls don’t have much to show for their efforts. Each pop has been sold into, so you gotta wonder how willing they will remain to buy stocks up only to have things pushed back in their faces.

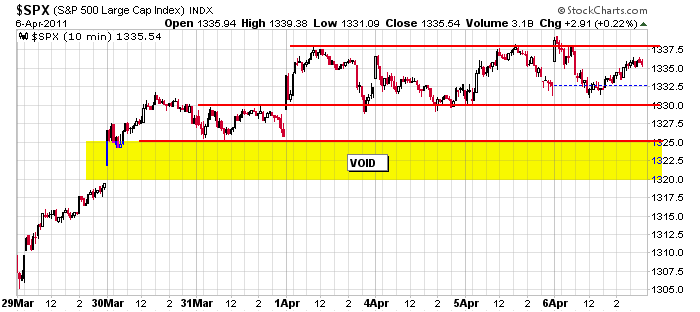

Here’s the 10-min S&P charts. Not much changed yesterday. We’ve had 4 days of rangbound prices. On the downside, there should be support at 1330 and then again at 1325. Then there’s a void space down to 1320. On the upside, the February high at 1344 is a level everyone is watching.

The trend is up; don’t fight it. Don’t get lazy either.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Apr 7)”

Leave a Reply

You must be logged in to post a comment.

ECB rates up, heat on Fed to do likewise. For now? Dollar down, but exports up and the E in P/E goes up and driving stocks up. First time claims down, a few more job. Phony numbers anyway; discouraged are not counted. No budget agreement in Congress and a fight looming. So much for the macroenvironment which is confusing to most.

Yesterday was not impressive, but the intentions were good. I am invested only 20% of account mostly scalping set ups. The Nas is the key, wants to go higher, but no volume behind attempts.

Concern over Silver’s run away in the commodies sector.The common man’s precious metal is either setting up for a let down, or things are worse than I can see. Fear, pure fear.

The problem with the Silver trade is that there

is no stock equity to back it up. The metal

trades very loosely surrounding hype, fed speak

and all that other crap. Too many unknown

quantities to deal with at this point with Silver.

Even if it does go higher from here. HW

just love those vertical moves

perhaps pattern traper can help me ,Neal

does it trade on the 1 and 5 min charts,with piviots and ny tick ind and use esignal

–japan just had another quake and usa to shut down