Good morning. Happy Wednesday.

The Asian/Pacific markets closed mixed; China, Indonesia and Taiwan each gained more than 1%. Europe is up across the board; there are no big winners. Futures here in the States point towards a large gap up for the cash market that will put the S&P at its high of the last 3 days and about 9 point below its February high.

I’m not sure what the reason for the big gap up is. I don’t see any big news items. Who knows. Perhaps Wall St. likes the idea of the gov’t possibly shutting down. 🙂

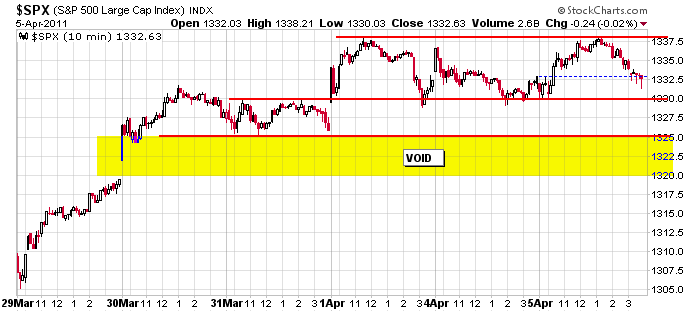

Here’s the 10-min SPX chart. If the futures hold their current level, today’s open will be at the high. If shorts scramble to cover or buyers step in feeling they’ll miss the next run up, the next stop would be 1344. On the downside, there should be lots of support all the way down to 1325. Below that there’s a void space.

The song remains the same. The market has a one-track mind – it wants to go up. Why fight it? It’s so much easier to trade in the direction of the trend. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Apr 6)”

Leave a Reply

You must be logged in to post a comment.

It’s interesting to note that Jason paints the yellow

void box in his chart despite the fact that the market

has been moving forward the last 7 to 10 trading sessions.

Wow! Talk about keeping an open mind//Yesterday’s trading

was weak with a classic pop and drop. Maybe…today..more

yet another…pop and drop. Regards, HW/nyc

Thursday the EU raises rates, Friday something happens in Washington on budgets, maybe. PM think they smell inflation and havoic. Following only silver of which we hold too much.

In the meanwhile I will follow Jason, the void is an attractor and it is like my hanker for chocolate, its is always there and always distorting my excellent judgment.

Riding the setups, and keeping the core invested in growth indexes. And nervous.

the ndx is trying to go up ,led by the dax –its failure will mean a panic that the end of the universe is here

last 5 hours feels like some type of exhaustion top is being atempted

Whidby ‘excellent judgment’ as you call it is an oxymoron.

There is no such thing as excellent judgment within the

context of the stock market because there are so many

variables to deal with. My gut gives me excellent judgment

and I think that Aussie JS in his statement about some

sort of ‘exhaustion top’ may be near. As soon as you see

the 30 min and 60 min charts starting to roll over, that

will be your first clue. Hang tight everybody. Hey,

by the way. Where is Neal W today? Doesn’t he know that

check out time at the hooker hotel is at 11am? HW

the ndx is ind a bad pattern –3 down days and a failed attempt –so far- to move up

the ndx could pull the world down–especially with those bad apples that wont keep the doctor away

just closed my shorts on everything –as a snipper i have enough scalps for the nite—oops day

Howard,–what is a 30 and 60 min chart–scalpers use a 1 and 5 min,but we need the long term 30 and 60 sup/res to push us into profit

nite all going to sleep

Does any know anything about TGG on the Frankfurt exchange? Their web site is http://www.tgeg.asia/ It sounds to good to be true. Thanks