Options expire this Friday, so let’s take a look at the open-interest on SPY, DIA, QQQ and IWM to see if they hint at movement the rest of the week. Here’s the theory: the market conspires to cause the most pain, to cause the most number of people to lose the most amount of money. If the market is to accomplish this, what does it need to do this week?

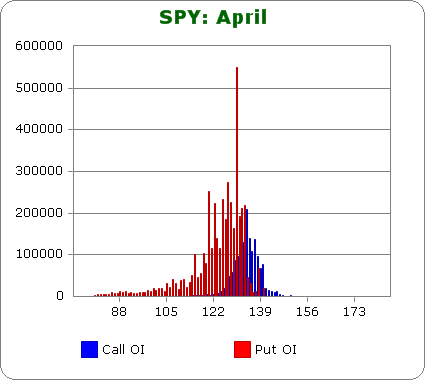

SPY (closed 132.46)

Puts out-number calls 2.3-to-1.0 – less bearish than last month.

Call OI is highest between 131 & 138.

Put OI is highest between 120 & 132 with that massive spike being at 130.

There’s some overlap in the low 130’s, and that spike at 130 can’t be ignored. With the stock closing at 132.46, there’s a little room to move down without allowing the put buyers to make money. Overall I’d say flat trading the rest of the week would cause lots of pain, and there’s a small amount of wiggle room in both directions.

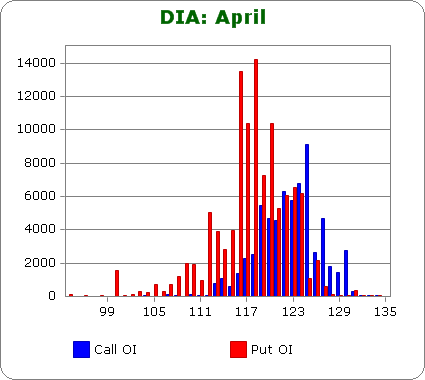

DIA (closed 123.64)

Puts outnumber calls 1.3-to-1.0 – less bearish than last month.

Call OI is highest between 119 & 125.

Put OI is highest between 116 & 120.

There’s some overlap between 119 and 120, and with the stock closing above 123 today, some call buyers have some paper profits. But I’m not sure it matters. High open-interest for DIA is 8K contracts. High open-interest for SPY is 200K contracts. Nevertheless, even though DIA OI extremely light compared to SPY, a move down would cause the most pain.

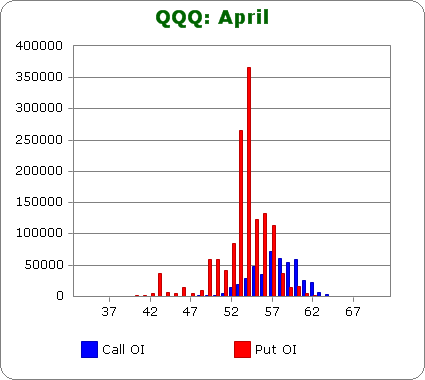

QQQ (closed 56.76)

Puts out-number calls 2.1-to-1.0 – same bearishness as last month.

Call OI is highest between 55 & 60.

Put OI is highest between 53 & 57.

There’s overlap between 55 and 57, but like other issues, put OI is so much greater than call OI, expiring as many puts worthless as possible would by default cause the most pain. For such to happen, QQQ shouldn’t go much below 57, so with today’s close, we need flat trading the rest of the week.

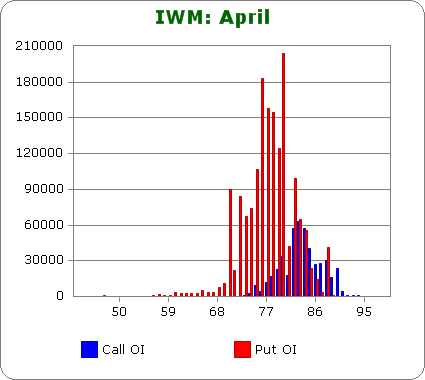

IWM (closed 83.23)

Puts out-number calls 3.5-to-1.0 – more bearish than last month.

Call OI is highest between 82 & 85.

Put OI is highest between 75 & 82.

The two blocks meet at 82, so closing there would cause the most pain. With today’s close above 83, a small move down is needed. As long as the stock is above 80 (the biggest put spike), lots of pain will be felt. A small move down is the call.

Overall Conclusion: Once again options buyers bet on a move down, and once again they’ll lose. A small move down the next four days will cause the most pain, but this isn’t an exact science. Flat trading would be fine too.