Good morning. Happy Thursday.

The Asian/Pacific markets closed mostly down – there were several 1% losers. Europe is currently down across the board – there are a few 1% losers there too. Futures here in the States point towards a flat-to-slightly-up open for the cash market.

The US dollar is down…gold, silver and oil are flat.

Yesterday was the market’s single worst day this year. After a couple up days that put the Nas and Russell at higher highs and the Dow and S&P close, the indexes got clobbered. We were looking for follow through and instead got nothing but solid and steady selling pressure all day. Charts of many individual stocks went from looking decent this past weekend to looking ugly all in one day. Nothing I was looking for to confirm a new leg up has played out. The AD line and AD Volume line have reversed down. New highs turned down. New lows turned up.

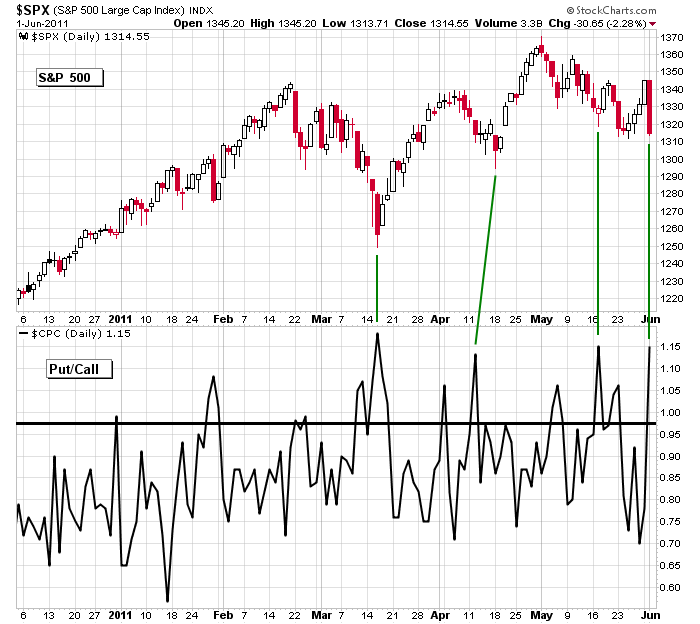

The put/call ratio hit a level that produced bottoms several times the last couple months, but notice in the chart below the green lines connecting the charts tends to lean forward. Hence the PC tops and then the market bottoms a few days later.

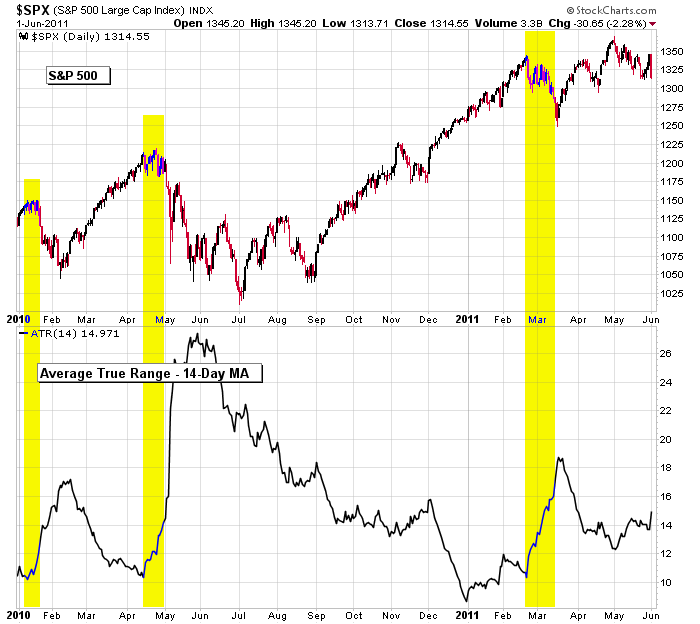

But the ATR has moved up to its highest level since late March.

I don’t like to make predictions. I’d rather just read the sign posts and play follow the leader. None of the things I was looking for to confirm a move up happened, so the 1-month downtrend remains in place. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

yesterday’s sector performance

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jun 2)”

Leave a Reply

You must be logged in to post a comment.

I was having a brief conversation with Aussie J this morning,

and he alluded to the fact that maybe the big boyz intentionally

pushed the market down yesterday so that they could pick up

shares today at a more affordable price today. HW

Howard,

It’s more likely the big boys pushed down prices as a message to Helicopter Ben that, “We want QE3 and if you don’t give it to us, this is what happens.”

(#2) As noted by one of the CNBC commentators. The 280 point

drop in the Dow yesterday was a gradual decline into the close

as opposed to, let’s say a huge ‘gap down’ in the morning.

This took me and everybody else by surprise, I suppose. HW

no HW i said,the nasty mutuals–the long onlys sometimes wait till the 2nd day into the trading month to do the rediculouse buying

the mutuals are almost always on the wrong side of the market at a turn

i much prefer the sane hedgies that can go long and short

a good set up from here would be a failed rally

but as long as we get intraday volitility–im happy

looking forward to some 500 dji point days

You know I’m drunk, Aussie JS, so who cares?

Nobody loves me anymore except Neal W. lol

The Mayor of Newark, NJ, Corey Booker, does not

allow anyone from Chicago to visit his town.

2) Hey Neal, June 9th is fast approaching. You

better tell us whassup…or else you will lose

all of your credibility with Leavitt Bros. HW

no wonder the banks and hedgies are so leveraged to the downside

they will make a fortune–more than they could ever make with the fed in their back pocket

yes Neal that will be the kiss goodbye from uncle ben

No QE3, can u back that up? Do you really think congress is going to bite the bullet? As I said earlier, I’d like congress, business and the people to focus spending on that which would stimulate and generate a sound economy. But that’s not the way. We spend money on what makes us happy and getting votes makes politicians happy. BTW Jason, its Happy Thursday today not Wednesday.

“Everybody is passing the buck…until there will

be no more buck to be passed around.” HW (my quote)

“Presidents are selected….not elected.” FDR

No QE3 is big Neal. Quit jacking around.

After several weeks of extensive and intensive training at the Philly FED, Chuck Plosser assigned me to work out of my home office on a consultant basis (1099 with no benefits). He told me the FED wants to buy as much time as possible so it’s important to keep the stock market averages somewhat stable (sideways) while Ben trys to figure out the next step. My assignment has been to present Chuck with technical chart formations that will look both bullish & bearish. I’ve suggested that he have his “traders” work towards a daily “Triangle” pattern that would be construed as bullish by the Longs yet also look like a “Broadening Top to the Shorts. So, for the bulls, we have the MAR low as wave “a”, the MAY high as wave “b” and we’re currently descending into wave “c” ideally down to SPX 1270-1294 area to be followed by a wave “d” rally and wave “e” down. For the bears, we’re suggesting that the FEB high is a “left shoulder” & the MAY high is the “head” of an expanding “Head & Shoulders” top with anticipated neckline to form along SPX 1250. That should keep both bulls & bears happy for the next few months while Ben figures out the next step in his “inflate or die” scenario. Chuck was thrilled and presented my idea to Ben over the Memorial Day weekend.

Nice to have you back in the saddle Pete M. Don’t cheat

on your taxes with that 1099 form of yours . Uncle Bennie

boy wouldn’t like that very much. HW

Show Ben the iconic Iwo Jima flag raising photo, six pair of hands on the same pole raising one flag. The enemy is reckless spending. The buck needs to stop in everyone’s hand. But, as I said earlier, we spend on what makes us happy not on what makes us healthy.

I have a funny feeling that someone from the Fed

(other than Pete M) is monitoring this blog. HW

Howard – I’m on a tight deadline with my next FED assignment but I thought you might find this interesting. I asked Chuck if he’s been to Chicago to meet the FED boyz there and what was his impression. He said the only thing he remembers about his visit was how bad those “deep dish” pizzas were (to much cheese with a too thick soggy crust). I have to take him to Trenton, NJ to DiLorenzo’s (“DiLo’s”)for the real thing. He asked me about NYC pizza. I told him I’d find out. Can you help me or do you only know the Jewish Deli places?

By the way, Chuck said he never met Neal when he was at the Chicago FED but heard all about him from the FED boyz. He wouldn’t elaborate.

great work ,Pete

if u wont to see the terminal broadening ,jaws of death look at the oz markets

we had a failed broadening pattern in 2010 –now just into the next and there are all little h/s ‘s running all over the world

eventually gabriel will fail to blow his horn-trumpet and the jaws of death will consume the fed and usa pollies

if u have ever read ew and looks like u have u will realize the fed is really insignificant

especially with out its viagra

my view of yanks is that they are too wraped up with their own importance and dont therefor see the big picture

trouble will come from europe and china and once the banks regain a taste for shorting–the fed will be caught with all the long only mutual and pension funds

nothing can save usa

try telling Uncle Ben nothing can save the USA

uncle ben start working for the taxpayer that pays ur wages not the banks that elected u

America is too big to fail. Who owns America’s debt? That’d be interesting to know. I’ll look for a chart after lunch. See where my priorities r.

The political system in this country remains relatively intact,

and the Tea Party movement (for what it’s worth), has made

some impact, but nothing more than sensationalism at this point.

When you start to see the political system break down as a

result of our financial mess, then you know where the pigs

go to roll around in. That will be us before too long. HW

Pizza…..I suggest that you go to one of those blog surveys

and find out what the general public concensus is. I’m afraid

if I give the FED a bad rec on food stuffs the IRS may want

to audit me for the last 7 years or so. Wind up in jail where

the pizza, I hear, is not too good. HW

Food Network, Bobby Flay

Don’t get me started RichE because you know what happened with Bobby Flay?

He grew up in Manhattan in the same neighborhood where I live (86th & Lexington)

and Bobby when he was a teenager he started working as a delivery boy for a

pizzaria-italian restaurant located on Lexington Ave corner of 84th St. HW

the carry trade is far biger than the fed

Are u saying it’s better for the carry trade if America goes under? How much has the carry trade borrowed from America?

The carry trade will go back to the japenese yen ,where it belongs if usa interest rates go up,then the usd will sky rocket,destroying the fed that has to pay interest rates on the bonds it hold

I don’t understand. Isn’t the interest rate fixed on the treasuries the Fed sold? Also, the FED owns 53% of the treasuries it sold so it’d be paying it’s self with one hand and collecting with the other. A net zero.

Hi RichE,

the carry trade is a diferent thing

if as Neal says the fed is going to raise interest rates,then japan at 0.5% will be the cheapest so the risk on trade with borrow in yen and come to oz,where interest rates are high -gold or where ever to get a better return

currently they are borrowing in usd’s as its the cheapest

dont know if ive explained myself enough

Hey old timer! What happened in 1980?

http://en.wikipedia.org/wiki/United_States_public_debt

From 1945 to 1980 the debt was 3 trillion. From 1980 to 2010 it increased 500% to 14 trillion. So what happened?

I don’t disagree. It will be better in the long run. I wish there were a less painfull way.