Good morning. Happy Monday. Hope you had a nice weekend.

The Asian/Pacific markets closed mostly down – Indonesia and Taiwan lost more than 1%. Europe is currently trading mixed – not all the markets are open. Futures here in the States point towards a positive open for the cash market.

I don’t have anything to add to my weekend report. The market is in bad shape for various reasons, but markets don’t move in straight lines for long. I expect a bounce sooner rather than later. It’s fine to take partial profits on shorts, but I’d maintain some exposure just in case the market melts down. If we do get a bounce, it’ll be shortable. We’ve haven’t had a complete washout, and as of now, there isn’t any catalysts looming that could turn the negative sentiment around.

The dollar is down. Gold, silver and oil are down too.

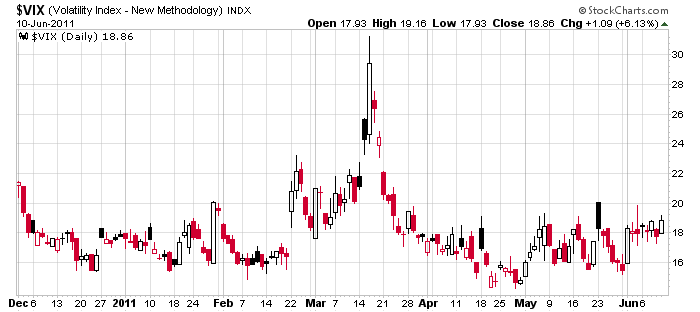

One chart I forgot to post yesterday was the VIX chart. Here it is…very odd that with the market’s recent weakness, the VIX has barely budged. I’m guessing there’s some funny math going on that’s related to the index’s lack of downward movement. Many stocks have gotten hit hard the last month yet the indexes are only down 6-7%. Doesn’t make much sense. I’m going to look into how the VIX is calculated.

headlines at Yahoo Finance

today’s upgrades/downgrades

yesterday’s sector performance

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jun 13)”

Leave a Reply

You must be logged in to post a comment.

I have been posting this based upon Elliott Wave theory, where everything

according to them is calculated in five waves. So, in order to complete

the current cycle we are in there has to be some sort of topping action

which would be considered waveE up. Topping action can manifest itself in

various forms:1. a blow off top 2. a truncated top or; 3. a normal top. HW

I believe the VIX is calculated from the IV of the S&P500. And since it’s flattened out over several weeks, current news won’t have as great an impact.

Well here comes the quarterly “make up the settlement” options and futures expiration this Friday…

Should be very interesting to see where the evil doers screw the longs and the shorts…

the big insto/banks are just loving this

go to the nyse tick chart—-negative extremes all over the place

the instos are selling everything the fed is giving them

the fed doesnt have a chance

also keep a eye on the euro

the fed is being controled from outer space

I thought that Australia WAS outer space.

You can tell just by the way those guys talk.

ur right HW we are from outer space

we control everything

nite all now that europes closed –ive made my money for the day

i will turn control back to the fed and those pit traders that want to control fri quad witching

if the fed was smart it would be shorting here so as to cause a short squezee at 1245 spx