Options expire this Friday, so let’s take a look at the open-interest on SPY, DIA, QQQ and IWM to see if they hint at movement the rest of the week. Here’s the theory: the market conspires to cause the most pain, to cause the most number of people to lose the most amount of money. If the market is to accomplish this, what does it need to do this week?

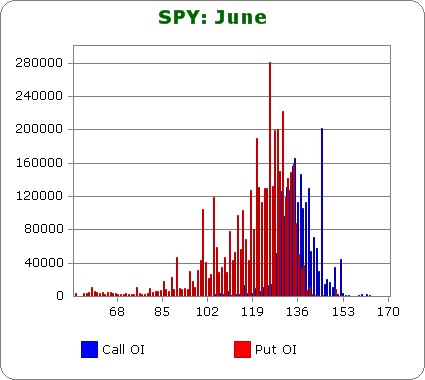

SPY (closed 127.70)

Puts out-number calls 2.2-to-1.0 – slightly more bearish than last month.

Call OI is highest between 129 & 140 and then there’s a spike at 145.

Put OI is highest between 120 & 134 and then there’s a few spikes below 120.

There’s an overlap between 129 & 134, and for the first time in over two years, some put buyers are set to make pretty good money this month. Anyone who bought puts at those higher strikes are likely well in-the-money with their positions. To cause a lot of pain, the market would have to rally big the next couple days. Otherwise, for the first time in a long time, significant profits will be made.

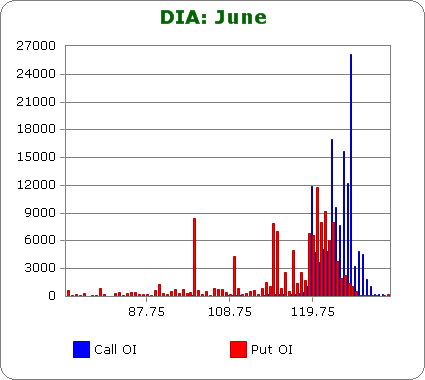

DIA (closed 119.46)

Puts and calls are about equal – same as last month.

Call OI is highest at 120 and between 125 & 131.

Put OI is higest between 120 & 125 and is much less concentrated than the call OI.

There’s not much overlap between the put OI and call OI zones, so picking a max pain area is relatively easy – it’s somewhere around 125. With today’s close under 120, the market would have to rally big to cause such pain. But it’s worth noting the OI for DIA is teeny tiny and irrelevant compared to SPY.

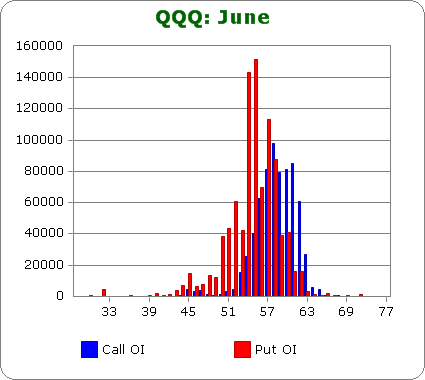

QQQ (closed 54.64)

Puts out-number calls 1.8-to-1.0 – about the same as last month.

Call OI is highest between 55 & 62.

Put OI is highest between 50 & 60.

There’s overlap between 55 & 60, but since puts almost double up calls, a close in the top half of the range would cause the most pain. The stock closed below 55 today – below the bottom of the range. Hence a rally is needed to cause lots of pain.

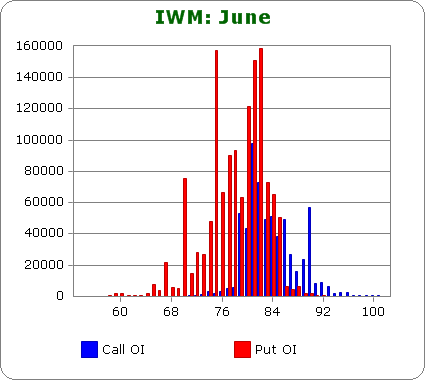

IWM (closed 77.78)

Puts out-number calls 3.0-to-1.0 – slightly more bearish than last month.

Call OI is highest between 79 & 86.

Put OI is highest between 75 & 85.

There’s overlap between 79 & 85, so a close near the top of the range would accomplish the mission to expire the most number of options worthless. Ideally IWM would close near 85 or perhaps a point or two below it, and with today’s close at 77.78, the market would have to rally big.

Overall Conclusion:The bears once again bet big on a drop, and for the first time since I’ve been writing these reports, they’ll actually make some money this month as long as the market doesn’t rally huge the next couple days. Since this is unlikely, I’m thinking things are actually different right now. The market has pulled back several times the last two years, but the put buyers never made money. Now that that they’re going to finally win, I’m tempted to say a character shift is underway.

0 thoughts on “Using Put/Call Open-Interest to Predict the Rest of the Week”

Leave a Reply

You must be logged in to post a comment.

Those put buyers haven’t been wrong. They’ve “just been early.” Now they can load up on puts (if they’ve got any money left) until QE3 is announced. Then reverse and buy calls.

Bernanke said the economy is slowing , earnings have been good already , the market ran up , QE3 in in question. Seems pretty simple doesn’t it ?