Options expire this Friday, so let’s take a look at the open-interest on SPY, DIA, QQQ and IWM to see if they hint at movement the rest of the week. Here’s the theory: the market conspires to cause the most pain, to cause the most number of people to lose the most amount of money. If the market is to accomplish this, what does it need to do this week?

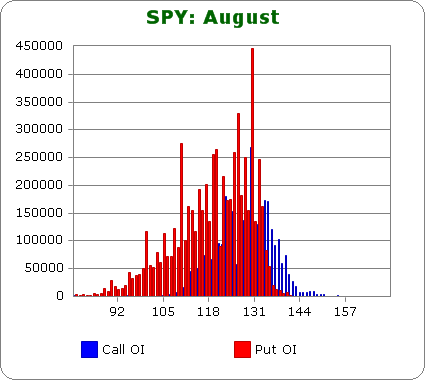

SPY (closed 120.62)

Puts out-number calls 2.1-to-1.0 – bearish but much less bearish than last month..

Call OI is highest between 119 & 138 – a big range.

Put OI is highest between 110 & 133 – also a big range.

Call and put OI zones overlap in the 120’s, but puts far out-number calls. Hence, instead of closing near the middle of the overlap, a close near the high would do more damage. With today’s close at 120.62, the bulls have a lot of work to do to accomplish this – the market needs to move up a bunch. As of now, the put buyers will profit nicely this month.

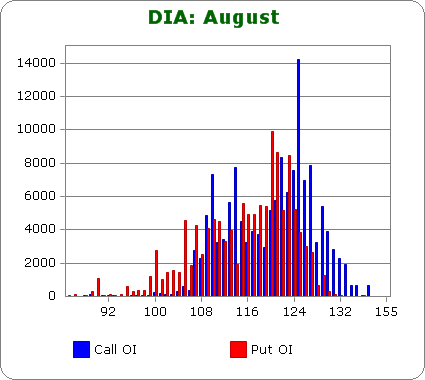

DIA (closed 114.81)

Puts and calls are about equal – same as last month.

Nothing is clear or telling here. Calls and puts are about equal, and there’s lots of overlap. I can pick a strike in the middle that will cause a lot of pain, but no matter where DIA closes, money will be made and lost. I can’t draw any conclusions here, and that’s fine because the open-interest is so small compared to SPY, any conclusions drawn here would be irrelevant anyways.

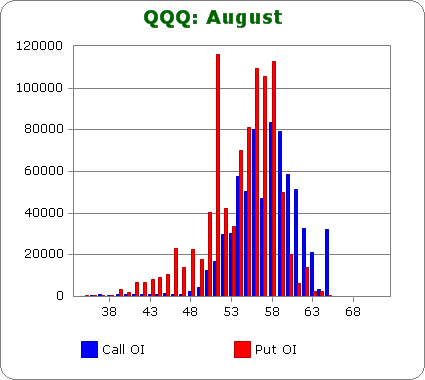

QQQ (closed 54.36)

Puts out-number calls 1.3-to-1.0 – much less bearish than last month.

Call OI is highest between 53 & 61.

Put OI is highest between 51 & 59.

Lots of overlap here too, so there’s no clear strike that will expire most options worthless. Instead, regardless of where QQQ closes on Friday, profits and losses will be registerd. No clarity. QQQ closed at 54.36 today – the bottom of the overlap zone, so for now all I can say is put buyers are positioned to profit more than call buyers.

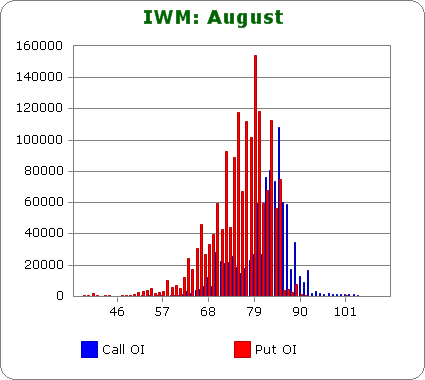

IWM (closed 71.76)

Puts out-number calls 2.1-to-1.0 – much less bearish than last month.

Call OI is highest between 80 & 87.

Put OI is highest between 72 & 85.

There’s some overlap between 80 & 85, and within this zone, calls and puts are pretty closely matched. Hence a close near the middle would accomplish the mission of expiring most of the calls and puts within the zone worthless or close to worthless and also expire all those puts below 80 worthless. With today’s close at 71.76, IWM is nowhere near where it needs to be – a big move up is needed. Right now put buyers are going to cash in big time.

Overall Conclusion: For the first time since I started doing these reports a couple years ago, the put buyers are positioned to make solid profits. It would take a big rally the next four days for this to not happen. Does this help predict the rest of the week? Well, it tells us there may be an upward bias, but in reality, there are so many other things going on in the world that trump the charts, I don’t think we can assume anything will happen simply because the open-interest data leans one way.

0 thoughts on “Using Put/Call Open-Interest to Predict the Rest of the Week”

Leave a Reply

You must be logged in to post a comment.

As long as I have been subscribed to your website I could never really understand the significance of this survey. But maybe you do since you continue to post this information

for the benefit of others. HW

Nice work as always

I use this report every month

This week will be interesting

the big question is how much puts are the market makers–big insto banks–the real hedgies

holding them self

remember they started at the may high

if this is going to be a big bear then at some stage everyone will be on the same side

the big thing to watch is when the hedgies –big banks change to calls

jason,do you expect 1330 for the s&p 500 on friday?