Good morning. Happy Friday. It’s not such a happy day for stocks around the world.

The Asian/Pacific markets got hit hard. South Korea dropped over 6%, Indonesia fell more than 4% and Australia, Hong Kong, Singapore and Taiwan lost over 3%. Europe is only slightly better off. It too is suffering across-the-board losses. And futures here in the States point towards another big gap down for the cash market.

I keep seeing headlines about a double dip recession. Why does it matter if we meet the textbook definition of a recession or not? It doesn’t change anything. If you ask me, with 9% unemployment for three years, we never exited the last recession.

Oil is down a buck. Gold is making another new high. Silver is up.

Bank of America is cutting upwards of 10,000 jobs.

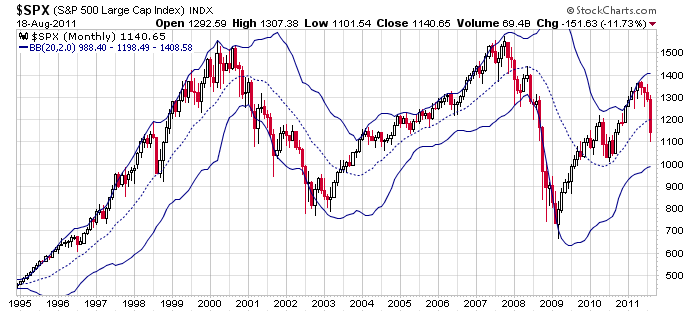

What can I say that I haven’t said numerous times the last couple weeks. The selling off the high, in my opinion, will not constitute a pullback within an uptrend. Instad we are in the beginning stages of a downtrend. Bear markets don’t last as long as bull markets, but they can cover the same amount of ground. My first downside SPX target has already been hit (1200). My second target is 1000 which is last summer’s low and the bottom Bollinger Band on the monthly chart. Here it is…

Until the market proves otherwise, I don’t see a reason to be long stocks. Yeah there will be ones that buck the trend, but it’s so much easier to trade in the direction of the dominant trend, which is down. You can short breaks of support with partial positions and dead cat bounces along the way. Bottom line is until the market improves significantly, the trend is down.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Aug 19)”

Leave a Reply

You must be logged in to post a comment.

get real Neal

I don’t normally post, but Neal, Jason’s an analyst giving his view, there’s bigger bears out there than Jason, and he’s been bullish the market up until very recently.

You should take the day off!

tell ur fed mates its a crime to run a ponsi racket

Your own service? Video Bash is already taken.

Neal: correction. I go swimming with Mayor Bloomberg

in the New York City public swimming pools. Please

make a note of that if you will. HW

I do have an opinion, I think the downside is way down in all probability, I’ve also been short S&P since the 200 MA, and the CAC40. And I’m Gold also short Gold as of last night European time.

The SEC fines people for telling the truth? That figures.

A name? Neal’s Peels the market.

Neal’s Peels Reveals the market. Stop pealing and start peeling. Do it Neal, reveal the market.

Neal A-peeling?

Apeeling Neal?

Geez, Neal! Let’s not take ourselves too seriously here on this site. We’re all just exchanging opinions and maybe we learn something from each other.

Anyway, thanks to Jason for the Desmond article. I also always like to see those long term charts and I see we both favor a test of the SPX 1000 area on this first leg down from the MAY high. I thought late yesterday that we completed a smaller 5 wave sequence but overnight trading seems to negate that idea. Regardless of EW wave counts, I think we get a rally in here somewhere today/MON. At this point, it doesn’t appear the SPX can rally higher than 1150 on any short term rally. Longer term, 1200 should be difficult to overcome, in my opinion.

sub 2 of 5 in some indexs may just have ended

i short bulls

Zen Buddah deposes and states:

Some men’s passion is gold

Some men’s passion is fame

My passion is souls

We have an Edward Allen Toppell fan I see.)

Neil,it is Jason’s informed opinion that a new bear market has begun. He never said it was the end of the world, YOU did. You did say that the current prices are at “bargain sale” prices. He is entitled to his opinion as much as you are entitled to yours. He changed his opinion when the market evidence showed it’s hand, capital preservation is the cardinal rule that can never be broken. Jason’s cautious stance at this junction honors that rule. IMHO, that adheres to the prudent man dictum very well. Loading up on stocks, based on an opinion of “bargain prices”, at any point in time,with no stop loss of some kind in place is a recipe for portfolio disaster. The market can stay irrational years longer than any one person can stay solvent.

get real neal–lunch money—i start trading 3 am ur time

for a 200 point dax short at open—i dont buy anything–im a bear

200 points at 100 euro per point on 100 to one daytrader margin

and thats only one trade

DID U MAKE LUNCH MONEY YET TODAY NEAL

ESU1: Whoa… looks like the steam just went out of that shuffle. If 1140 doesn’t hold then it’s back down to the LOW (1120).

Hey, AussieJS – see if this makes to sense from an EW point of view. From the AUG high at SPX 1356 area, let’s asume we have completed waves 1 & 2 off the MAY high. From the AUG high,

I’m thinking we may have completed wave iii of 3 at the AUG low of 1101. We may have seen wave iv completed ar SPX 1200 (in which case we’re already in wave v) which I favor or, wave iv of 3 is still evolving. My view is we will complete complete 3 waves down in the SPX 1000-1050 area. Is so, it could be an ABC sequence (corrective and possibly still bullish longer term) and a substantial rally could occur, or we could see wave 4 evolve, followed by wave 5 to complete a bearish impulsive sequence from the MAY high.

How do you count the sell off from the May high within the context of my EW analysis?

Pete–same as ur favoured one–wave 4 at 1200 and wave 5 down to 1000

this will complete wave 1 of large 3 ,with wave 2 of large 3 back up to 1200 max

then we we have grand euphoric panic for 3 of large 3 to 666

we may have finished sub 2 of 5 in spx as all indexes cash and futures hit main piviot

with tick extreme –1 hour ago –so im short

i dont use ew to trade –to much hassell–especially if trading 6 indexes at once

i just love shorting bulls

ndx 100 has a diferent structure

Damn! This bag of quarters is getn heavy.

ESU1: 1132.50 weird place to stall, but it looks like it’ll hold. Closing shorts.

Geez, I need a wheelbarrow.

midday on a boring opts ex day

nite all–hava good w/e

Boring? You’re so jaded. I’m going to lunch with other girlfriend.

Neal: Burt Reynold’s home is in foreclosre, why I’m not sure.

Maybe you can buy the house and create another Graceland

Elvis style, charge lots of money to tourists who love

to see the bed Burt Reynolds slept in. HW

Neal – No, I don’t. I began a subscription to Prechter’s EW Theorist back in the early 80s. In 1987, when the market crashed, Prechter called it a Super Cycle topping event. I called and someone answered (not Prechter). I said, please ask BOB where he sees 5 waves down so far (I only counted 3)that justifies a Super Cycle high call. I got no answer, cancelled the subscription but continued following EW on my own trying to learn it. As I said the other day, put 10 people in a room and you can get 10 different interpretations, all of which may be creditable. I think the wave counts are clearer in bull moves and much more difficult in bear markets. I agree with AussieJS in that you can’t use it to trade, but I like to look at it from a longer term perspective. For example, since calendar year 2000, I only see larger 3 wave structures. I think the anticipated move off the MAY high will be another 3 wave event that may even break the MAR’09 low but maybe not substantially.

Neal if you can’t handle jason’s no nonsense vision and thorough analysis and having a disciplined trading plan but rather place comments by ridiculing him you’re really admitting that you’re far less sure of yourselve than him and start to panic when people start to get a little realistic on things and the economy.

Jason’s no bulshit feedback and inside is most appreciated. If you want to rather follow visionless mass media, win a buck to then loose a ton and get crushed fine.

If we’re going to see a rally back to the SPX 1152 area or higher it would be nice to see it begin in the last hr of trading today or early MON AM.

Not going home. Having dinner with 1st girlfriend.

From Zacks. Damn, may not have home to go to.

{snip}

How bad was the Philly Fed Survey? It fell from +3.2 to -30.7. A reading that low has ALWAYS signaled that a recession was coming in the near future. Now tack on to that the recent Consumer Sentiment reading which also has historically ALWAYS led to a future recession. And just for good measure consider that the more broadly used ISM surveys both point to contraction.

Add it all up and the evidence continues to point to a US recession. The only savior in my book is some kind of massive fiscal stimulus from the government. In particular, a serious overhaul of the tax code and regulations to promote job creation in the states. Knowing that the folks in Washington are starting to percolate on these issues gives me some hope that we might not go over the edge. But that hope is slipping away.