Good morning. Happy Friday.

The intermediate term trend is up, but we must recognize the possibility yesterday was a false breakout or bull trap – a new high that suckers in late-to-the-party bulls before the selling begins.

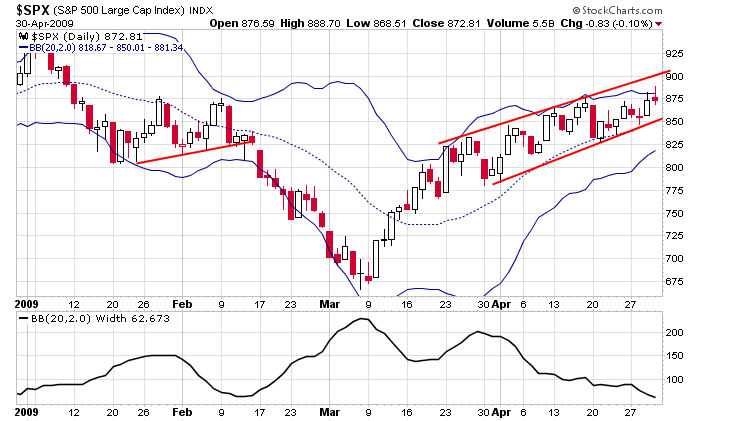

Here’s the daily SPX chart. There’s nothing wrong with it. We got a solid move off the low, and for the last six weeks, it’s been 2 steps forward, 1 step back. It’d be easier of the market would rally steadily and then consolidate for a couple weeks before breaking out again, but oh well. We don’t get to call the shots.

April is in the books, so the end of the traditionally strong Nov – Apr time period has come.

I’ve been day trading only the last 10 days. It’s not my style; I’d rather enter and let positions run for a few days or weeks, but I’m not very comfortable holding long when the overall trend is down and the market has rallied 30% off it lows. Simple as that. We had several dozen great breakout plays over the last 2 months, and I’m just being a little cautious during the grinding period.

With the SPX’s proximity to 875 (maybe that level is meaningless, don’t know) and the Bollinger Bands narrowing, I’m still of the opinion we have a big move coming. A squeeze that gets us well into the 900s or a sell-off that puts us back near 800.

headlines at Yahoo Finance

stocks to watch MarketWatch

upgrades/downgrades

earnings & economic releases