Good morning. Happy Thursday.

The market’s reaction to the Fed yesterday was less than lukewarm, but that doesn’t mean the party’s over. There’s a big tendency to reverse the post-FOMC move. Premarket futures are up a bunch, so this makes playing the bullish sentiment harder.

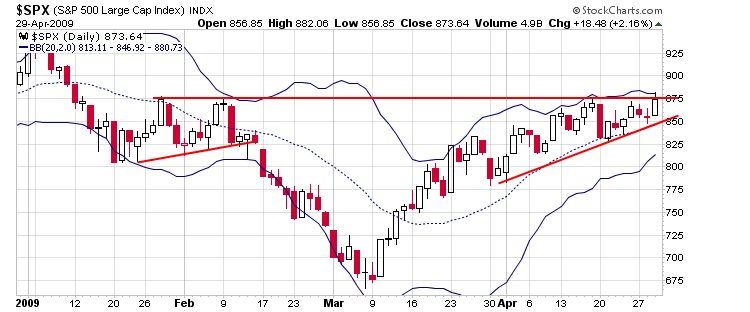

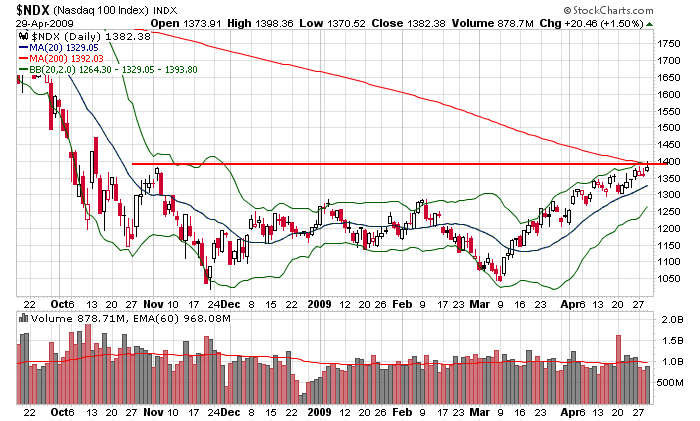

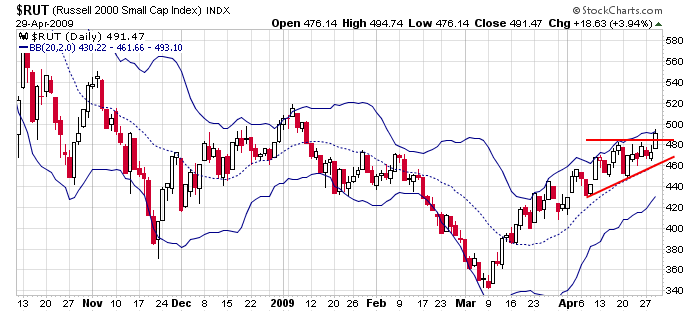

Yesterday all the major indexes made new highs (the SPX traded above 875 but closed below it), but I don’t yet think we’re in the clear yet. I’ve been looking for an inflection point – a level that will either cause the bulls to be more aggressive and the shorts to cover or one that will cause the bears to dig in and defend their territory. We may be there right now. Anything can happen so it’s entirely possible the market just sits here until May 5 when the results of the stress tests are made public, but I lean towards some sort of resolution coming right now. The market either breaks out and runs or comes down hard.

Here are the daily SPX, NDX and RUT charts. All are in the process of breaking out, but a solid up move is needed today and follow through is needed tomorrow.

I’ve been day trading only the last week (no holding overnight) and currently have no positions, so I’m not rooting for the market to do anything. I’m just calling it as I see it.

Today is also the last day of April, so perhaps some window dressing is in order.

Be on your toes. We could get a breakout and run today…the breakout could also get sold into.

headlines at Yahoo Finance

stocks to watch from MarketWatch

today’s upgrades/downgrades

this week’s earnings & economic releases