Good morning. Happy Tuesday.

The Asian/Pacific markets closed mostly up. Hong Kong, India and Japan did well. Europe is currenly most up. Austria, Amsterdam and Londone are leading the way. Futures here in the States point towards a down open for the cash market.

The market has put in two consecutive up days and has taken out its most recent high, but volume has been declining. That’s not a great sign. I would not fight the move, but I wouldn’t trust it either.

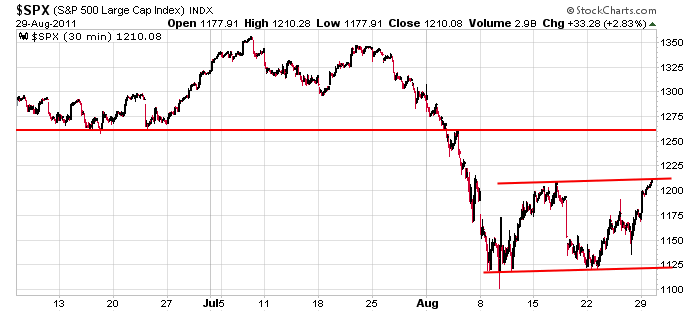

Here’s the 30-min SPX chart. The trendlines capturing the movement of the last three weeks are parallel, so this would be a place the odds price gets turned back are higher. There are no guarantees, just odds, and attached to those odds are either more or less motivation to take all or partial profits or initiate new positions. Taking a few bucks off the table late yesterday was a good idea.

The long term trend remains down. Short term things have shifted. But we’ve had many sudden moves in both direction, so I trust nothing. It’s one thing to be in a consolidation period for a couple weeks. It’s another thing for that consolidation pattern to be 85 S&P points. That’s big enough to turn a good trade into a bad trade in a short period of time. Your goal is to take money out of the market, not predict what will happen next. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Aug 30)”

Leave a Reply

You must be logged in to post a comment.

I predict the S&P will go down to 1175, chatter, head fake, up-down, and end the day heading towards 1150.

Yes, don’t predict. Trade the setup.

Def looking to hit down with a head fake….

head not ‘hit’

Coming soon to MTV …Neal’s Vendetta singing “Jason and his Technicolored amazing bearish coat”…..

The “ending diagonal” I mentioned yesterday apparently was completed and the initial downside target at SPX 1195 is being tested. If 1192 is broken in smaller degree 5 wave downside sequence the next downside target is 1170-1182. Otherwise, I can still higher prices ahead to test 1235-1240.

From a longer term perspective, we’re at a point where the worst case bearish scenario seems to require the appearance of downside acceleration soon. So far, I don’t see it. I see 3 waves down from 1370 and what appears to be 3 waves forming off of 1121, which equates to neutral,sideways action. Despite Neal’s objections, the trend off of the 1370 high is, as Jason indicates, DOWN.

From an investment perspective, I’m selling weaker performing stocks and, on signs of further weakness, I’ll be fully hedged and stepping further out on the Treasury yield curve. From a swing trade or longer term trading perspective, I’m standing aside for now.

PeteM should have started his own website and charge $300 dollars a month.

200 subscribers @ $300 = 6 figures for sure. My dad wanted me to open up

a coin operated laundrymat when I was a kid. He said, “Howard…you’ll

be counting quarters all day long!” Maybe my dad was right, don’t you think?

This should be the head fake.

AWESOME my dead cat,whom is sitting in a awesome bar in soho ,catching the awesome london bounce confirms this is a awesome head fake

sooosh–its a secret—awesome my bouncing dead cats project whilst in europe was to convince those dumb greedy central bankers inc china to buy stocks/bonds with newly minted euros

he did this because he knows i like shorting bulls

awesome is leaving europe now as the central banks have ran out of money

Pete M. Can you tell me what you see as the current wave count on the monthly chart of the SPX?

all indexes are now in a sub 5,except the ndx 100 which is just starting its wave 3 down

Taking profits. May go small lot short after lunch. Later.

apple jucie

For example: Head Fake. How would you count that? That’s why I use intent.

Neal, your crap may play out with a few of the members on this board

but be forwarned. PeteM knows where you live and he can very easily

get the Feds knocking at your door at 3am with an official gag order

from the President of the United States. Or even worse, he may fly

you in to New York City and force you to sit through 2 hours of Cramer

of CNBC speaking at the 92nd St Y with a written exam shortly thereafter.

Neal – I checked out the Gross bit. If I had listened to him, I would not have put my clients in laddered Treasuries in APR/MAY. Fortunately, those positions gained 10-15% during the stock market sell off since May and kept their overall portfolios flat or in the green while the S&P 500 was losing 13%. So, I don’t what your point is.

From a macro point of view, my analysis is that we’re in a deleveraging/deflationary enivironment. You may disagree. Unlike you, I don’t think the FED can stop it and each attempt to try will have continued diminshed results. The technical long term indicators that I use, seem to support and confirm that. You don’t care about “technical” analysis. Again, we disagree. I see a secular bear market since calendar year 2000 with cycle bull & bear markets since then. I don’t know what you’ve seen during that time. I see strong evidence that we’ve begun a cyclical bear market since the May highs in the stock market. The only question in my mind is how we decline. When I comment on this site, I try to be clear whether I commenting from an investment point of view or a trading point of view. I have no issue with others who daytrade, etc. and I have no issue with you. But you’re a one trick pony. When you disagree, you attempt to ridicule. It’s old, it’s boring and now it’s to the point that it’s not even humorous! And that, my boring friend, may the worst sin of all!

He who sins becomes a slave to that sin. JC

This peak feels flakey, but this may be wishful prediction on my part. I’ll go one lot short.

A final thought for today. The 80 week SMA at SPX 1210 continues to be significant, in my opinon, e.g. in the past hour there has been consistent trading between 1210 -1214, with an apparent attempt to close the day above 1210. A close above 1210 for a few days suggests a test of the 50 day ema is quite feasible. I still see movements in 3 wave sequences in shorter and longer time periods, which I construe as favorable to the bulls, especially if 1210 becomes support on a closing basis.

ESU1: Tomorrow 1170 or bust!

“But we’ve had many sudden moves in both direction, so I trust nothing”

Agree but there are some great short term ops. here.