Good morning. Happy Monday. I hope you had a nice weekend.

The Asian/Pacific markets closed mostly up. India rallied 3.6%; South Korea moved up 2.8%; several others gained more than 1%, but China dropped 1.4%. Europe is currently up across the board…better-than 1% gains are being posted. Futures here in the States suggest a solid gap up for the cash market.

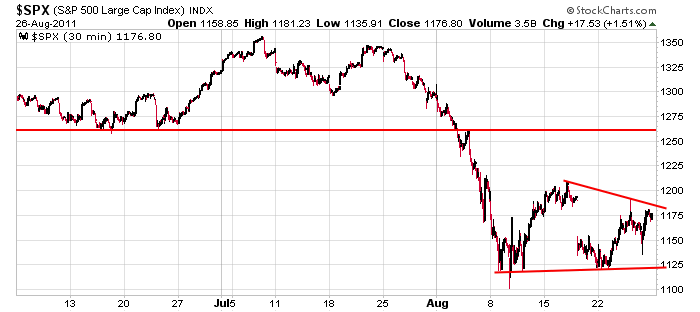

The market broke its 4-week losing streak last week with a solid up move. But overall the trend is down, and over the last month, the price action is neutral (a lower high and higher lows is in place). A lot of bad news has been abosrbed, so assuming the current price is the “correct” price based on the news already released, if good news comes out or if the negative news flow dries up, an upside pop is doable. That’s where I lean as we head into the new week (I stated it at the end of last week and over the weekend). This will be the second attempt at recapturing some of those early-Aug losses, so I think the odds are greater it happens. And the great number of false breakdowns adds to this analysis.

Here’s the 30-min S&P chart. The overall picture is definitely bearish, but short term I lean to the upside. Be flexible and don’t fight it. The biggest up moves occur within downtrends, and the direction of the market is never one-sided. There could be bounces that last several weeks. If you’re bearish, these bounces are gifts…assuming you’re not “all in” on the short side and you still have money to add to shorts. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Aug 29)”

Leave a Reply

You must be logged in to post a comment.

Buffet the bottom feeder? What’s your take on Buffet and BofA? With the financial sector comprising 30% of the S&P500 what will be?

ESU1: August on a 60 minute looks like basing. I’ll give you the higher-low but not the higher-high. Granted, Friday’s performance does look like a prelude to a High-high.

Fractals: Anybody hear of anybody applying fractals to the market?

q. what does PeteM and Warren Buffet have in common with each other?

a. they are both on Ben Bernanke’s payroll. HW

Are you rehearsing a stand-up routine? What’s your point?

Well, it does appear that today (perhaps into tomorrow) will give a valuable clue regarding both the bull & bear case beyond a day trade. My triangle wave 4 idea will be negated on a move above SPX 1208 with the EW “flat” wave 4 (or wave 2 depending on your count) still in play. From 1121, I can see a case to make that we’re in a bullish lower degree 3rd wave, especially if SPX closes above 1208. Any strong reversal today may be a good shorting opportunity for a swing or longer term trade with a protective stop above today’s high or above 1210, in my opinon,depending on position size and risk aversion.

From a longer term investment perspective, my focus remains on the 80 week SMA at 1210. A failure on this test to close above that level leads me to exit weak stocks and fully hedge

remaining long positions in high dividend low P/E stocks while extending further out on the Treasury yield curve.

Day Traders are talking about getting stopped out at 1207.

If that happens we could see the market rally +100 Dow points.

(covering their shorts)

What’s the anatomy of a “Short Squeeze”? Where and when should we be putting our Sell Stops?

thats not a daytrader

a day trader trades the intraday swings

a scalper is even shorter term –in for a few points larger parcell and out

a scalper can be a expert counter trend trader

It looks like RichE went out shopping with his girlfriend

over the weekend and 1. maxed out his credit cards;

2. car got stuck in Hurricane Irene and; 3. liquor stores

all closed early thus forcing him to drink vanilla extract.

Boring.

i know nothing about ew,being a daytrader

but from observation could wave 1 be a abc and wave 2 be a abc

see ndx 100

what comes after abc –i cant spel

does 3 come after 2

does a lower double top mean a completed action

tick divergence—price may roll

everyone one should have fun at the casino

i sleep when the bulls are playing

is rut -russell a lower double top

if so where does russell go

spx res 2 piviot is at 1210 on the cash –that should get those nasty short stops out of the way for a prolonged crash

Maybe an ending diagonal pattern forming off of 1195ish that completes at 1208-1210 – almost like a magnet how it wnats that level.

wants that level

all indexes spot on lower double tops

now thats a coincidence

and we know the dji loves them

as its not the first time its had this perverse behaviour

start of 3 down in dji was also a lower double top

another tick divergence –do we roll this time into close for a larger scalp

AussieJS – if the ending diagonal idea is working we should get another high into 1208-1210. The support a few minutes ago at SPX 1205 (if it holds) came in an ideal area. Now a move beyond today’s high would complete the pattern after which we would see a sharp move down to test 1195. We’ll soon find out. By the way, this is a short term pattern observation. If it happens, we go from there.

OK, we fulfilled the requiremnets for an ending diagonal at today’s high thus far. If this is a correct interpretation, I would expect a reversal going into the close or perhaps early tomorrow AM. If we continue moving right on through 1210 and close above that level there may something more bullish occuring short term, at least, and a projection to the 50 day ems in the 1235-1240 area would be appropriate.

50 day EMA (expoential moving average)

If we can break down through 1207.50 in the last 15 minutes of trading, a short position with a stop loss above today’s high could be high reward/low risk.

Has the last short covered yet?

Wow! 1207.50 tested and held. No short trade for me today. Let’s see how we trade earlytomorrow.

tomorrow ftse re opens and that should be key to usa early on