Good morning. Happy Tuesday. Hope you had a nice weekend.

Yesterday, while the US markets were closed, the Asian/Pacific markets dropped 1-2%, and most European indexes sold off 4-5%. Today, the Asian/Pacific markets closed mixed but with a bearish bias. The biggest losers were Australia, Japan, South Korea and Taiwan. Europe is mostly up. The Swiss market is up 3.8% and London is up 1%, but Stockholm is down 4.6%. Futures here in the States suggest a large gap down for the cash market. We have some catching up to do.

This week is setting up as a make or break week. The lows can hold, and this volatile range we’ve been in may continue. Or the indexes could completely melt down and drop 10%.

The overall trend is down…it’s been down for over a month…that hasn’t changed…my longer term bias has been firmly planted in the bears’ camp since the beginning of last month. Short term, by bias has alternated between up and down. Twice the S&P has bounced 100 points the last month…no reason not to play those bounces…you just gotta know you’re going against the overall trend, so it’s wise to be ahead of the curve taking profits, and you can’t worry about leaving money on the table. Right now the short term trend is down…no surprise there.

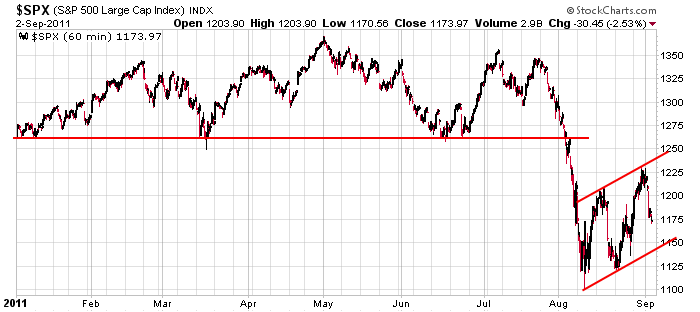

Here’s the 60-min S&P chart. From a chart pattern standpoint, charts don’t more simpler than this. The index broke down from a large topping pattern and now trades in a bear wedge/flag/rectangle (whatever you want to call it). Several measuring techniques put the target under 1000 should the pattern resolve down.

This will be a huge week…it may dictate the next couple months. Be careful. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Sep 6)”

Leave a Reply

You must be logged in to post a comment.

I was going to give everybody my big lecture about typical

end of month/beginning of month bullish cycle, but having

been trashed in the dumpster a few times in my life I

decided not to share it with you all today. HW

I’m back. Did you miss me?

ESU1: Wow! The sucker blew right through my 1170.

stay with the long bond and gold, even silver perhaps. hope you could load up on that flash pullback last few weeks. i sure did.

I just want to share a few thoughts, big picture wise, as the week opens on such a weak note.

It seems to me the fundamentals are in line with the technicals, i.e. we are seeing the denial of a weakening economy transition to the recognition of “recession” (deflationary depression?). The long term trendline drawn from the MAR’09 low thru JUN?JUL’10 low has been broken, confirming the end of the cyclical bull market. We are now seeing declining lows & highs from the MAY SPX high of 1370. The 50 day EMA has broken below the 200 day EMA and both are declining while the 80 week SMA at 1210 is about to rollover into decline. Shorter term, the 13 & 20 day EMAs provide near term resistence in the 1180-1190 area with stronger resistance at at 1210-1230. Everyting points to a cyclical bear market where rallies can be sold for traders and investors should use the same rallies to raise cash.

In my opinion, the only thing left to do, is try to ascertain the most probable roadmaps for the decline. EW analysis indicates 2 scenarios: 1) super bearish – we’ve completed wave 2 rally and are now in 3rd wave of 5. Ultimately, it implies a break below MAR’09 SPX 667 low; 2) less bearish (my preferred count) – we’re embarking on a larger 3 wave (ABC) decline with first stop at 1000-1050, an intervening rally before a further decline to 850 (+/- 50 pts). The time frame would be 2012-2014 using long wave cycles.

By the way, if you look at the “flag” formation off the 1100 low, you can prject a downside target of 895ish (EW nothwithstanding. Note today’s low tested the lower trendline of the flag.

Thanks for your comments Pete.

Geez! Nobody missed me.

ESU1: Looks like 1137.50 is support for the moment. I think it’s going to hold, but if it don’t, well let’s hope Marie Antoinette keeps her mouth shut.

PeteM, Are you saying we’re in a Wave5dn? BTW; could you put a DN or UP after the wave number? thanks.

RichE – Let me see if I can clarify. Some EW analysis considers the real EW high as the JUL SPX 1356 high (not the MAY high at 1370). Under that interpretation we completed a smaller degree 5 wave pattern (for wave 1 in AUG) and the recent 1230 high was a completed wave 2. Therefore, it’s assumed we’ve now begun wave 3 (of a larger degree 5 wave sequence). As I said, I think we’re in a larger 3 wave decline from 1370 (my interpretaton of the final EW high from MAR’09).

The real point is not to get bogged down in the “correct count”. Either count will take us lower (faster or slower). Any way, I’m looking at other technical factors to give a hint. In my opinon, if we’re headed down faster, we should see today’s low broken soon with more rapid downside action (in keeping with a dynamic wave 3 of some degree). But, consider how oversold we are and how bearish the sentiment is. If we hold above 1100-1121, we can rally back to 1180-1190. That’s where I see the longer term short trade, regardless of the “wave count”.

ESU1: I think I’ll buy the next dip, which should be coming up shortly.

Hey RichE you are obviously jumping for joy this morning. What happened?

Did you propose to your girlfriend over the weekend and after she hesitated

for a few moments she finally agreed and said YES, I do.

Don’t forget the three rings of marriage: 1. the engagement ring;

2. the wedding ring and 3. the suffer-RING.

Her dog likes me. #4. Ring-a-ding-ding.

ESU1: stuttering; moving stops two ticks above Break Even.

im a big bad bear–black in colour

this is a reply of last nite

the key is the euro/usd

apart from a enourmouse euro spike as switzland interviened to weaken its from preopen

the euro is now back to S4 piviot,breaking below key S3 support at1404 on the way to 1350

i like the bulls to make short soup

replay of mon

i have a worldly outlook –as its all one market

AussieJS – I agree. What has to be disturbing for the bulls is the gathering strength of the U.S. Dollar and the decline in the U.S. 10 yr & 30 yr Treasuries. Today, the 10yr Treasury Note actually took out the 2008 lows! To me that’s just more evidence of the deflationary economic enivironment we’re in now which is bearish for stocks, commodities (maybe gold) denominated in U.S. dollars. So, is “CASH” a position? In my opinon – yes! Especially if it can buy more U.S. dollar denominated goods and services in the coming months/years. That’s been my investment theme since the quarter of this year, i.e. raise cash, lower stock exposure, and go out further on the Treasury yield curve.

I meant to say a decline in U.S. 10 yr & 30 yr Treasury yields (in an investment portfolio, we know that as yields decline the value of the notes/bonds goes up).

with uncle ben distorting the yeild curves with his QE’S ect and shortly the chubby checker twist -i use the cpi as a proxy–naturally currencies come into it and like the 1930’s trade tarif wars we now have the currency wars–none of which are good for equities

if this was a raging bull market would u be in cash or fully long

if this was a raging bear market would u be in cash or fully short

i will open a shop shortly and sell my bull scalps

ESU1: Wow! So close to scratching the belly of my 1170. I didn’t think it’d get that close today. It looks like real buying to me not brush clearing. This maybe the bottom.