Good morning. Happy Thursday.

It’s not happy day for markets around the world. The Asian/Pacific markets got crushed. Indonesia down 9%…Hong Kong down 5%…Taiwan, South Korea and China down around 3%. Europe is also getting clobbered. Austria, Belgium, France and Germany are down more than 4%. Futures here in the States point towards a large gap down for the cash market.

Things have changed quickly the last couple days. They looked ok at the end of last week…not great, just not horrible, so the bulls had a little cushion to work with. That sentiment is now gone. I looked at 500 charts last night and didn’t find one worth buying. Instead there are many very good short set ups in addition to our shorts that have already triggered this week.

My opinion of the market hasn’t changed in 6 weeks. A top is in place, and the trend is now down. But the market’s biggest up days occur within downtrends, so it won’t be a one-way ride down. Expect bounces and have a plan to deal with them.

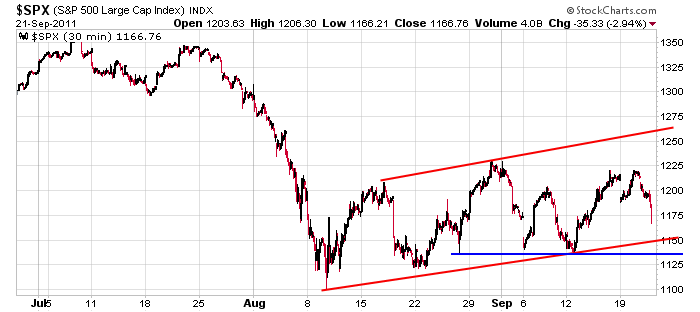

Here’s the 30-min S&P chart. My next two potential support areas are 1150 and 1140, but as of now the S&P is going to open below 1150.

My ultimate target is 1000 even. I think the market goes lower than that, but that’s where I see potential for strong support.

Don’t fight or argue with the movement. Be ahead of the curve taking profits. You know the routine. This is not a time you can sit back and let charts run their courses. Here area few trading ideas.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Sep 22)”

Leave a Reply

You must be logged in to post a comment.

love my puts today!

Hey Farmboy, do you have a sister I can date maybe?

Does she like a guy who lives in a hi-rise in Manhattan,

I wonder? I have to be the new court jester now that

Zen has been banned from Leavitt Bros. HW

The Trading Gesture.

don’t know how my sisters would deal with the lifestyle change, but there all married anyway.

Neal was something else, we haven’t broken major support yet we are on it though.

ESZ1: the Bell Hops tried to make a higher-high, but didn’t. I’m not sure what to make of the volume. I’m waiting for a dip to go LONG. It’s already down 3% I don’t see it going anywhere today. A, ‘Dust Settling’ day.

who is zen ? is that Neal ? and I have four sisters.

Zen is Neal spelled backwards.

Howard, this is a trading site not a dating site.

I’ve got a date with a fig on prune street. HW

uncle ben killed the carry trade and inverted the yeild curve for the future

and now we will limbo lower now in a impulsive 3rd wave

wave 3 will last untill the carry trade relocates to the yen from the usd for their zero interest rate gambeling

Why would the carry trade be interested in long term rates?

uncle ben is deserting holding down the short term bonds/notes and selling their short term stuff to buy 20 year and above bonds

this will push down long term yeild ,with the risk the short term will rise and invert

the carry trade have been using the safty of the usd short term zero ish rates to borrow and buy oz aud to get 4.75 %

in reality ben just raised the interest rates -squezed the banks and will send the carry trade back to the yen

its the flow of the carry trade that causes currencies to move and equities up/down

spx wave 3 to 666—no subdivisions—wave 5 to 333 with subdivisions

i have no idea what EW is all about

im just a emotional retailer –i rely on my feelings and emotions

that’s interesting, I knew they try to make money off the difference, but that’s as far as it goes for me, i quit that emotional stuff long time ago.

my emotions are a key indicator–with out them i would have no idea what elliott wave we are in

of course i could just read the future but that would be cheating and spoil the game

not me anymore, cost me too much money, you must do the opposite of what you feel.

Thanks, long term going down, short term going up.

Most likely there was some friction between the White House

and the Fed, and Uncle Ben cracked from all the pressure.

I’ll be on high alert at the next AA meeting to see if

Ben Bernanke is in attendance somewhere in the audience. HW

no he won’t be, he likes his booze too much.

Duh!

can i be the court jester now please Howard

Geez, welcome to Comedy Central.

break on thru to the other side

I’ve got to get a part for my chainsaw. See ya tomorrow.

what kinda saw? I have some McCulloch’s

Totally agree with Jason on 1000 for S&P.

Keep it simple and look at as 5 year chart as we are now have been trading under the 200 ema and institutions would consider that as Bear Market territory.

Also look at the rounded slope of the 200.

yep, keep riding the wave down, we have more down side left on my weekly indicator, daily is not oversold yet, so we could go down tomorrow too. my weekly just rolled over.

had a hard time this morning trading A.M.T. wouldn’t put my trades thru, they are making it right tho, had to give me some money back, had a margin call of 54k at one point, lol

For starters, it’s a positive for this site to have Neal gone. Jason gave Neal more leeway than he deserved. The shame of it is that he may actually have had something positive to contribute but his ego and envy kept getting in the way.

It’s obvious that yesterday’s breakdown and today’s follow through has ushered in a new leg down from the MAY high. This shelf of support between SPX 1120-1140 may be sufficient to spark a brief rally which will probably be weak and short lived. The question is only how sharp would any rally be and to what level? If we have a rally, from a longer term trading perspective, I’m looking at 1145-1150 to sell and/or on an attempt to fill a small gap in the 1165-1167 area.

Kudos to those daytraders who got short yesterday and decided to hang on overnight!

AussieJS – I thought of you (and all daytraders) when I heard this: “Yesterday is history, tomorrow’s a mystery – I live (substitute “trade”)for today”.

We can tell from Neal’s style of writing if he decides

to participate here on this blog under a false name.

i closed out in early asian trading,but got back in before europe open when i realized how strong negative sentiment was—i had been saying for a few days now this was planed

i hope we do get a bit of a bounce as i would like to load up in my non daytrading longer term a/c

one thing insto hedgies dont like but is any hitch hickers

if we dont the methods i use to get on board are —-a intraday lower high preferably at a piviot and maybe a touch of my 20 ema or 60–i like to see 5 min euro confirmation

preferably with all indexes turning at same time

so far it looks like dji is the weakest but i would expect ndx to eventually lead

if its a impulsive move which it looks like it can have a 1 -3 day countertrend

but it looks strong–even 1987 ish

AussieJS – normally, with this kind of bearish sentiment, you’d expect a rally right in here from todya’s low at 3:30 pm (EDT). But, if we’re in the beginning of a larger wave 3 (of 5 waves) down, we can go right through SPX 1100. I’m watching today’s last 1/2 hr & tomorrow’s opening hr for a clue.

By the way, if what we saw since the AUG low into TUE’s high was a triangle formation, I’d look for SPX 1056 as the first downside target on the way to 850 with an intervening rally from 1056 (or Jason’s 1000 target)first.