Good morning. Happy Thursday.

The Asian/Pacific markets closed mostly up . South Korea gained 2.7% and India and Malaysia more than 1%. China dropped 1%. Europe is currently mixed, and not one index has moved more than 1% from its unchanged level. Futures here in the States point towards a solid gap up for the cash market.

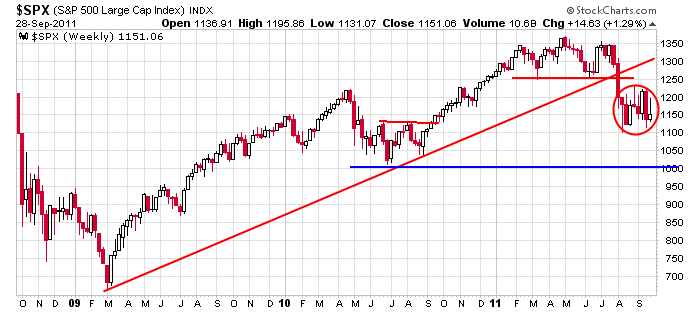

Everything about the market has remained the same. The overall trend is down, so that’s where my bias lies, but the indexes have been range bound the last 8 weeks, so we’ve needed to keep trades shorter term. Taking profits proactively as opposed to waiting for a trailing stop to get hit has been a good idea because otherwise chunks of profits are given back. It is still my belief a top is in place and a downtrend underway. Right now the indexes are trading within distribution patterns within those downtrends, and these patterns are likely to resolve in the direction of the trends. There are some who believe a Greek default is inevitable and is being priced into the market. This may be partially true, but in my opinion, the trend is down until it’s not.

Per the lower Bollinger Band on the Monthly and the 2010 lows on the weekly and a measured move on the daily, I’m sticking with my 1000 price target for the S&P. The weekly is below.

Today is a Jewish holiday…expect light volume.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Sep 29)”

Leave a Reply

You must be logged in to post a comment.

we are still held hostage to fri opts ex in europe,ect and end quarter

so up/down—if we dont break y/days high we are ok

my pets teddy and grizelly bear get back from vacation today ,so all will be alright

Yes end of month options expire here too.

Agreed …… 1000ish S&P

grizelly bear said spx 999 then 666 then 333-zero -minus 333

teddy said he is being to bearish

dead cats gruesome /awesome have been fighting with them all day

ESZ1 1d1m: Volume picking up on this dip. Waiting for followthrough volume.

…and I’m going long just because all you guys are going short.

I mentioned yesterday that I’m noticing the swings are finding support and resistance around the .618 retracement areas, e.g. the .618 retracement from SPX 1196 to yesterday’s low is just above today’s intraday high. From today’s intraday high to yesterday’s low the .618 retrace is in the 1160 area. Havng been stopped out on 1/3 of my short position yesterday only to see a move down to new lows prompted me to take off my trailing stop before today’s open on my remaining positions and rethink things.

Jason made an interesting comment today about taking profits more quickly in this swinging trading enivironment (as opposed to trailing a stop), so If I see SPX approach 1160 and it finds some support, I’ll follow his idea and take profits on another 1/3 of my psoition.

i just took nice profits on the world from jobs report preopen

ndx 100 is the weakest—dji strongest for longs

Waiting for a Higher-Low b4 going long. P.S. I maybe waiting a long time.

Jason, I just read your comment about Jewish holiday and light volume. What percentage of traders are Jewish? The volume is light.

No clue. It’s also partially a self-fulfilling prophecy. Traders think volume will be light, so they trade less.

Thanks. It is light today.

For the non-cognoscent,

what is the ESZ please ?

Approaching 11AM (EDT), we’re below SPX 1160. Yesterday, I mentioned the .618 retrace from 1114 to 1196 was around 1145 – in the middle of a band of support between 1140-1150. Again, if the bulls have regained control in the very short term, this would be an area where we could see some buying. If not, it seems to me that the bears press 1120-1140.

with commodities falling to bits and vanishing the spx should be eaten up by the bears

ndx 100————

longer term gabriel failed to blow his horn and the jaws of death closed on the ndx 100

topping in july

it then had a impulsive non stop wave 1 down and has now completed wave 2 up at relevent fib ect—impulsive wave 3 looks like started y/day and today has decisivly broken y/days low and at S1 piviot on futures –it has also kissed its upside trend line good by

the ndx 100 will now lead the world in a new bearish revival,that will supass all previously

seience

teddy bear said that about the ndx

it is a fact that in this physical universe 2 objects can not occupy the same place in time and space

therefore to stop my observations from causing my predictions to vanish ie the physical universe price and pattern–i create immageary creatures to make my forcasts thus introducing a lie and stoping a vanishment

therefore i hope u will all understand about teddy and grizelly and gruesome /awesome

I haven’t a clue as to what you’re implying. Why do you have two? I assume teddy and grizelly are both bears. Why two bears and two cats? I’m assuming the cats are oversold.

thats ok RichE,–just treat them as comical characters

AussieJS – you have commented in the past on DAX & Euro. Can you update and do you still feel they will lead the U.S. stock market?

PeteM

the dax hasnt been able to get up of the ground for a 2 up—it may have a little abc up

and is vibrating in the 5600-700 range but did break to the upside of its down channel ,but not by much

if germany is going to bail out europe ,then germany will be bankrupt and may be downgraded along with france/england—and its grouth is slowing along with its exports

the euro –i hope has started a wave 3 down and broken its trend line–target 1.32 then parity

Thanks for the comments. I was thinking DAX might have enough in the tank to test 5900 & Euro to try 1.37 – 1.38 before rolling over, implying more consolidation in SPX between 1100 -1210 into OCT

just took profits on a smaller scalp—world wide

Following Jason’s comments, I’ve covered a second 1/3 at 1160 and I’ll give my remaining 1/3 a little more time to see if a third test of 1150-1155 develops that will lead to a break down to 1145. Of course, if that level holds again, I’m closing out my last position.

At every time frame I look (except for those intraday short term moves) I still see 3 wave patterns since SPX 1370. It doesn’t alter my long term bearish position, but I just don’t see evidence yet of a sharp move down developing at this time.

I could laugh, except it hurts when I do! 2 days in a row, as soon as I cover a short position, it accelerates downward. Well, we’ve broken below the open and I’m looking at SPX 1145 just below and waiting to see if that’s it or between now and the close of trading we can accelerate even lower into the 1130-1140 layer of support.

By the way, I see the move down so far from 1196 as a possible EW “abcxabc” (first abc ended at SPX 1150 area followed by x wave rally to 1176 and we’re now in second abc with broad target of 1145 (c = a of second abc) or 1130 (second abc = first abc). Or, of course I could be full of spit! Anyway, I’m giving this last 1/3 position more room, which I may regret.

this is fun–just close out the world again for more profits

spx 1145–dji y/day low piviot and ndx at below S2 piviot

–we should get a bit of a bounce to the next highest piviot but if it cant break through then short again

Pete if spx cant get through y/day low–short

————fast in -fast out

this is insto selling with almost constant tick extremese

dji now confirming the drop and below y/day lows

Presented with the opportunity (after reaching the 1140 area) between 3-3:30PM (EDT) on several occasions, I’m out of my last psoition at 1145. Now I need I to find the next place to go short for what I hope will be a longer term trade as I have no inclination to take a long position in any time frame.

SPX 1160 – 1175 would be an area I would think about reinstating a 1/3 position