Good morning. Happy Wednesday.

The Asian/Pacific markets closed mixed and for a change there were no big winners or losers. Only Indonesia moved more than 1% (up 1.1%). Europe is currently mixed, but there are no big movers there either. Futures here in the States point towards a small gap up open for the cash market.

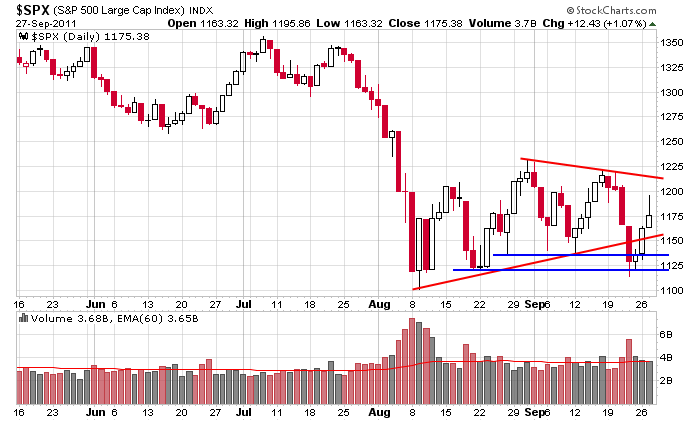

Things are very unclear in the near term. After the indexes broke support last week and took out their most recent low from within their patterns, they’ve bounce 3 straight days and now lie smack in the middle of their ranges. Here’s the S&P daily. We’ve had lots of up and down movement and lots of ground covered in a relatively short period of time, but there is no net change in almost 8 weeks. Day traders have had lots to play with. Swing traders have had to significantly reduce their holding time. Ideally a swing trader would want to hold for several weeks or longer to give charts every opportunity to fully run their courses, but for the last two months, holding times have mostly been less than a week. That’s the way it goes. You have to be flexible and take what the market gives.

Europe remains in Wall Street’s cross hairs, so risk remains high. A big move in either direction could happen fast, so keep that in mind when you decide how aggressive to be and how big your positions are. This is not a “coast is all clear” time. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Sep 28)”

Leave a Reply

You must be logged in to post a comment.

ESZ1: I believe today will make a run at 1200. I’m waiting for a dip b4 going long. The Bell Hops are throwing things at each other at the moment.

RichE – If SPX 1182-1187 can’t contain an upside rally, you may be right.

It’s getting ready to tell.

ESZ1 1d1m: If this dip is a higher-low I’ll go long.

ESZ1 1d1m: A bit more selling than I like. This next dip needs support or it’s not going to hit 1200.

ESZ1 1d1m: Nope, it ain’t hitting 1200 today.

small caps are lagging….market isn’t going to move up as long as this is the case

Thanks Jason.

ESZ1 1d1m: This dip’s being bought. Long 1 scalp mode target 1170.

Basis SPX, if any rally off of today’s lows thus far (1169.50) fails below 1180, I’ll be looking to add my last 1/3 of a full postion with the expectation that we should begin to see signs of some acceleration downward. Failing that, I’ll be covering my existing short positions from yesterday at SPX 1187 & 1180 at break even.

Re SPX: I don’t think it’s a good idea to put on a swing short position. Look at this weeks volume and it’s currently filling the 9/27 gap.

What are small caps doing now? The ES just took off.

Here’s my very simple chart…

http://www.leavittbrothers.com/members/options/images/mw/spxrut%2028-2.png

…and the others are at or above their yesterday’s close. I have no idea what that means.

I find the small caps normally lead, so when the market made a rally attempt around noon and the small caps couldn’t get much of a bid, a decent risk/reward short day trade was presented.

with a lot of the world going into end week quad witching and end quarter shuffle

we have sideways

technically we are still in the land of hope which is wave 2 not wave 5 choppy apathy

reality is pressing and pain will be felt soon with uncontrolable downward exhuberance

–wave 3——-i look forward with the glee of insanity

Well, I can only trade what I see and protect myself with proper stop losses to reduce my risk exposure.

Having seen SPX come off a double intraday bottom in SPX, I saw the failure just below 1180 and put my last 1/3 position on when SPX broke below the open at 1175.39. I’m now short at 1187, 1180 and 1175 with a stop loss on all postions at 1180 (the last rally failure area).

If we don’t break the intraday low with force, I’ll either lower a trailing stop loss or make a decision whether to cover at the close if I still have my open short positions.

should be ok –we have mostly a negative tick ind with many tick extreme readings and no positive ones–meaning someone is selling on the down tick

spx is the weakest siting at and just below main piviot and y/day close

price is under the moving aves–euro is intraday down,but beware of lunch time pop and closing sell

dax has had a weak wave 2 if that or perhaps small abc and looks like they are trying to keep price at 5600 and ftse at 5250-5300 for fri opts ex

aussie share opts ex thurs and well controled

I’m lowering my trailing stop to SPX 1177.50 so I can at least make some profit overall. I don’t see the downside movement I’ve been anticipating.

Just in case we’re forming a triple bottom here at the intraday lows and not accelerating lower, I’m trailing my stop now at 1175.50.

Now we see if we can break below SPX 1165.

To me it looks like it’s setting up for a wave1up. The Aug 8tish volume is very high. That looks like buying to me.

See you guys tomorrow.

From the low of SPX 1114ish to yesterday’s high of 1196ish – fibo support is 1165 (.382), 1155 (.500) & 1145 (.618).

By the way, draw a trend line on the 15 min chart from 1114 and you’ll see we’re sitting on it at 1165. Break it and we should see the next support level(s) tested, which should happen if the bears are back in control.

Nice work Pete. Good trading.

Thanks Jason! Yesterday & today I’ve felt like a day trader. I don’t know how they do it day in and day out. Your comments today pretty much sums the situation. Now all I have to do is figure out whether to hold on or not to my position(s).

I hope no one minds my sharing my thoughts. It helps me clarify my thinking. The rally from the intraday low thus far (SPX 1159ish)appears to be corrective and is finding resistance at the 1165 area. I want to give this move room to play out but at the same time I don’t want to see a nice profit start evaporating. So, I’m moving a stop down to 1168 on 1/3 of my position while looking for a resumption of the down move to 1155. If that occurs, I’ll look at how I interpret the EW structure. If we get into the 1145 area before I’m stopped out, I may look to take partial profits at that time. I’m seeing the .618 numbers proving to be both support and resistance to moves in both directions.

PeteM. What charts do you look at. I can’t seem to access the ESZ1 only the EPZ1 and I don’t seem to be able to access the Russell 2000. I like some of your comments as it gives me an insight into other peoples thoughts. I trade from Australia and last night I went short on the SPI and was stopped out (bugger near the high) and now the market is down nearly 60 points from were I was stopped. I probably should have had more patience but I try not to let my thoughts beat me but over the past 3 weeks I have had a dreadful time as the market is so wippy. I appreciate your comments as it also helps to clarify my own thoughts.

Besides the Charts I look at the BIGGER PICTURE : |

I suppose I could cry, but I won’t. Stopped out of 1/3 at 1168 only to see it reverse and head to (you guessed it) 1155. I see no reason to close out the remaining 2/3 position by the close, so I’ll see how things look tomorrow – especially if we can get into the 1140-1150 area.

good work everyone–im holding short the world into the asian session inc aussie axjo,but closed out most europe at usa close,untill they confirm their downturn