Good morning. Happy Wednesday.

The Asian/Pacific markets closed mixed and with an upward bias. China and Indonesia rallied 3%, India more than 2%, Hong Kong, Malaysia and Singapore more than 1%. Except for Austria, Europe is up across the board. France, Germany, Amsterdam and Norway are each up more than 1%. Futures here in the States point towards a moderate gap up open which will put the cash market above yesterday’s high.

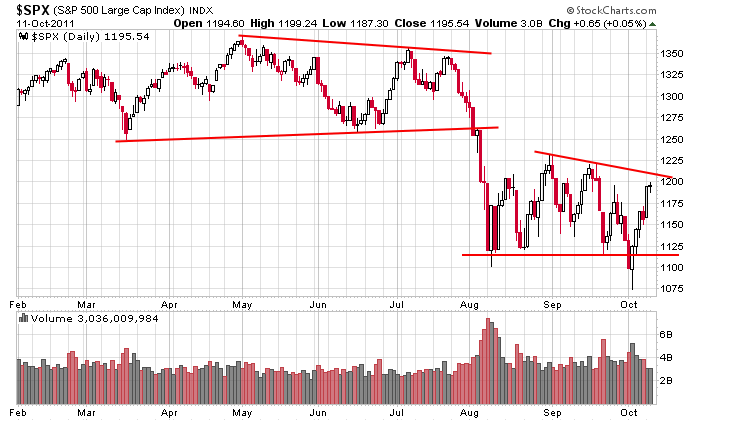

The S&P has rallied about 125 points the last 6 days – that’s the best 6-day rally this year. What started out as an innocent bounce – a bounce that differed little from several other bounces we’ve had the last two months – has turned into a pretty big move. But overall the indexes remain in their ranges, and volume the last two days has been very light. Here’s the S&P. Other than a single close below the horizontal trendline and quick snap back which has made clearly defining support more difficult, the index remains range bound.

Respect the move but be careful up here. Considering the move we’ve just had and the proximity to the highs of the pattern, I don’t think the risk/reward for initiating new longs is very good. The rest of this week will go a long way towards telling us if this is just another bounce within the range or something that has legs. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Oct 12)”

Leave a Reply

You must be logged in to post a comment.

If a news reporter from the WSJ or the Financial Times doesn’t mind

losing their job, or in fact has been thinking about changing careers

it would be good of you to expose all of the Wall Street corruption

and what methods that they use to artificially keep the markets up.

That’s a bit cryptic. Are you grinding your axe or teeth?

SPX: to me it looks like a Wave1up building from the 10/4 low and needs to break 1250 to get converts on the band wagon.

IF:

1. You’re an Intermediate Long trader

2. This is a Wave1up

3. It breaks 1250

I’d wait for the Wave2dip (sweet spot) before going long.

Hello folks, happy trading.

Following Jason’s pre-market for a while. Looking to enter TVIX and FAZ positions at around SPX 1220 unless we break with volume.

GL,

From Zacks; “… small caps and growth oriented stocks continued to bounce back from the severe beatings they have taken the last two months. This means that more investors are pondering the notion that there may not be a recession and willing to take on more risk.”

If SPX can rally back to 1212.50-1216.50 and then fail, reverse and move quickly down, I’d like to add my last 1/3 of a full short position on a move through 1209 – but it has to happen between now (3:30 EDT) and the close or I do nothing.

Well, the set up I was looking for took place and I had ample opportunity in the last minutes to put my final 1/3 of a full position on at the SPX 1209 level. My overall short position averages out to SPX 1143, so I won’t be holding on too long if things don’t go in my direction in early trading.

Look for a minor sell off Thursday if we hit Wed highs. Don’t get excited if you are a bear it won’t last.