Good morning. Happy Thursday. Happy Passover. Happy (almost) Easter. Happy last trading day of the week (the market is closed tomorrow).

We entered this week thinking a big move was coming and instead have gotten a whole lotta of nothingness. The market was weak Mon and Tues and closed well yesterday. Volume has been very light. According to the current futures trading, the SPX will open a couple points below last week’s close, so if the level can be held, we’re looking at a flat-ish week. That’s not bad considering the market 4 consecutive weeks and was sitting right at resistance with overbought breadth indicators.

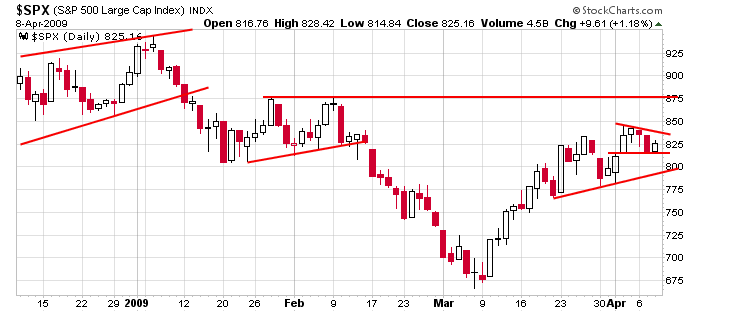

Here’s the daily chart. I see nothing wrong with this picture. Sure the “2 steps forward, 1 step back” nature can be frustrating, but you can’t deny an uptrend remains in place (on a short term basis).

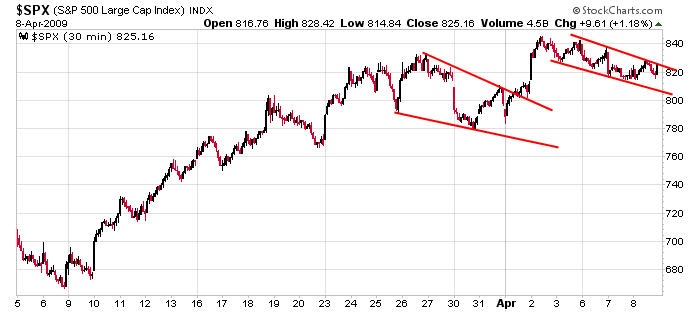

And here’s the 30-min chart which covers the entire move off the low. Again, I see nothing alarming here. Consolidation within an uptrend.

Most economic news is behind us for now, but earnings season is here and the personality of the market during earnings season has yet to be established. I’m still not placing big bets now, and I’m certainly not going to be aggressive ahead of a 3-day weekend. Stay on your toes.

headlines at Yahoo Finance

stocks to watch from MarketWatch

today’s upgrades/downgrades

this week’s earnings & economic releases