Good morning. Happy Friday.

The Asian/Pacific markets closed mostly down, but there were no big movers in either direction. Hong Kong lost 1.4% and India gained 1.2%. Europe is currently mostly up. Belgium, France, Amsterdam, Norway, Stockholm, Switzerland and London are each up around 1% or a little more. Futures here in the States point towards a moderate gap up open for the cash market.

The big news overnight was Standard & Poor’s downgraded Spain’s long term debt rating. For most of the last two months, such news would have prompted the S&P futures to be down 25 right now but instead they’re up 11. Has all the negative anticipated financial issues in Europe been priced into the market? I’m not sure, but the market’s reaction is worth noting. Strong markets embrace good news and ignore/absorb bad news. Today’s news is bad and the futures are moving up anyways. Respect the price action. It doesn’t matter if it makes sense or not.

Yesterday JPM got hit hard after earnings. Today GOOG is up big. An earnings season personality has not been established. So far poor reports have induced selling and good reports buying. We need more data to see if this is a trend or if these first handful of reactions were unique to the specific companies.

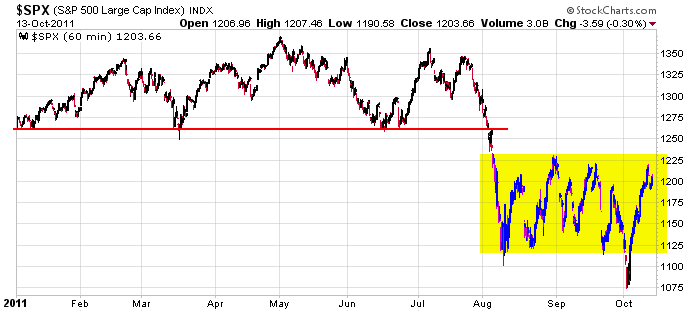

The indexes have gone almost vertical the last 8 days and are close to the tops of their ranges. Short term sentiment is up, but I don’t think the risk/rewards for initiating new positions is great. In many cases stocks have gone straight up and aren’t forming tradeable patterns. By not being more aggressive, I run the risk of missing trades. Oh well. That’s the way it goes. I plan on trading for a long time, so missing a couple entries doesn’t matter to me. And besides, here’s the S&P. It’s still range bound.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Oct 14)”

Leave a Reply

You must be logged in to post a comment.

Jason’s yellow box formula. Normally I would be looking for a series of higher lows or lower highs, but the only thing one can visibly see from Jason’s yellow box is a definitive ‘V’

bottom established around October 4th. Tops are more of a rounding nature. HW

It looks like a “Goose, goose, duck” day. Bull, bull, bear. This, 10/4 wave, still feels like a wave1up.

The boyz are sitting pretty for another goose up, but on the

other hand instos, banks, hedgies might not want to hold long

over the weekend. MA at 1210 is a must to hold and make the

weekly charts appear to be bullish right now. HW

Yep, not holding over the weekend should give us a, “Ducky” close.

Taking Jason comments into consideration, I’ll make a few observations. Basis SPX, I see the 50 day EMA has turned up and is now, in my opinion, a key support level at 1191. The 200 day EMA is trending down at 1235 and may be the key target/resistance area for this rally from 1075.

If I back up to a daily chart, I could argue that from yesteday’s low around 1191, we are now in a EW 5th wave up from 1075. If we’re considering the consolidation since early AUG as a consolidation in a bear market that began in MAY, I would label the action as an ABC “flat” correction in EW terms. It would be a 3-3-5 wave affair, i.e. 3 waves up from 1101 to 1230ish, 3 (complex structure) waves down to 1075, and now 5 waves up targeting 1220-1235. That’s the bearish view.

The bullish view might be that at 1075 we completed at least part of a corrective move from the MAY high and this move from 1075 is a bullish 5 wave sequence. If so, a pullback that finds support in the 1165 – 1191 area may be a place to go long for a test of 1250-1275 minimum. I still favor the bearish view with 1235 the key area of resistance that must hold.

S/R 1180/1225. For this bull wave to maintain it needs to hold 1180 or break through 1225.

Currently I’m short, playing the 1180 scenario, but watching out for Goosey Lucy.

And by the way, to keep the 5 waves up idea from SPX 1075 intact (at least as far as I interpret the move), you would ideally like to see any pullback from today’s 1221ish intraday high thus far, hold above 1207.

I put it at 1206. Currently 1209 is the hold.

Whoa! not often I see a gap down on 1 minute. 1180 here we come, (maybe)