Good morning. Happy Monday. Hope you had a nice weekend.

The Asian/Pacific markets closed mostly up. Hong Kong gained 4.1%, Taiwan and South Korea more than 3% and Australia, China and Indonesia more than 2%. Europe is mixed; not one index has moved more than 0.5%. Futures here in the States point towards a flat open for the cash market.

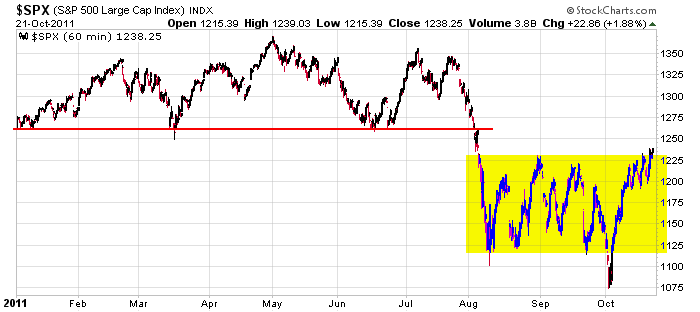

The Nas and Russell are sitting right at resistance. The Dow and S&P are in the process of breaking out, but I hardly consider last week’s action to be a build up or pressure followed by an explosive move. Here’s the 60-min S&P. The index has spent most of the last three months in a range, and although it’s above the range right now and there’s a thin area above (until 1260), we don’t have enough separation for the bulls to relax.

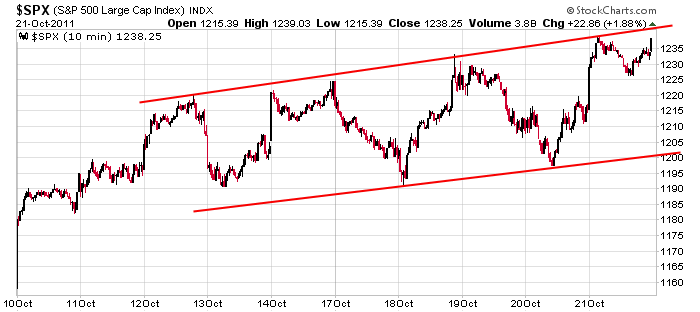

Zooming in on the 10-min confirms the lack of breakout and insteads shows an entity which has made higher highs and higher lows for a two weeks. There’s nothing wrong with this, but it has different implications than a breakout.

My bias remains to the upside. How could it be anything else. Two weeks ago I stated the bounce looked and felt different than the other bounces that had taken place the last three months. Here we are near the tops of the ranges. There are still lots of headwinds, but we need to get used to them because they aren’t going away any time soon. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Oct 24)”

Leave a Reply

You must be logged in to post a comment.

According to Jason’s 10min chart I would say we pop at the open today

and then should look for a pullback of some magnitude. In view of the fact

that tomorrow is ‘turn around Tuesday. this makes a lot of sense to me. HW

Good call! So far. Looks like the Bell Hops had ‘PopRocks’ for breakfast. Where are you putting the turn? I’m guessing 1260ish, but I don’t think the drop will be that dramatic.

The bulls are probably waiting for a massive pop once this European crisis

meeting gets resolved. How quickly we forget (mind you), that the Dow just

ran up a mere 1000+ points plus, so we might see a 5 to 10% correction

later on in the week. 1) Looking to buy UUP limit order in @ 21.40

2) Have an order in to short GDX and; 3) buy TVIX limit of 54. HW

Re: UUP Strong dollar?

Depends on how negative the Greece resolution. I think the SPX and USD will go up.

Right on Jason. The EU meetings were disappointing, no money, lots of promises = phoney solution.

EU in recession which will worsen, but the US may scrape through with + GDP. This means little happening in the markets until they start down in Dec and Jan’12.

Signal: 20 WKMA was exceeded by the Dow and S&P OCt 21st. That would be a buy signal, so we must see which way the institutions go. Maybe up a little today, but ultimately it is weak market. Looking at bonds and currency spreads.

Cheers

Looks like we’ve had two accumulation weeks (Oct 7 and Oct 12) in the last three. Some managers may view this as bullish.

The iPod is 10 years old yesterday. To date, Apple has now sold more than 304 million iPods.

ESZ1 1d1m: No volume on this dip. 1250 maybe the high for today.