Good morning. Happy Tuesday.

The Asian/Pacific markets closed mostly up. China, Hong Kong and India gained over 1%. Europe is currently mixed. Austria and Germany are up more than 1%. Nothing is down much. Futures here in the States point towards a slight up open for the cash market.

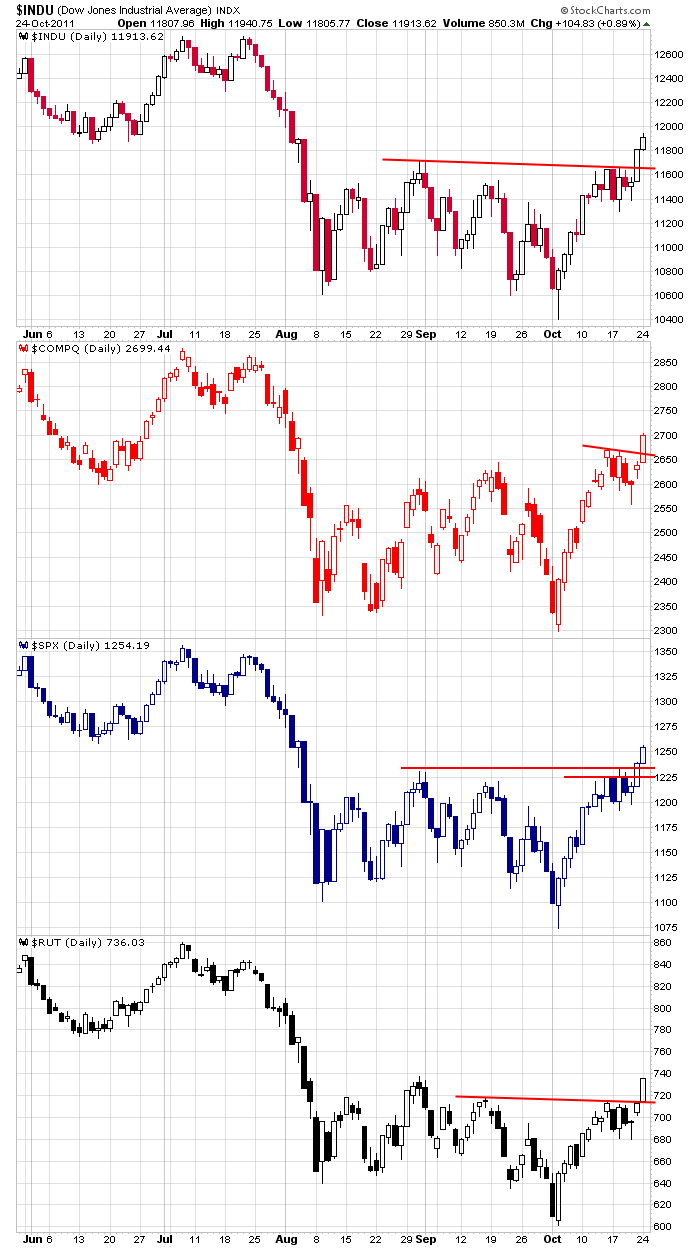

My bias has been to the upside for three weeks. Several times I’ve said the bounce felt different than previous bounces over the last couple months. I hope you haven’t been in a state of denial. I don’t know why the market does what it does, but I can see what’s it’s doing and decide not to fight it. Yesterday we got across-the-board breakouts from the indexes. From a technical standpoint you can’t be anything be long here. Could the moves prove to be false breakouts? Sure, but trading is a game you play where you don’t know the outcome ahead of time. So you have to read the sign posts and take the high-probability set ups and then play good defense. Those are the two steps to trading. 1) Be on the right side of a trend and 2) Play good defense. Being on the right side will save you from some bad set ups because the market is highly correlated. That means when the market moves up, almost everything moves up. Managing positions means dumping losers quickly, and with your winners, knowing when to take quick profits and when to let positions ride.

Here are those daily charts. The Nas has been back inside the bottom of its Jan-Jul range for almost two weeks. The Dow and S&P will bump into their bottoms soon. Don’t get lazy.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Oct 25)”

Leave a Reply

You must be logged in to post a comment.

Earnings from Zacks:

Last week about 60% of full-year estimate revisions for 2012 were heading lower. Now, it was only a little more than 1% and does leave us with year-over-year growth, but the direction is a cause for concern.

Question: Will any and all European solution(s) result in a weaker Euro?

We have a .618 retracement thus far from the MAY SPX high to the OCT low. From my perspective, there is room for more upside to the 1270-1275 area and good support in the meantime in the 1200-1225 area. I’ve read from a number of sources that this week has a cluster of cycle turn points, while longer term cycles have or are peaking. Make of that what you will. Also, as I see it, the past 10 or so trading days strike me as being part of a distribution pattern.

However, in the short term at least, the tremd is up and Jason’s comments are on target. I’m focused on the long term trend, which I still identify as being down, so I have not taken any long positions. In fact, I still have 2/3 of a full unleveraged short position in place at lower levels – much to my dismay. On hindsight, I should have paid more attention to the extreme oversold position of the market at SPX 1075, which may still have not been worked off enough to set up conditions for a resumption of the long term downtrend.

I’m sure many see the potential “triangle” formation in progress in SPX that suggests further downside activity. Depending on one’s mode of measurement, it could prject down to 1215 if fulfilled. We’ll see soon if the pattern completes with a downside breakdown.

Another breakdown measurement would be the 1227-1230 area.