Good morning. Happy Tuesday.

The Asian/Pacific markets closed up across the board (except for Japan), but there were no 1% winners. Europe is currently mixed; only Stockholm has moved more than 1% (up 1.3%). Futures here in the States point towards a moderate gap up open for the cash market.

On Monday the indexes broke out. Yesterday they gave a big chunk of the gains back. I’m not going to abandon my bullish bias just because the market drops one day. That’s not my style. I’m a swing trader who varies his holding time based on market conditions, but I maintain my bias as long as possible. I’ve been long for three weeks, so it’s going to take more than one down day to get me to change. There’s nothing wrong with being bullish one day and bearish the next…you just have to admit you’re better suited for day trading, not swing trading.

We’ve already seen several large cap tech stocks (IBM, AAPL for example) take hits after earnings. Add AMZN’s name to the list. The stock dropped 4.4% yesterday and is down another 12% before the open.

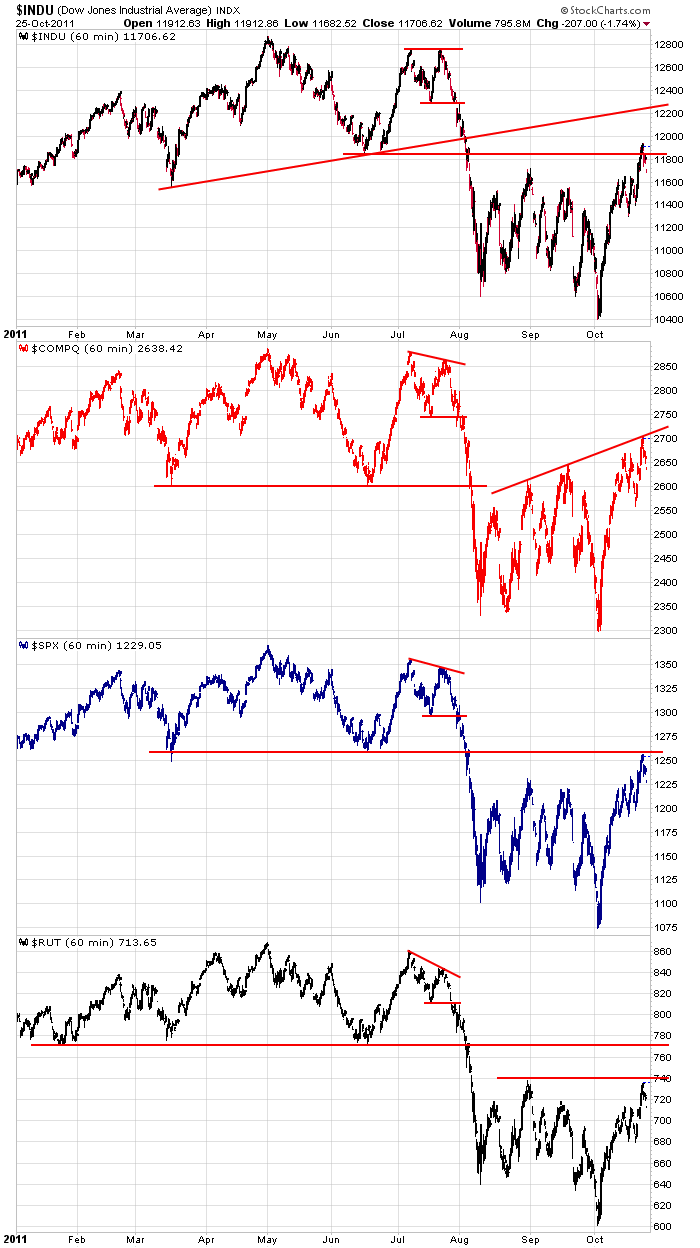

Here’s a repost of the 60-min charts. The Dow is at it June lows. The Nas, S&P and Russell are at resistance of some sort – either in the form of a previous high, a previous support level or a trendline connecting previous highs. The indexes have gone virtually straight up for an entire month, so the risk/rewards here aren’t as good as they were last week. My bias isn’t changing, but I’m recognizing the possible need to rest before resuming the uptrend. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Oct 26)”

Leave a Reply

You must be logged in to post a comment.

ESZ1 1d1m: That was fun! The Bell Hops are on pogo sticks or somebody sneezed the answer in the elevator.

Seriously, after the dust settles I think I’ll go long. I don’t think the bulls have given up yet, but, as Jason implied, “Daytraders get to change their minds”.

key reversal in dax–some nice short profits

we have conned enough bulls now into calls so the bears will be out for holloween

ESZ1 1d1m: Lunch time! Still waiting for the dust to settle.

I think we’re at an interesting juncture in SPX today. Here’s why I aay that. At this week’s high, SPX has retraced .618 from the MAY high to the OCT low and has traded downward since MON’s high into today’s low. Interestingly, from the low of last week (1198ish), today’s low is a .618 retrace from 1198 to to this week’s high (1256ish).

From an EW perspective, the sell off from 1256 is probably best counted so far in 3s, i.e. corrective, although the hourly chart can be argued as 5 down (for wave 1)into yesterday’s low with today’s opening rally as wave 2. That would mean that we’ve begun a wave 3 down since today’s high. If you’re at least short term bullish, you’d like to see today’s low thus far hold, and a resumption of the rally to new highs. If your’e a bear, you’d like to see today’s low broken and an acceleration downward to at least 1215 but ideally down to and through 1198.

I agree with Jason that the short term trend is up. I still see the long term trend as down with a distribution pattern that began 2 weeks ago. SPX 1198 to 1225, in my opinon, is key to keeping the short term trend bullish. Below 1192 to me confirms the distribution pattern and suggests any rally will fail below 1256 and be a long term selling oppotunity.

With SPX 1221 holding as support late today (best read as a 3 wave corrective decline), the short term uptrend remains intact and chances remain favorable for further upside and new highs for this move from 1198. A break below today’s low wouldn’t necessarily change the short term bullish outlook as long as 1192-1198 isn’t broken, in my opinon.