Good morning. Happy Friday.

The Asian/Pacific markets closed up across-the-board. China, Hong Kong, India, Japan and Singapore led the way. Europe is mostly down. Austria, Amsterdam and Norway are weakest. Futures here in the States point towards a moderate gap down open for the cash market.

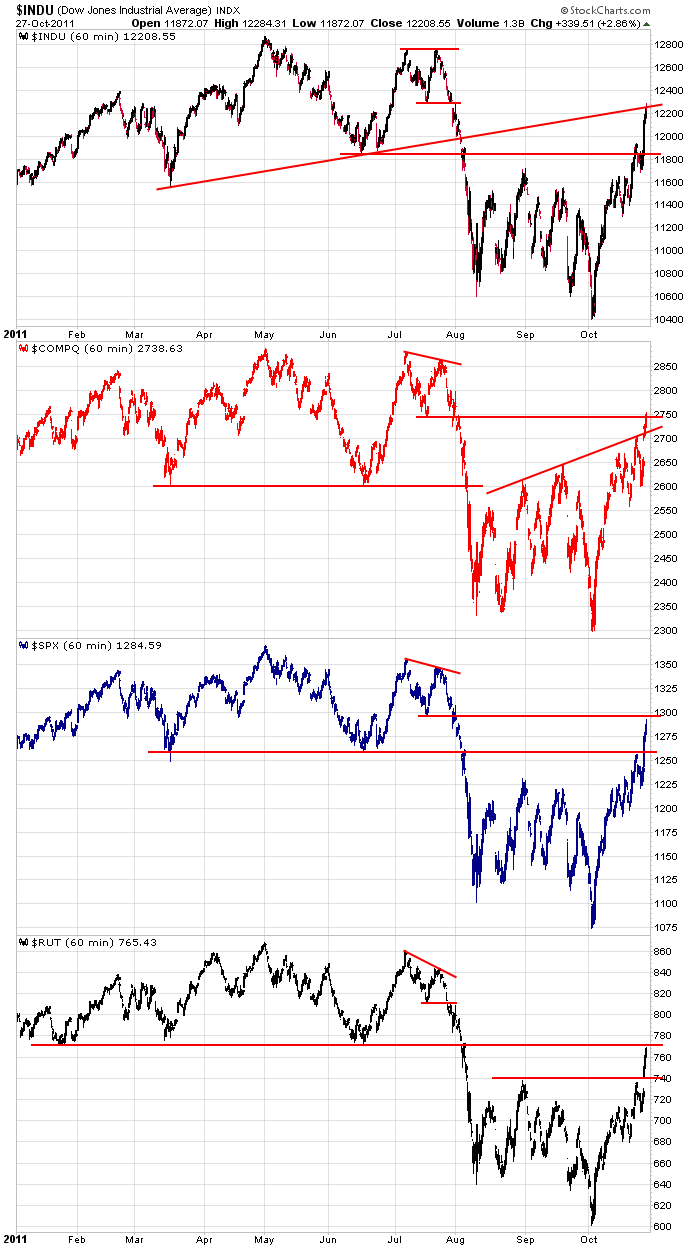

With two more trading days to go this month, October has been the single best month in many years, so I’m glad we’ve been long most of the month. Here are the 60-min charts identifying some potential overhead resistance levels. The Dow is up against a trendline created by the March and June lows. The Nas moved above the slanted trendline I posted earlier this week and is now at its early-July low. The S&P moved above its March and June low and is now up against the same July low the Nas is testing. The Russell is lagging. It’s the only index that has not yet climbed back into its Jan-Jul range.

It’s hard to argue when the market has its best month in years, but unfortunately, although we’ve had many very good trades the last few weeks, there are virtually none left. Very few stocks are set up to breakout. They’ve all already broken out and are way too far gone to chase. The market is healthy from a technical standpoint and from a sentiment standpoint, and when you consider the bears out there who are not long yet, there’s shadow buying that will come into the market on any weakness. Odds favor a continuation of the uptrend. Don’t get lazy and chase stocks higher. Don’t fight the trend either. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Oct 28)”

Leave a Reply

You must be logged in to post a comment.

and thank God that Eurotrash thing is all solved and kosher….

no dont thank me —europe is bankrupt and toped y/day with opts ex today

It ain’t over until the Inflated German Banker Lady sings.

I would like everyone to know that the NBA basketball league is rumored to be close to a contract agreement. If so, this would be a huge boost to the American economy and may cause the DOW to jump anywhere between 200 – 300 points. From what I hear, there is no truth to the rumor that the FED was prepared to intervene in contract talks but there is speculation that the FED may guarantee any league losses that may come out of an agreement.

LOL-we are all in good mood t/day

must be the big boy hedgie banks are accumulating shorts as the retailers load up on calls

AussieJS – I better have a sense of humor about this as I’ve been wrong all the way up on this rally. I am now trying to discern the “big picture” since the MAY SPX high. Call me stubborn, but I’m still inclined to look for a selling “opportunity” as opposed to getting “long on the dip”. Jason is probably rolling his eyes!

my dead cats grusome and awsome stoped bouncing y/day from exhuastion

and have promised any further bounce from a retracement will fail

Well, I’m short an unleveraged SPX position at 1284 and will cover at 1287 unless we see 1277 on a retest of the day’s low, at which time I’ll move my buy stop to break even or lower. My rationale is that the move down from yesterday’s high to today’s low was impulsive and this morning’s rally was corrective of the downward impulse. It may not be the end of ths rally from the OCT low, but I think there’s at least some further downside potential before an attempt at new highs above yesterday’s high.

what an opportunity it was to buy gold under 1600, wasn’t it? i’d still buy it up here. 4th quarter is usually pretty good for metals, so buy gold and silver here, lots of it. we sold our bonds 10 points (for 30y) above, we are still not buying though. 4th quarter is usually a down q for bonds. if it really collapses, we’ll buy in mid december. otherwise mid january is the time to go back in. good luck all 😉

I’m still looking for that test and break of 1277 but, just in case, I’m going to cover my SPX short at 1284 – breakeven.

After covering my early shaort position at breakeven, I may look for another “opportunity” to try the short side today. Call that persistence or something less flattering. Forgive me, Jason!

As Ronny Reagan once said, “Well, there you go again”! I think I’ve been looking at bearish “triangle” formation which may have completed around 3PM, so I’m short again at 1284 with a breakeven stop loss.

Market will ultimately move to SPY 134-136 with resistance at SPY 133

I forgot to mention my projections should take place by end of November or December

whilst as Jason says –he wouldnt be looking for new longs here

when i put on my new holloween bear suit it should suprise all the existing bulls

ill wait and see if they liquidate for end month shufle