Good morning. Happy Monday. Hope you had a nice weekend.

The Asian/Pacific markets closed most down. Australia, Indonesia, Singapore and South Korea fell more than 1%. Europe is currently down across the board. Almost everything is down at least 1%. Futures here in the States point towards a relatively large gap down for the cash market.

I don’t have anything to add to the comments I made over the weekend in my Weekly Report. The market is in good shape. From a technical standpoint all the indexes have broken out of their ranges, and although the moves are unsustainable and resistance levels are just overhead, I’d expect a dip to get bought (and there will be a give back soon). News wise, the biggest item has been dealt with (Europe). I don’t think they solved anything, but they’re making sure a default won’t domino all over the world. Sentiment wise the bulls are feeling good and the bears are frustrated and pissed off again. And there are many money managers who are either not long or not long enough, so a correction here is likely to get bought.

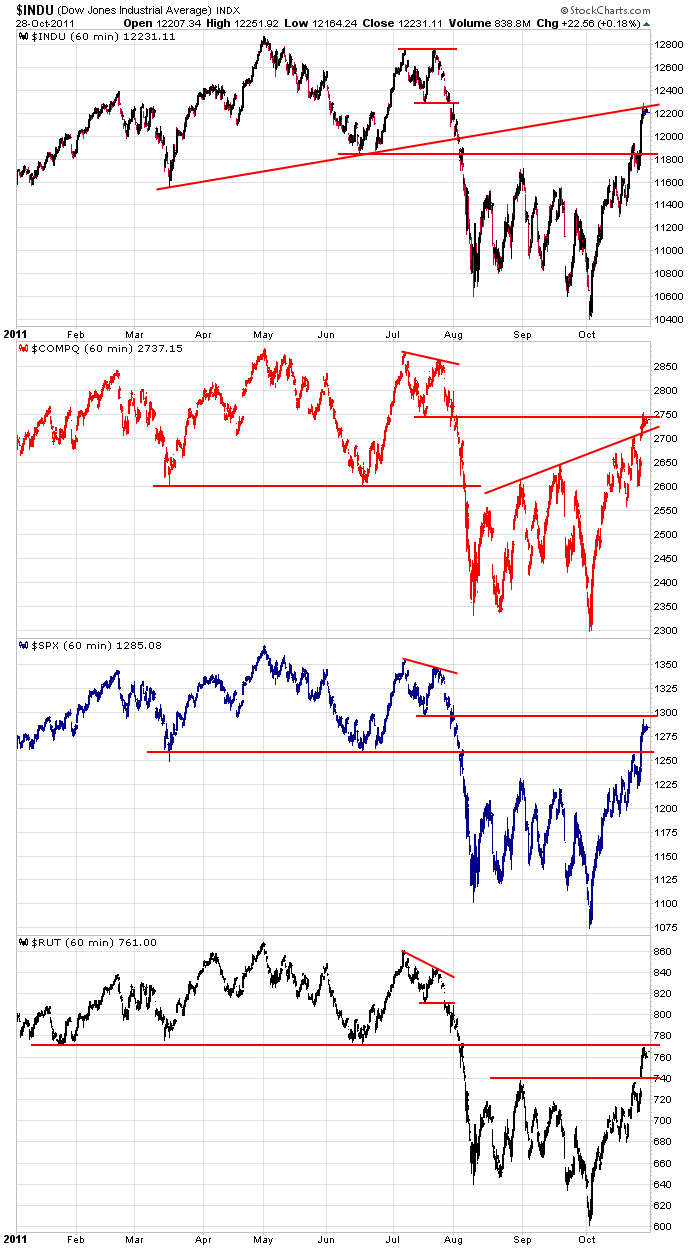

However you look at the market, things look good (although unsustainable). My bias has been to the upside for the last month, and that’s where it will remain. Here are the 60-min charts. Each one is at a resistance level. The Dow is near a former support trendline which connected the March and June lows. The Nas and S&P are at levels that support prices in mid July. The Russell is at the bottom of its January-July range. The trend over the last month is solidly up, but when you back up, there are technical headwinds to deal with. Be careful.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Oct 31)”

Leave a Reply

You must be logged in to post a comment.

Recession in the EU is the fear. The capital needed is not evident. They do down.

MS Global is supported by the FRBNYC. The real focus should be on the CDS held by US banks like BAC and C, not to mention WFC. The FDIC has no capacity to cover these risks. So they go to the Fed and its nortorious balance sheet.

Trading will falter today but we are going into year end. Take heart the institutions what it up, so its going up, then prepare for something else.

i have a new holloween bear suit and its terifying and no im not pissed off im eager to sell some bull

thurs we had a top and a faults break world opts ex fri–the euro toped and japan intervention hurt it today

now i dont know if this will be a LARGE move downor a small sideways distribution before a resumption of the bear

but anyone seeing my awesome bear suit will immediatly capitulate and not buy the dip

the insto hedgies have been accumulating puts as the retailers and yukky long only mutuals have been conned to buy calls

I think today will be a tale of two cities. Down in the morning then up later today. HW

rembering europe closes 1 hour later today at 12.30 pm

if we get the usual mandatory attempt to close the gap open,then that may excite me for a short

As one who has not participated in the OCT rally, I would describe myself as frustrated. We all know the “fundamentals” don’t support this move but price is all that counts and Jason has been correct. From what I read, the bearish sentiment is slow to dissipate which fuels the rally further. But, I think that analysis and the euphoria over the European debt “fix’ last week are too simplistic as reasons for the extended rally last THURS.

I came upon John Mauldin’s “Thoughts from the Frontline” over the weekend and here’s the best explanation I’ve come across: “The banks ‘voluntarily’ took a 50% haircut….And because the writeoff was voluntary, there would be no triggering of credit default swaps clauses. Because if it’s voluntary it’s not a default……the risk evaoprated: there would be no CDS event. So why buy CDS? Time to cover. And then the shorts get covered….Further, the risk to financials was cut by a large, somewht murky amount. But it was definitely cut. So buy some risk assets. Which puts any long/short hedge fund in a squeeze, especially those with anti-financial sector bias….And it just cascades. The high frequency-trading algo computers notice the movement and jump in, folloed quickly by the momentum traders, and the market melts up.”

To follow up on my previous comments, it now seems that the deed is done. Absent a news event that is super bearish, it would seem that hedge funds (who are reportedly in the red this year) and the institutions have some catching up to do with this market advance. Jason is probably correct that any pullback will attract buying interest. That, in addtion to the still relatively high bearish sentiment, should be sufficient to get SPX north of 1300 as WALL STREET locks in those bonuses in time for Santa. Sweet, huh?

Hi Pete, Unfortunatley I did not participate in the October rally

and was mostly in cash. I have to say I did get a tip on NFLX that

they were going to miss so I took a punt and got lucky on it.

Sometimes it’s better to be lucky! My frustration has been increased by today’s rapid move down after the open. Having been short twice on FRI with breakeven stops, I was stopped out of both positions. At times like this, I’ve found it best to step back and reasess the long, intermediate and short term trends and where, when and if I want to trade.

I’m thinking the bias is up for the remainder of this quarter. If SPX 1256 – 1265 holds in here, we can test 1300 first before we get a deeper correction. If 1256 fails to hold, then we may go further down first to the 1210-1215 area before an attempt can be made to test 1300. Am I inclined to trade both sides? I just may do that, but with tight stops and a willingness to take profits quickly, as Jason has suggested. A major down move seems to be pushed out into 2012, in my opinion. I had previously thought we were in a distribution phase over the past several weeks, but now I think we’re more likely forming a longer term rounding top with a test of the MAY high a real possibility or at least the 1300-1350 area.

Jason,

For old times sake:

This is how I see the problem with the markets in Europe versus the rest of the world…

http://rgh.cc/albums/userpics/10184/Catch_of_the_day.jpg

LOL !!!

We all know that major down moves just seem to come out of

nowhere for no reason at all so..where there’s smoke there’s

fire. We should get some sort of a test down into the 1230

area but will that dip get bought or do we still go down?

Very unclear to me just keeping my trading light at the moment.

the bear has returned

follow the euro and nothing was fixed in europe–now even worse

falts break highs in ftse /dax

the long only mutals will loose all and the smart insto hedgies win