Good morning. Happy Tuesday.

The Asian/Pacific markets closed mostly down. Hong Kong, Indonesia and Singapore lost more than 2%. Australia, India, Malaysia and Japan dropped more than 1%. Europe is getting clobbered. Germany is down more than 5%. France, Belgium, Norway and Stockholm are down more than 4%. Futures here in the States point towards an extremely big gap down for the cash market (S&P down 37).

Yikes, suddenly sentiment is shifting. A weak day followed by a big gap down is how the market acted in Aug and Sept. For the last month, shallow dips got bought and there were no massive gap downs or back-to-back down days. Is the market shifting back to its Aug/Sept character?

One thing is for sure. The situation in Europe is not over. News out of Greece is the main reason for the selling pressure

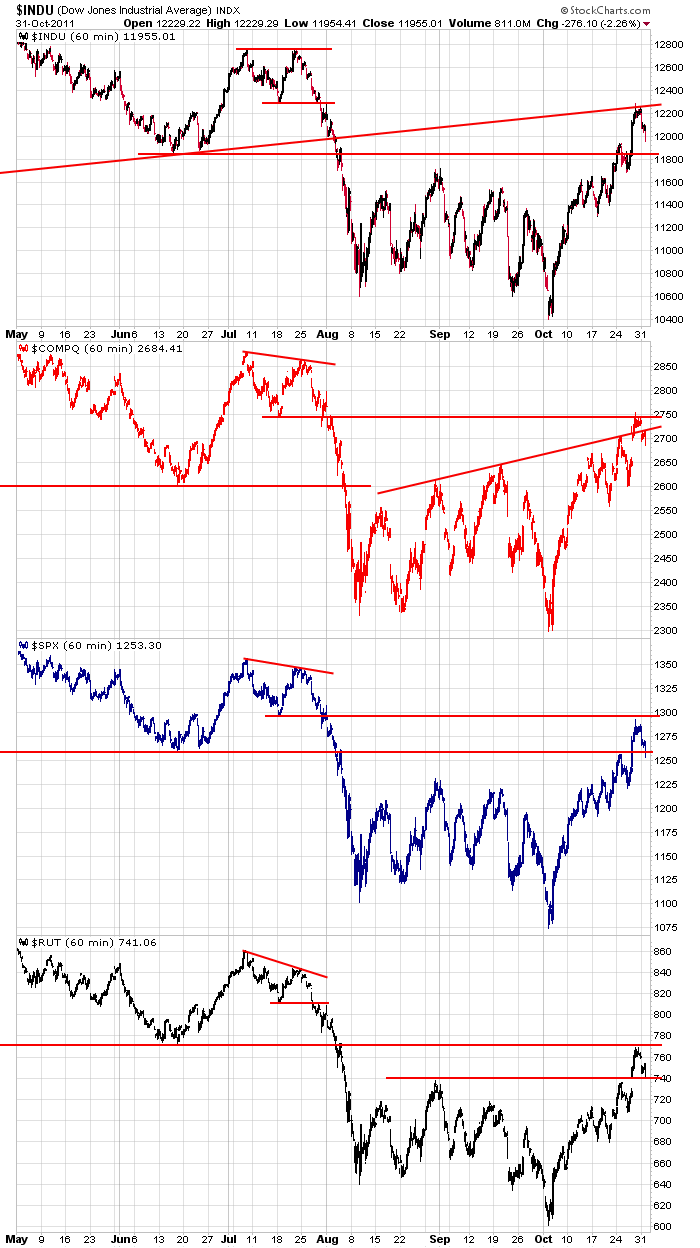

Here’s an update of the 60-min charts I started posting at the end of last week when I started suggesting traders be a little careful. Each index hit a resistance level (the Dow hit former support, the Nas and S&P hit their July lows, the Russell the bottom of their Jan-Jul range) at the same time. Given Oct was one of the best months in two decades, the risk/rewards were not as favorable as they had been.

Well, we had a month of relatively easy trading. Dozens of stocks broke out and most rallied to their targets or close enough to their targets for all or partial profits to be taken. I don’t think we could have asked for a better technical situation. Dips got bought, there were no scary times, no back-to-back down days…just lots of upside movement and very positive sentiment. Now things have changed, so we need to change. Perhaps things get cleared up in Europe, and the market will right itself. Or perhaps things won’t get cleared up, and the market will be weak until we have more clarity. Your guess is as good as mine. My personal preference is to chill out for a few days and let the dust settle. I’ve many good trades the last month. I’m content to lay low and see what happens for now. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Nov 1)”

Leave a Reply

You must be logged in to post a comment.

with many islands to sell its hard to name them all

but im having fun with the gaps

Jason, in the interest of all honestly how are you positioned going into today?

I am personally 100% in cash with the exception of 10 AAPL weekly 415 calls

that I bought at the bell yesterday at 1.18 = #1,1800 (lost money thus far).

Well, as I see it, today’s down move thus far has just enough intensity to call the bullish case for higher prices into question and confuse both bulls & bears. If you take fibonacci support levels using the the range from SPX 1075 to 1292-93, the .382 level comes in at an interesting level, i.e 1209 – not far from the midpoint of the daily bollinger band at 1217ish and the 80 week SMA at 1213ish. Today’s low so far is is 1218ish. I have various trendlines showing the 1210 area as support as well.

EW analysis has been difficult for me from the OCT low and the move down from 1292 can be interpreted several ways, as usual. However, under any interpretation (corrective or impulsive) given all of the evidence, I’m of the opinion that any near term bounce from 1210 -1220 can be sold in anticipation of a test of lower levels, e.g. 1192-1198, even if SPX is destined to exceed 1292 in coming days/weeks. Where to sell will depend on how the anticpated bounce unfolds and I would view a short position as a short term trade.

I wonder how much money the 1% spends on not paying taxes?

Also wondering about the EUR/USD/CNY.

The solutions for Europe are:

1. Print money >>>inflation

2. Forgive the debt>>>the lender(s) lose and their investors flee.

3. Raise taxes>>> riots

4. Become self-sufficient>>>interesting

What’s your solution?

a distribution failed bounce is possible but dont count on it

the fear of a full greek default may be stronger

and the insto hedgies are short from the top with the retailers /mutuals caught long on calls,but a attempt at a bounce by the mutuals is pos

we have half hour for bounce to materialize before europe close

greace may have realized its got all its going to get out of europe and now intends on giving europe the flick

the euro is not confirming any bounce atempt so far

EW is simply a emotional index and feels like the bear has returned for large 3 down

i lost a couple of hunfred bucks on mf global—ive had a dormant cfd a/c -contracts for difference–thats been there for a few years–just as well it wasnt millions as i use other cfd providers—-but i try not to keep much in them –only for immediate needs

because who knows when ur broker will go bust

well Pete was right off went the euro and indexes

i look forward to shorting some more bull shortly

It seems the EUR/USD is leading.

I think I’m looking at SPX making another attempt to go lower in the last hour. Anyway, I’m short at SPX 1231 with a breakeven stop now that SPX is at 1226.

it wouldnt suprise me to get a one day up that cant go on with it

On the failure to break to nw lows at 3:30PM, I’ve covered my short position at 1224 and see what tomorrow brings. I now have 2 EW counts in mind, both of which would project lower in the short term at least.