Good morning. Happy Monday. Hope you had a nice weekend.

The Asian/Pacific markets closed mixed. Malaysia moved up 1%; no other indexes moved 1%. Europe is currently mostly down, but movement is small. Futures here in the States point towards a negative open for the cash market.

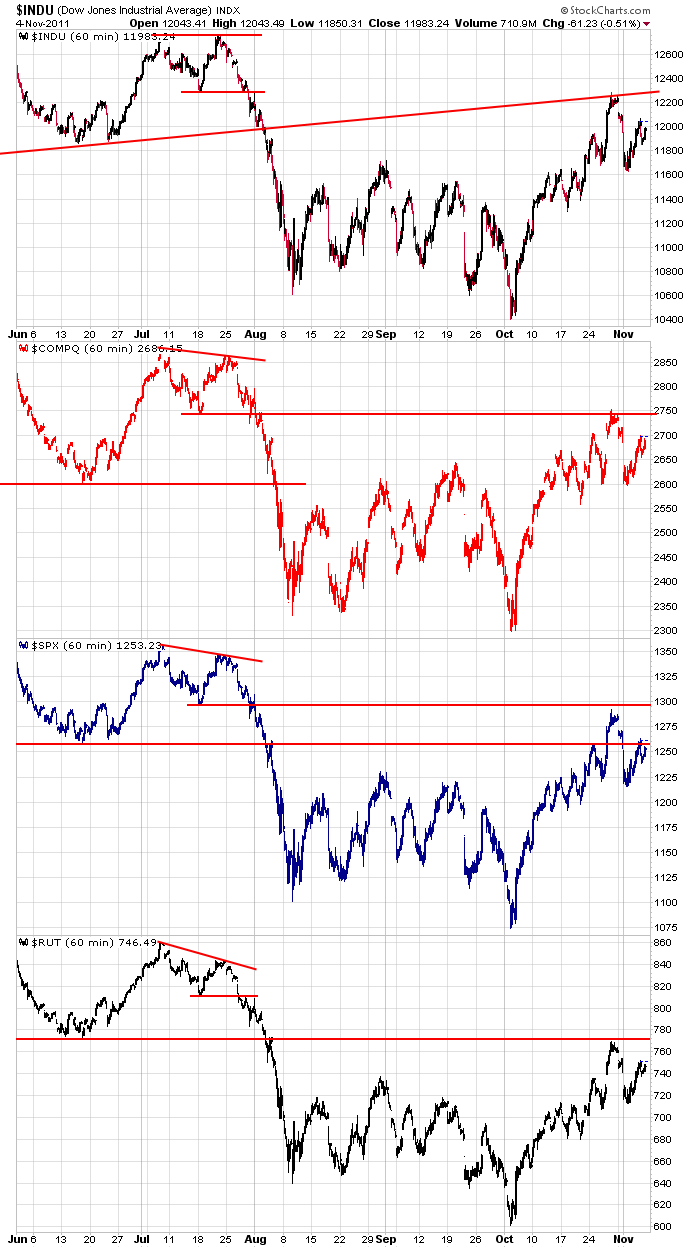

I don’t have anything to add to the report I posted over the weekend. All the indexes ran into a resistance level of some sort and got turned back. I still consider the trends off the October lows to be up, but the market is now resting. Absent major news, the indexes should leg up again when this consolidation period ends, but we don’t live in a world that is absent news. Last Tuesday we got a huge gap down and sell off when negative news from Greece hit the wires. Those losses were recaptured by Thursday’s close when the news was taken back. It just goes to show you a 50-point S&P move can happen at any time, so risk remains elevated. There are also a handful of breadth indicators which are weakening. This doesn’t mean a top is in place and a downtrend underway, it just means they may need to cycle down for a week or so before moving up and supporting a market rally. At this point, I remain in conservative mode. Here are the 60-min charts showing resistance. Support is harder to read. The Dow and S&P made lower lows last week while the Nas and Russell held their lows. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Nov 7)”

Leave a Reply

You must be logged in to post a comment.

so easy is the bear forgoten

are we in a bull market from may2nd

or

do dead cat bounces happen in bear markets only

but no worries for a daytrader –we have our own trend

and today will be down

so easy is the bear forgoten

are we in a bull marketfrom may 2

or

do dead cat bounces only happen in bear markets

but no worries for daytraders–we have our own trend

and today is down

I agree with AussieJS that it’s a trading affair in various short term time frames. So, I’m looking for a place to get short SPX intraday after what I believe was an impulsive down today into 11 am. A failure on a rally to between 1248-1250 is what I’m looking for as I’m not inclined to chase at lower levels. I’m looking for an initial downside test of 1239-1240.

What appeared to me to be reisitance at 1248, prompted a short position at 1247 and now I want to see some acceleration downward.

Doesn’t look like this dip is being bought.

If SPX gets to 1239-1240, then 1235 is important. If that holds, I’ll cover my short position and think about going long for another day trade.

just closed all my shorts at apropreate piviots

no longs for me

nite all

Everything continues to look bearish with further downside potential. I wouldn’t want to see any bounce get above 1245 though. A little consolidation around 1242 followed by a break of 1239 could lead to 1235 or down to 1230, in my opinion.

It does feel Bearish. This s/b make or break right here. If it does go below 1230 then today will be a lower-high and lower-low.

When I left for an appointment at 1:30 PM, I had hopes my breakeven stop would hold up. Who knew some guy over in Europe was going to say all would be well in Europland in 2 years? Who needs this? See ya tomorrow.

didnt trade the long ,but looks like distribution before the hang over