Good morning. Happy Thursday.

The Asian/Pacific markets got hit hard. Hong Kong and South Korea dropped 5%, Taiwan 3.4% and Australia, Japan and Singapore more than 2%. Europe on the other hand is up across the board. Germany is up 1.7% – it’s the only 1% mover. Futures here in the States point towards a moderate gap up open for the cash market.

The market is being held hostage to Europe. Simple as that. What happens in Europe with their debt and whether the debt of Greece, Italy and others can be contained is driving the market right now. I’m a technical trader. The technicals work best in an environment absent news and absent big surprises. That’s when the natural imbalance of supply and demand can play out. The current environment obviously isn’t absent news. That means I can continue trading (and assume the increased risk) or stop and wait for things to clear up. I’m picking the one on the middle. I’m still trading, but I have less positions than normal and am trading smaller size and am being content to shoot for singles. These are times when you just try and peck away and make a few bucks and otherwise preserve capital until the situation is better.

Greece has a new Prime Minister, and Italy will be voting tomorrow on austerity measures.

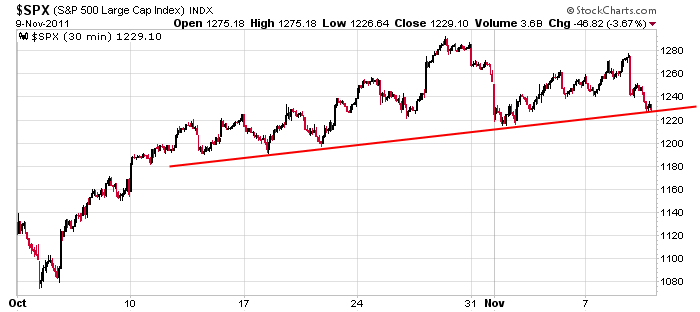

Here’s the 30-min SPX chart since the beginning of October. The trend is still up but at a much shallower slope. There should be support between the current level and ~ 1190, so just because the trendline is broken doesn’t automatically mean the market is headed back to its lows.

Good news from Europe and yesterday’s losses are quickly recaptured. Bad news means the S&P could quickly lose another 50 points. Oye. This is not ideal. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Nov 10)”

Leave a Reply

You must be logged in to post a comment.

As far back as I can remember the markets have always been news driven to a certain extent, thus making it difficult to trade purely on the technicals alone. Unfortunately, this kind of volatility might continue for some time to to come. So I, for one will keep my positions very light and if I can grab a quick profit just take it and wait for another set up. What they teach you in AA is ‘you don’t have to have a drink…just for today’ Well, nobody says that you have to trade today, do they? Just sit back and wait for a good set up and go for it. HW

Sounds like you two are going to trade, “By the Seat of Your Pants” LOL

The Market is driven by the fear and greed of supply and demand. There isn’t such a thing as “overbought and oversold”. These are just words given to reversals.

I’ll make the observation that on the daily MACD (13,20,9) that I use, the trend has turned down. I’ve found this to be a pretty reliable indicator but, for some reason, I seem to ignore it more often than not. This time, until it changes, I’ll look for the short side to trade and follow Jason’s advice to keep it light & tight.

Your stops are one dimensional. Try taking profits rather than relying on being stopped out to exit. You’re betting on the trade going in your direction and the stop proving you wrong. As soon as you think you’re wrong get out or get partially out. It’s ok to be wrong as long as you’re right about being wrong.

I was referring to SPX in my last comment about the daily MACD.

I’m looking for a rally that fails in the SPX 1235-1239 area for a short position.

Good call. It’s there now.

I just went short SPX at 1239 after what I think was a trendline break going back to 11am. We may have had a “kissback” failure to that trendline, so I’m short looking for some downside acceleration through 1236. My stop loss is at 1242 and I’ll move it to breakeven if I don’t see what I’m looking for.

It will be disappointing to me if SPX can’t at least break below 1233 and test the 1228-1230 area.

Oh well – I’m out at 1236 and I’ll step aside.

What should you have done on that trade? Sounds like you went short a the right time but didn’t get out when it turned. I went short, got out at the reversal bump and now I looking to go short again if this isn’t a higher-high.

You have excellent entry, you just need to focus on stops.

Lot’s of noise, playing it short.

I was wrong. I’m out. Later

i once had a trianglar space ship

Are you writing a song?

song——-my triangular spaceship as found taking off from a egytian pyrimid

on the one usd note /spx/dji———–

my be destroyed by the rectangular ndx

Stick to trading. LOL