Good morning. Happy Monday. Hope you had a nice weekend.

The Asian/Pacific markets closed mostly up. South Korea, Taiwan, China and Hong Kong gained around 2%, and Indonesia, Japan and Singapore gained more than 1%. Europe is currently down across the board. Belgium, France, Germany, Amsterdam and Stockholm are down more than 1%. Futures here in the States suggest a negative open for the cash market.

I don’t have anything to add to my weekend comments. Technically the market is in decent shape on an intermediate term basis. The indexes rallied nicely off their early-October lows and are now in consolidation mode. Absent major news that has the ability to trump the charts, the odds favor a continuation of the trend and a test of the summer highs. But we don’t live in a world that is absent potentially market-moving news. At any time news from Europe could pull the floor out. This means despite my up bias, we need to be careful.

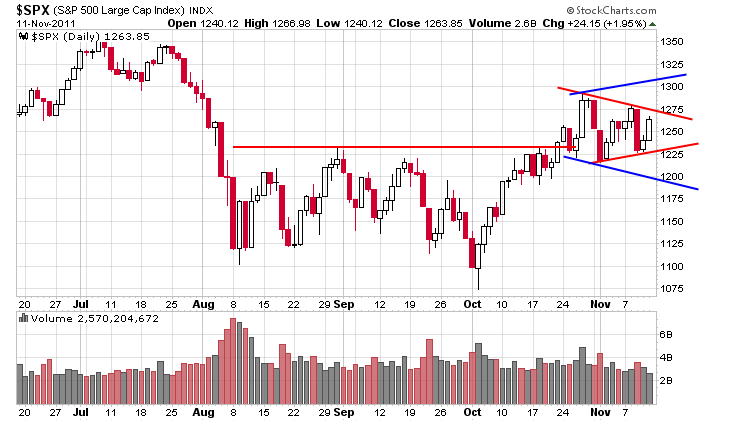

Here’s the daily S&P. Soon the index will move through one of the red trendlines. If the move is up, I’ll eye the upper blue trendline which is drawn parallel to the lower red. If the upper blue can’t turn price back, the summer high becomes my target. The same, but opposite, is true for a downside move.

The technicals say a move is coming soon, but can Wall St. run without more clarity from Europe? We’ll see.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Nov 14)”

Leave a Reply

You must be logged in to post a comment.

shares are but pawns to their opts masters

chess is the game

Sounds like you’re staring out the window and not your trading screen.

i hear the surf pounding in on the crisp tropical sands

the palm trees bruseling with the mild tropical breaze

the moon dancing across the calm ocean seas

for it is 2.19 am tues morn here

naturally im short from the sun nite usa time spike and the demise of the euro

I’m short also, but my KVO says accumulation. The other indicators are mere ripples of time.

yes ,price is showing relative strength to my negative tick

i will put on my horific bear suit –that will fix it

we mite be in a trading range for the cash market ,today

-going to sleep

Closed short.