Options expire this Friday, so let’s take a look at the open-interest on SPY, DIA, QQQ and IWM to see if they hint at movement the rest of the week. Here’s the theory: the market conspires to cause the most pain, to cause the most number of people to lose the most amount of money. If the market is to accomplish this, what does it need to do this week?

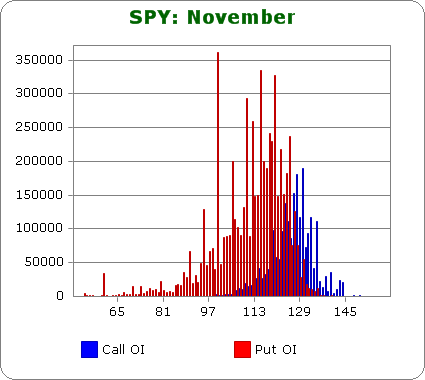

SPY (closed 125.46)

Puts out-number calls 2.7-to-1.0 – slightly more bearish than last month.

Call OI is highest between 123 & 133, and there are spikes at 120 & 135.

Put OI is highest between 105 & 127, and there are spikes at 95 & 100.

There’s a little overlap between 123 & 127, but since puts dominate calls, lets focus on those. To cause a lot of pain, most of those puts will need to expire worthless Friday. With today’s close at 125.46, SPY could close right here to accomplish the mission, but a slight move up would be even better.

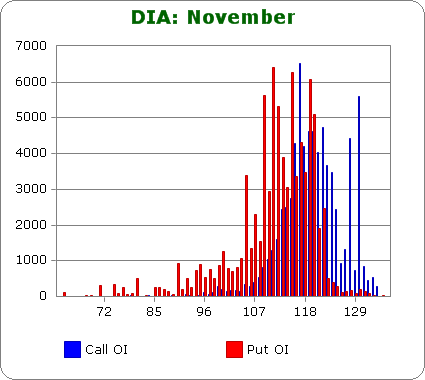

DIA (closed 120.71)

Puts out-number calls 1.2-to-1.0 – about the same as last month.

Call OI is highest between 116 & 122.

Put OI is highest between 109 & 120.

There’s some overlap there, but it doesn’t matter. Open-interest for DIA numbers in the thousands; OI for SPY numbers in the hundreds of thousands. There’s no sense studying the Dow data too closely.

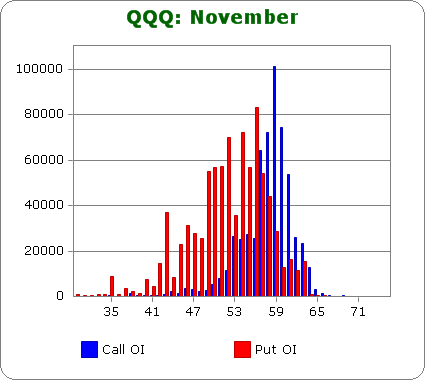

QQQ (closed 57.49)

Puts out-number calls 1.5-to-1.0 – slightly less bearish than last month.

Call OI is highest between 57 & 61.

Put OI is highest between 49 & 58.

There’s overlap at 57/58, so a close right there would cause lots of pain. QQQ closed at 57.49 today – exactly where it needs to be, so a flat market the rest of the week would do the trick.

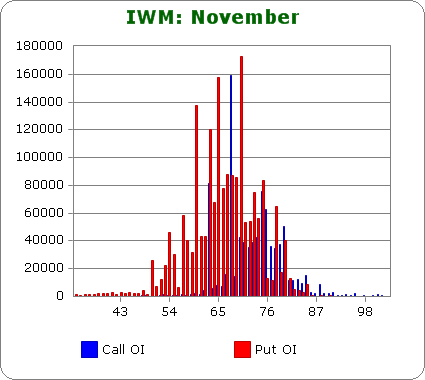

IWM (closed 73.71)

Puts out-number calls 2.1-to-1.0 – slightly less bearish than last month.

Call OI is highest between 70 & 76, and there’s a huge spike at 68.

Put OI is highest between 63 & 75, and there’s a spike at 60.

Like SPY, puts dominate calls, so let’s key on the put OI because expiring most puts worthless will by default be max pain. IWM closed at 73.31 today, so if there was no movement the rest of the week, a lot of pain would be felt, but if the stock moved up slightly, the pain would be greater.

Overall Conclusion: The bears again placed bets to profit from a sell-off, and again, barring solid selling pressure the rest of the week, they will lose. Flat trading between now and Friday’s close would cause lots of pain. However, a slight move up would cause even more pain.

0 thoughts on “Using Put/Call Open Interest to Predict the Rest of the Week”

Leave a Reply

You must be logged in to post a comment.

If you put a gun to my head and ask me what is the market going

to do for the rest of the week I couldn’t tell you. We are still

in that triangle formation and they could very easily hold it

around here for the rest of the week. Then all the option

holders will lose (both bulls and bears) and the House wins.