Good morning. Happy Tuesday.

The Asian/Pacific markets closed mixed. Indonesia gained 1.5%; it was the only 1% mover. Europe is currently mostly up; there are no noteable movers. Futures here in the States are mixed with perhaps a slight bullish bias.

Borrowing costs continue to climb in Spain. Interest on 3- and 6-month bonds jumped to 5.1% (from 2.3%) and 5.2% (from 3.3%). This comes on top of the nearly 7% Spain had to pay on a 10-year auction last week. These rates are unsustainable. How can a country that is already struggling continue paying higher and higher rates? That’s like a homeowner here in the States who has a variable rate mortgage see his monthly payments climb at the same time he’s having a hard time making the payment. It’s unsustainable.

Closer to home the Super Committee failed to agree on ways to cut the deficit. This functions to kick the can down the road and add to the uncertainty. The market is good at dealing with bad news, but it has to know what that bad news is. The failure of the committee to agree allows the situation to linger – exactly what Wall St. hates.

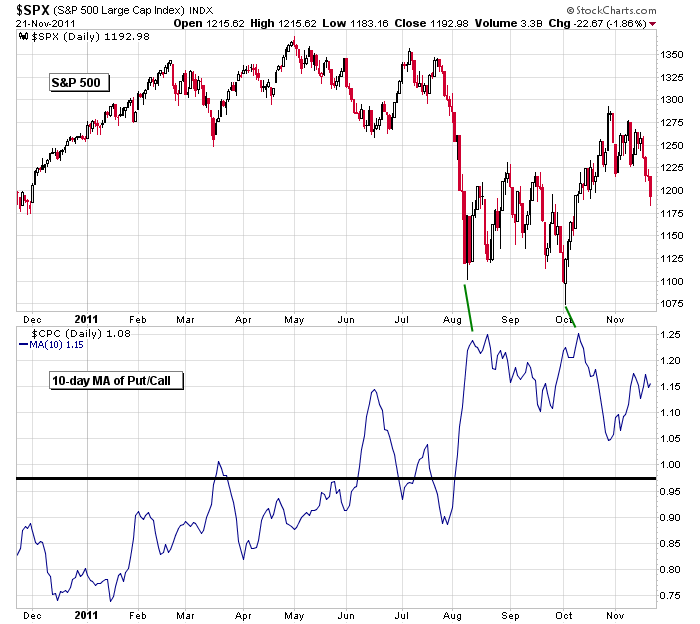

Technically the indexes are no longer in consolidation patterns within short term uptrends. In some cases enough damage has been done to render the charts unsalvagable in the near term absent very good news. Time is needed for the charts to reset themselves. Personally I’d rather see a washout that pushes the indicators to exteme levels. Here’s an example – it’s the S&P 500 vs. the 10-day MA of the put/call ratio. I’d like to see enough selling take place to push the PC to the levels hit at the Aug and early-October lows.

I remain in conservative mode.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Nov 22)”

Leave a Reply

You must be logged in to post a comment.

What I see now is a retest of yesterdays lows in the first hour of trading today.

Whether or not we get a cascading effect and down to the new lows remains to be seen.

a minor gap down on the heels of a news-driven big down day in a short, light-volume holiday week. it’s gotta be good for 20-30 TF point on the long side by friday’s close, right?

i intend on put on my horrific bear suit and whipsawing the euro and ndx for some fun today

this will also help Jason’s put/call chart

I continue to think we need one more minor new low in SPX before we can expect a more sharper rally.

I note kunta kinte’s TF remark and see a downside gap in the RUT hourly in the 712-718 area that may need to be filled.

there was a small sub 4 jig saw virus released y/day

this will be resolved in the futures in europe on thurs to the downside

i am having fun collecting 10 minute bull scalps

——-aint im a showoff——–

going to sleep now may wake up soon for some more fun

I’m going to look for a long position in the SPX 1186-1188 area.

Close enough to my 1186-1188, so I’m long at SPX 1189. I’ll get out quickly and perhaps re-enter lower depending on whether it can get above 1194 first.

From an EW perspective, I think the initial move up from the day’s SPX low was an impulsive 5 wave count, followed by a corrective wave to the 1188 area. We now have a break above the initial move up to the 1194 area which may be a wave 3 in progress from the day’s low. I’ll cover my long position at breakeven or higher depending on whether this continues to look like an impulsive wave advance from the day’s low.

In the event this rally turns out to be only a 3 wave (corrective) affair, I’ve taken my profit at SPX 1196. If a pullback finds support above 1194, I’ll re-enter on the long side again.

I meant if SPX finds support above 1191.

Well, it looks as though the rally from today’s low was a 3 wave corrective affair.

Now, what are we looking at since the week began? Could it be a triangle into week’s end, followed next week by a move to the Fibo .618 retrace level around SPX 1158? I’m beginning to lean that way so, if we hold at 1188 or above on this pullback (which I’ll designate as wave D of a potential triangle), I’ll be tempted to short the next rally attempt that fails below 1197.

i think its a small range catapilla,that may turn into a moth

some may say its bottoming,whilst others will say its resting

as we get closer to the close i will know what to do about asia

this is scalping material only

and europe ,whos futures trade untill end usa close