Good morning. Happy Monday. Hope you had a nice weekend.

The Asian/Pacific markets closed down across the board. India and Taiwan dropped more than 2%; Hong Kong, Indonesia, Malaysia and Singapore dropped more than 1%. Europe is getting hit hard. Austria is down 3.5%, and Belgium, France, Germany, Amsterdam and Norway are dowm more than 2%. Futures here in the States point towards a large gap down open for the cash market.

Besides the weak overseas markets, weighing on the futures is the expectation the Super Committee will concede defeat in its attempt to lower the deficit. The committee’s co-chairs will issue a statement later today. Also, Moody’s warned France’s credit rating could be cut. Higher borrowing costs were cited as a reason.

The US markets have held up well the last month given the flow of negative news out of Europe. Earnings here haven’t been bad, and econ news has been tolerable. The market wants to move up, but unfortunately it’s being held hostage to Europe’s financial situation. Last week the market cracked, and this week it could completley break if news flow doesn’t improve. We live in a very connected and correlated world. We can buck the trend in another market for a period of time, but eventually positive and negative feelings elsewhere take their toll here.

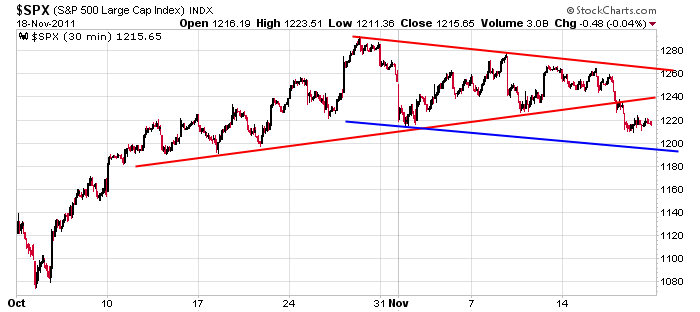

Here’s the 30-min S&P chart we’ve been following the last 7-8 days. Today’s open will be near the blue line.

I remain in conservative mode…mostly because I’m a technical trader who prefers trading when the natural forces of supply and demand are playing out, but when major news is circling, I don’t like having a lot of exposure because a huge gap and run (in either direction) could happen any time. Hence I’ve been doing much more day trading the last few weeks while Europe sorts itself out. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Nov 21)”

Leave a Reply

You must be logged in to post a comment.

I thought Jason would mention more about the fact that Thanksgiving Week

tends to be bullish but I guess the news is trumping all of that for now.

Even though this is a short week, the trading action should be an important clue to the overall weakness or strength of the broad averages. I’ve interpreted the rally from the OCT low as a countertrend bear market rally and I’ve traded mostly from the short side. Today, we should test Jason’s lower end blue trendline. The SPX Fibo support from the OCT low to OCT high is 1209 down to 1158.

From an EW perspective, we have 2 main counts in play, in my opinion, i.e and ABC pattern from 1292 or a 5 wave sequence in progress. If this down turn picks up in intensity, we could be in the midst of a 3rd wave down of some degree. If we hold around 1200 (+/- 10 pts), then an ABC pattern of some degree could be completed, laying the groundwork for a year end rally. As I’ve mentioned previously, according to the time cycles I read about, time is rapidly running out for a continuation of the rally from the OCT lows.

PeteM, you don’t have to wait until this Friday to figure out what’s going on. The afternoon session today should prove worthwhile to see if there’s any bounce to it or do we just crash.

At the moment I am 100% flat since last Friday. I had some LVS 50 call options from another blog that I follow, but fortunately got rid of them last Friday at a small loss. Actually,

McHugh has been doing rather well for himself as of late. He is more of a swing trader and does not really participate in all these daily wild swings that we are currently experiencing.

Howard – you may have a good point about this afternoon being an important time frame, at least from a short term perspective. At this moment, the SPX is trying to gather support around 1192 which has some significance going back to mid OCT. I think this morning’s low thus far will be broken and the key area for me will then be the Fibo 50% retracemnt area around 1183.

Consider this. There’s a lot of bearish sentiment already in the market and building today. The 50 day EMA (as well as the 50day sma) have been broken and the foregone conclusion is that the AUG/OCT lows will be tested (1101 down to 1075). Despite my own bearishness, we could be looking at a bear trap unfolding, i.e. a move down to new intraday lows today only to see a reversal around 1183. This would be the ABC pattern I mentioned. A lot of bears would be caught short in a thinly traded market. I’m just sayin’….

should i go long now to europe close

all markets turning at /or near piviots

unless the bulls know their abc -rallies in a bear market get eaten by the bears

I guess volume is the key to this whole thing today, I’m just sayin. HW

I’m thinking a new SPX intraday low with less downside momentum may signal the potential for a reversal and a low risk long side day trade with a close stop loss. A good low risk/high reward trade, perhaps.

well u have been right so far today ,Pete

and we have broken our intraday down trend with some HL-HH and stoped at a support piviot now res

the dji has been underperforming the ndx-spx

ill wait to see if we go lower

if this is the start of a C up–id like to see some momentum

imo could still be a wave 3

AussieJS – I may be wrong, but I still think SPX has to retest today’s low and make a lower low with some bullish momentum divergence to signal at least a tradeable bottom. So far, the move off today’s SPX 1183 area looks corrective of the move down. Maybe tomorrow will make for a more clear picture.

sorry Pete,

i must have misunderstood u

yes the move up looked corrective to me to

things i would look for confirmation are–euro -dax ftse and lets see how asia goes

all markets seem to be corrolated atm